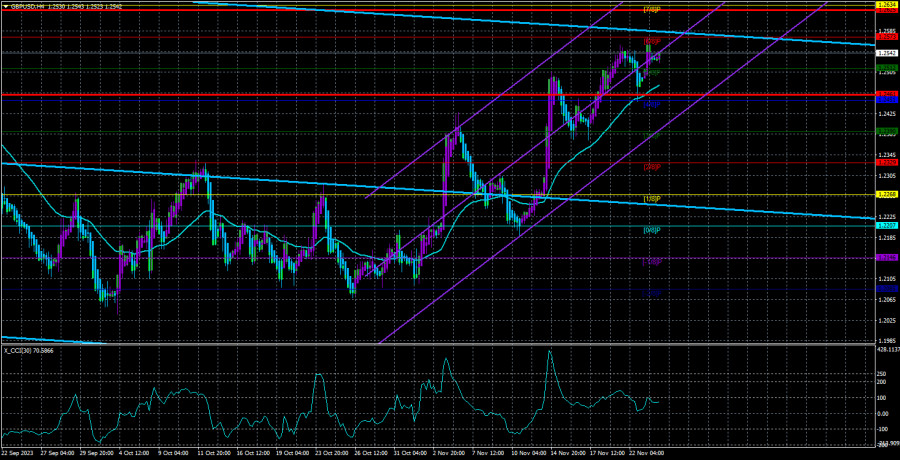

The GBP/USD currency pair resumed its upward movement on Thursday and updated its recent local high again. Yesterday, there were quite specific reasons for such a movement. November is a dismal month for the dollar in terms of macroeconomic statistics. Many reports from across the ocean have failed, while at the same time, British statistics have been more encouraging than disappointing. Thus, on Thursday, business activity indices in the service and manufacturing sectors of the United Kingdom turned out to be above forecasts, triggering another strengthening of the British currency. However, the feeling that the current upward impulse is on its last breath does not leave us. The illustration above shows that the movement is slowing down, and bulls are attacking with their last strength.

The triple overbought condition of the CCI indicator still needs to be worked out. The meager pullbacks we occasionally observe are too small to "close the issue" with the CCI indicator. As often happens, a decline can start abruptly and unexpectedly when no one expects it. Therefore, we advise all traders to be on alert. Certainly, this is the currency market. Any movements are possible here, in principle. Tomorrow, Andrew Bailey may announce that the Bank of England has decided to raise the rate even more, and the pound may soar into the sky, although today, everything indicates an impending decline. Of course, believing in such a scenario is very difficult, but there have been a few important events and news in recent years that no one could predict.

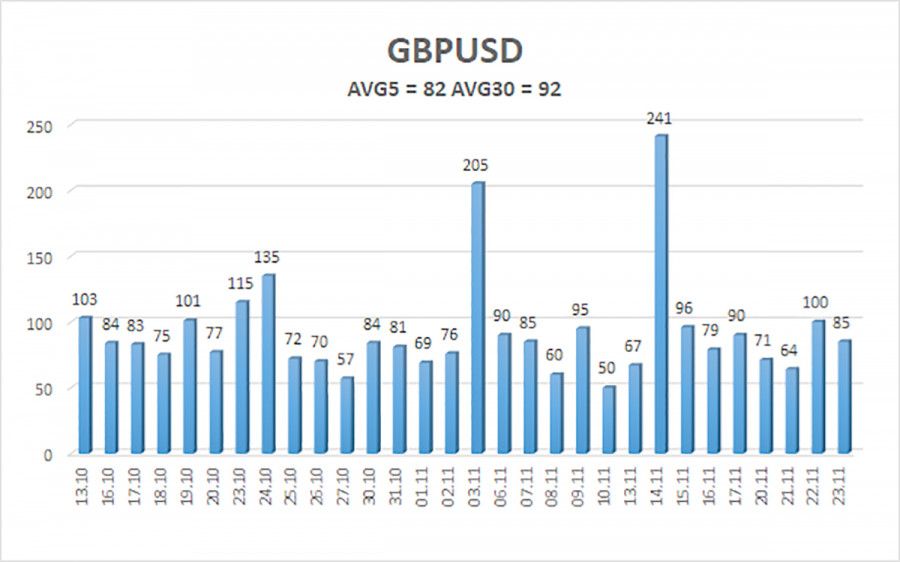

In most cases, the British pound's volatility does not currently exceed 100 points. This is quite good value for the British currency, allowing trading the pair and expecting a profit. The technical picture indicates an upward trend, which confuses me. There are signals of overbought conditions, an understanding that the pound has no support other than individual macroeconomic reports.

The Fed is not planning to tighten monetary policy again.

This week, the Fed's minutes were published, the main message: "a cautious approach to interest rates, changing monetary policy based only on incoming data." On November 1, the FOMC showed no signs of another tightening of monetary policy, although inflation in the United States at that time was 3.7%. It has dropped to 3.2%, so what are the chances of seeing a new key rate hike soon?

Experts at Rabobank believe that the latest Fed minutes indicated that the regulator is not inclined to increase rate hikes. The September dot plot implies another tightening, but the bank's economists believe it is no longer relevant, as the Fed had grounds to start talking about a new tightening. Still, these grounds no longer exist after the release of the latest inflation report. According to Rabobank, the Fed is waiting for an "easy landing" of the economy, so no one wants to take risks now by raising the rate. If the statistics show a slowdown in inflation and a stable state of the economy by the last meeting this year, the forecast for another rate hike will be replaced by a long-term maintenance of the rate at the current level.

The bank's experts also noted that the Fed will likely keep rates at the maximum level until mid-next year and gradually start lowering them. If this is true, we must determine when the ECB and the BOE plan to lower rates. This will also happen next year, but which of the central banks will start first and how quickly they will start lowering rates are big questions that need an answer.

The average volatility of the GBP/USD pair over the last five trading days is 82 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, November 24, we expect movements within the range limited by the levels of 1.2461 and 1.2625. A reversal of the Heiken Ashi indicator back down will indicate a new downward correction, which may be the beginning of a downtrend.

Nearest support levels:

S1 – 1.2512

S2 – 1.2451

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2634

R3 – 1.2695

Trading recommendations:

The GBP/USD pair continues the new upward movement and is located above the moving average line. Short positions can be opened with targets of 1.2390 and 1.2329 in case the price consolidates below the moving average. Long positions can formally be considered, as the price is above the moving average, with targets of 1.2625 and 1.2695, but the triple overbought condition of the CCI indicator still indicates the danger of opening such deals.

Explanations for illustrations:

Linear regression channels help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel in which the pair will move in the next day, based on current volatility indicators.

CCI indicator – its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.