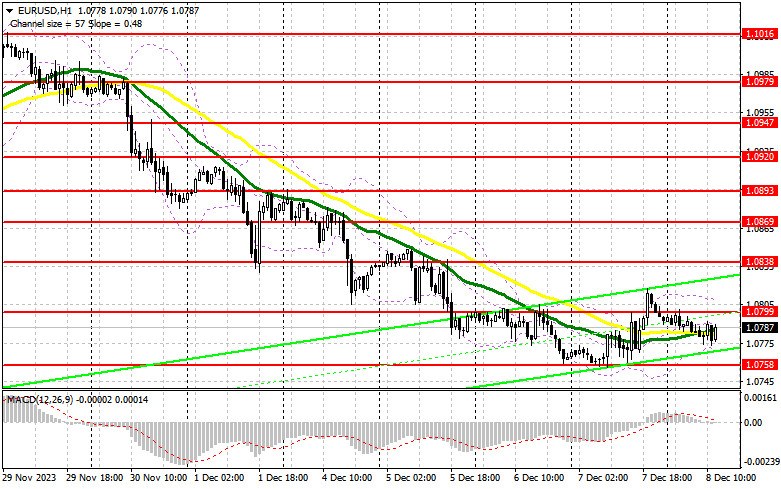

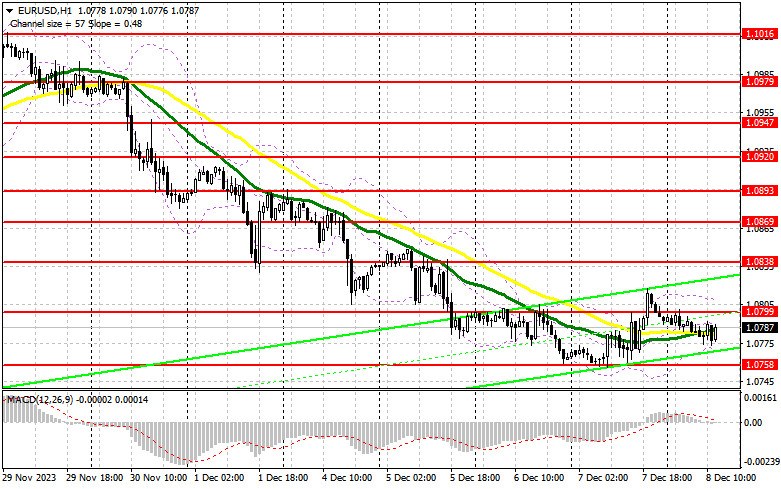

In my morning forecast, I drew attention to the level of 1.0770 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The decline in the euro occurred, but due to low volatility ahead of significant fundamental data, it did not reach the test of 1.0770. For this reason, suitable market entry signals were not obtained. The technical picture was revised for the second half of the day.

To open long positions on EUR/USD, the following is required:

Considering the low volatility and trading volume, it is evident that the entire market is awaiting U.S. labor market data, which could disappoint, allowing the euro to make another attempt at an upward correction at the end of the week. If the figures turn out better than economists' forecasts, this could shift expectations for the first interest rate cut in the U.S. next year, putting pressure on risky assets and providing additional support to the U.S. dollar. In the case of strong statistics, I prefer to act on the decline after forming a false breakout around the new weekly minimum of 1.0758, formed yesterday. The calculation will be based on the rise of EUR/USD and testing the resistance at 1.0799, just below the level at which the moving averages pass. Breaking and updating above 1.0799 and weak reports will undoubtedly lead to a new buying signal, preserving the chance for a correction and an update to 1.0838. The ultimate target will be the area of 1.0869, where I will take profits. In the case of a decline in EUR/USD, and there are many more prerequisites for this, as well as the absence of activity at 1.0758 in the second half of the day, the downtrend in the pair will continue, creating even more problems for buyers. In this case, I will enter the market only after forming a false breakout around 1.0733 – the new local minimum. I will open long positions immediately on the rebound from 1.0706 with a target of an upward correction within 30–35 points within the day.

To open short positions on EUR/USD, the following is required:

Sellers continue to control the market even now. Given the revised technical picture, the focus has shifted to protecting the intermediate resistance at 1.0799. The formation of a false breakout after strong labor market data will provide an excellent selling signal, counting on a further decline in the euro. The nearest target is the weekly minimum of 1.0758. Only after breaking and consolidating below this range, followed by a reverse test from bottom to top, do I anticipate receiving another selling signal with an exit at 1.0733. The ultimate target will be a minimum of 1.0706, where I will take profits. In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.0799, the upward correction will continue to develop at the end of the week, which will seriously harm the bearish market, opening the way to 1.0838. You can sell there, but only after an unsuccessful consolidation. I will open short positions immediately on the rebound from 1.0869, with a target of a downward correction of 30-35 points.

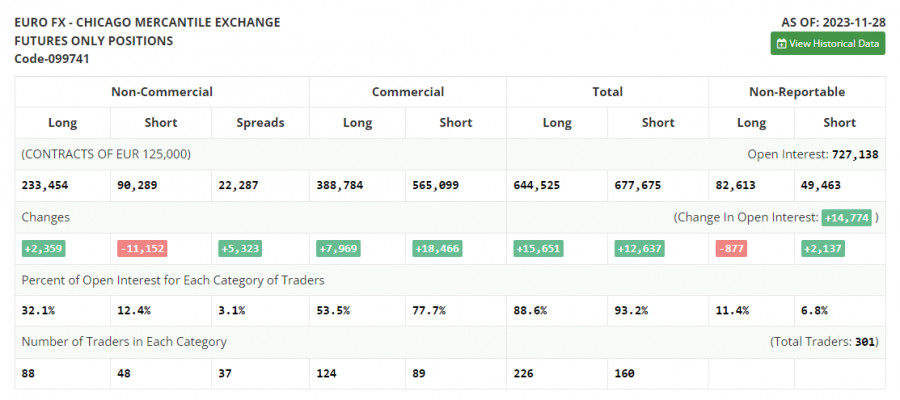

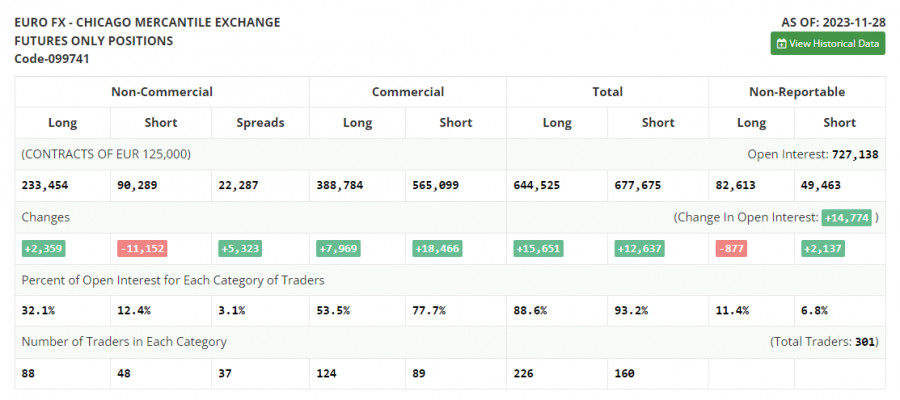

In the COT report (Commitment of Traders) for November 28th, there was an increase in long positions and another significant reduction in short positions. Recent statements by representatives of the European Central Bank regarding high-interest rates, even against the backdrop of a rapid decline in the European economy, look rather absurd, as the market and traders are counting on completely different, softer steps from the ECB next year. Dovish statements by U.S. Federal Reserve representatives also affect the U.S. dollar's positions, which helps the euro grow. A lot of important fundamental statistics related to the U.S. labor market will be released soon, which will help determine the further medium-term direction of the pair. The COT report states that long non-commercial positions increased by 2,359 to 233,454, while short non-commercial positions decreased by 11,152 to 90,289. As a result, the spread between long and short positions increased by 5,323. The closing price increased and amounted to 1.1001 against 1.0927.

Indicator signals:

Moving averages

Trading is carried out around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author determines the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In the event of a decrease, the lower boundary of the indicator, around 1.0770, will act as support.

Indicator Descriptions:

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders – speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.