Indices fall sharply as investors panic

U.S. stocks ended Monday trading with significant losses after Donald Trump announced he would impose 25% tariffs on goods from Canada and Mexico. The S&P 500 posted its biggest one-day decline since December 18, and market dynamics signaled anxiety among investors.

Statistics Add to Stock Market Pressure

Even before the president's statement, markets were showing weakness amid the publication of the ISM Manufacturing Purchasing Managers' Index (PMI). According to the report, the indicator fell from 50.9 in January to 50.3 in February, while the New Orders Index fell from 55.1 to 48.6. These data only reinforced investors' fears that the economic situation is worsening.

Who was hit the hardest?

Tech and energy sectors were at the epicenter of the collapse. Nvidia (NVDA.O) shares fell by 8.7%, while Amazon (AMZN.O) lost 3.4%. Overall, most of the largest companies from the growth sector ended the day in the red.

Islands of stability

Amid the sharp market decline, defensive assets showed a slight strengthening. Real estate, healthcare, utilities and consumer staples stocks all closed higher, suggesting investors are seeking refuge in more stable sectors.

The stock market remains under pressure, with upcoming retaliatory measures from Canada and Mexico likely to cause more volatility.

Indices plunge: Wall Street ends day in the red

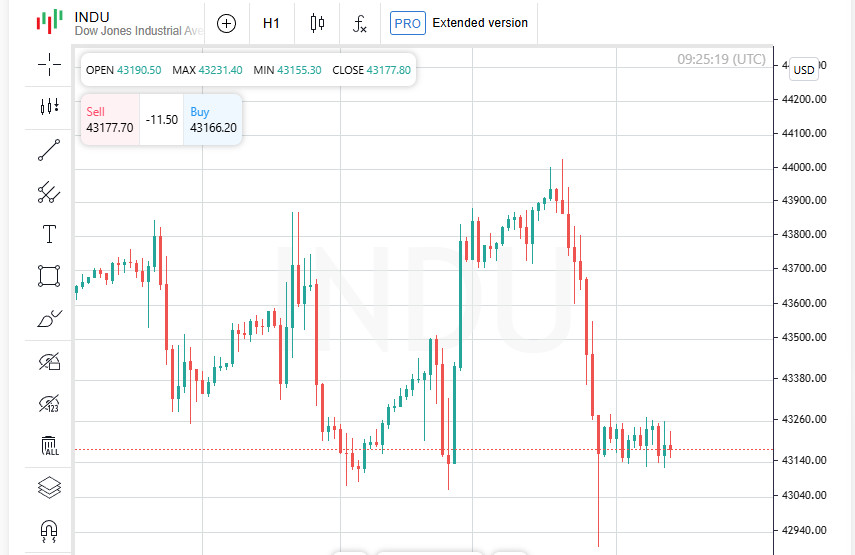

The US stock market closed sharply lower on Monday, reflecting growing concerns about an economic slowdown and rising inflation pressures. The Dow Jones Industrial Average fell 649.67 points (-1.48%) to 43,191.24. The S&P 500 lost 1.76% to close at 5,849.72, while the tech-heavy Nasdaq plunged 2.64% to 18,350.19.

Consumer demand weakens, and the tariff war heats up

The key factor putting pressure on the markets was the alarming signs of a decline in consumer activity, which increased fears about a slowdown in economic growth. An additional blow for investors was the news of a possible increase in tariffs on Chinese imports of fentanyl from 10% to 20%. Donald Trump is ready to introduce this measure as early as Tuesday if Beijing does not stop supplying the substance to the United States.

Chinese companies under pressure

Amid news of tightening trade restrictions, American investors began to get rid of shares of Chinese corporations. As a result, Nio shares fell by 8.6%, and JD.com lost 4%.

Tesla and Intel failed to maintain growth

Tesla shares, which showed positive dynamics at the beginning of the day, went into the red by the close, losing 2.84%. Despite this, Morgan Stanley analysts still call the company the best bet among American automakers.

Intel also failed to stay in the green - after the morning growth, the quotes fell by 4%. The initial rise was associated with news about the testing of its chips by such giants as Nvidia and Broadcom, but by the end of the day, investors were taking profits, which led to a price rollback.

Prospects remain uncertain

Markets remain in a mode of increased volatility, and further developments in the situation will depend on the White House policy, China's reaction and new data on the state of the US economy.

Tariffs as a pressure tool or a long-term strategy?

The month since the start of Donald Trump's second presidential term has been tense for financial markets. Investors and analysts are still trying to figure out whether the tariffs imposed are a tactical move in trade negotiations or part of a larger strategy that will last for many years.

Many experts warn that new trade barriers will inevitably accelerate inflation and negatively affect corporate profits. In particular, Morgan Stanley analysts calculated that if 25% tariffs on imports from Canada and Mexico, as well as 10% tariffs on China, remain in place until 2026, this will lead to a decrease in the total profit of S&P 500 companies by 5-7%. In their opinion, the market will begin to factor this factor into quotes even before companies feel its real impact.

Europe's Fightback: New Tariff Conflicts

In addition to escalating trade tensions with Canada, Mexico, and China, Trump recently imposed retaliatory tariffs on European products. This further complicates matters for multinationals whose profits rely heavily on international markets.

According to Michael O'Rourke, chief market strategist at JonesTrading, the largest companies in the S&P 500 will feel pressure on margins as their costs rise and profits shrink.

The Global Economy Is Slowing—and That's a Problem for the U.S.

The U.S. stock market doesn't exist in isolation: According to Apollo Global Management, 41% of all revenue for S&P 500 companies comes from outside the U.S. This means that if the global economy starts to slow down due to tariff barriers, the effects will inevitably hit U.S. companies too.

Rising Uncertainty Fuels Volatility

Market tensions have reached new heights, with the Cboe Volatility Index (VIX), widely considered a "gauge of fear" on Wall Street, rising to its highest level since December 19, suggesting investors are bracing for more turbulence in the coming weeks.

The market remains on the fence about whether the White House will maintain its hard line or give in to the talks. Either way, rising uncertainty and tariff barriers pose serious challenges to the global and US economies.

Investors Flee to Safe Havens

Asian financial markets opened lower on the day as investors reacted nervously to the new US tariffs on Canada, Mexico and China. This has heightened global trade tensions and triggered a sell-off in risk assets.

Bond yields fell as investors sought safe havens. Equity pressure mounted, with commodities also under pressure.

FX: Australian dollar falls, pound holds firm

Amid growing global risks, the Australian dollar fell, reflecting the anxiety in the Asian region. At the same time, crude oil fell to 12-week lows, which further increased the negative backdrop for the global market.

Bitcoin, which reached $95,000 earlier in the week, rolled back to $86,000, almost completely giving up recent gains.

Against this background, the pound sterling remained stable at a 1.5-month high, and the euro held its positions, as European leaders prepared a peace plan for Ukraine for presentation in Washington.

Asian exchanges in the red, markets continue to decline

Asian stock indices continued to fall:

- Japan's Nikkei lost 1.6%;

- Taiwan's TWII fell by 0.5%;

- Hong Kong's Hang Seng fell by 0.4%;

- Chinese blue chips (CSI300) fell 0.2%.

US markets posted their biggest drop of the year

Asian markets responded to Wall Street's biggest losses of the year. The S&P 500 fell 1.8%, while the tech-heavy Nasdaq plunged 2.6%, marking its steepest decline since the start of the year.

However, US index futures rose 0.2% this morning, raising hopes that the decline may be halted by the end of the day.

Europe braces for a weak start

European markets also look set to open in the red. STOXX 50 futures fell 0.8%, signaling a likely decline in European stock indexes early in the trading day.

The situation remains tense, with investors continuing to monitor the further development of US tariff policy and its impact on the global economy.

Weakness in Canadian Dollar, Peso and Aussie

The Canadian dollar and Mexican peso weakened as the United States imposed new tariffs, reflecting growing concerns about the economic impact of trade restrictions. The Australian dollar fell to a one-month low, reflecting weakening demand for currencies linked to commodities and risky investments.

Meanwhile, the Chinese yuan pared some of its losses, climbing from its lowest since February 13 in offshore trading. The People's Bank of China continues to support the currency by adjusting its official fixing to the upside.

Euro and Sterling Hold Their Ground

Despite market turbulence, the euro remained steady at $1.0484 after rising 1.1% earlier in the week. Sterling also held its ground at $1.2697, up 1% the previous day.

US Treasury yields fall

Investors continue to move into safe haven assets, which led to a further decline in US Treasury yields. The yield on 10-year bonds fell to 4.115%, which was the lowest level since October. This suggests that the market is pricing in a possible weakening of economic activity and an increase in demand for safe assets.

Bitcoin loses ground after a wave of optimism

The cryptocurrency market is also showing instability. Bitcoin is trading at $ 84,220, after investors lost enthusiasm for a possible US strategic cryptocurrency reserve. A day earlier, the rate reached $ 95,000 after Donald Trump published a list of five digital assets, including bitcoin, that could become part of the economic program. However, the excitement quickly died down, and the market corrected.

Gold Slightly Down

After a recent rally, gold prices slipped 0.2% to $2,889 an ounce. However, demand for precious metals remains strong as investors continue to seek safety nets amid economic uncertainty.

Oil Continues to Fall on Expectations of Increased Production

World oil prices remain under pressure. After Brent and WTI fell by about 2% on Monday, the decline continued.

- Brent futures fell 0.9% to $70.97 a barrel;

- US WTI oil lost 0.7% to $67.87 a barrel.

The fall was caused by the news that OPEC+ will maintain its planned increase in oil production in April. This raised concerns about a possible oversupply on the market and pressure on oil prices.

Markets continue to monitor the situation closely, assessing the impact of trade barriers, currency movements and the global economic outlook.