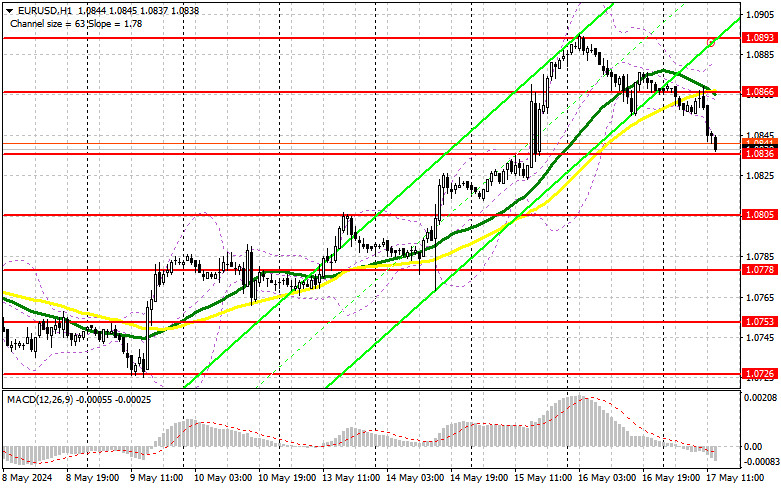

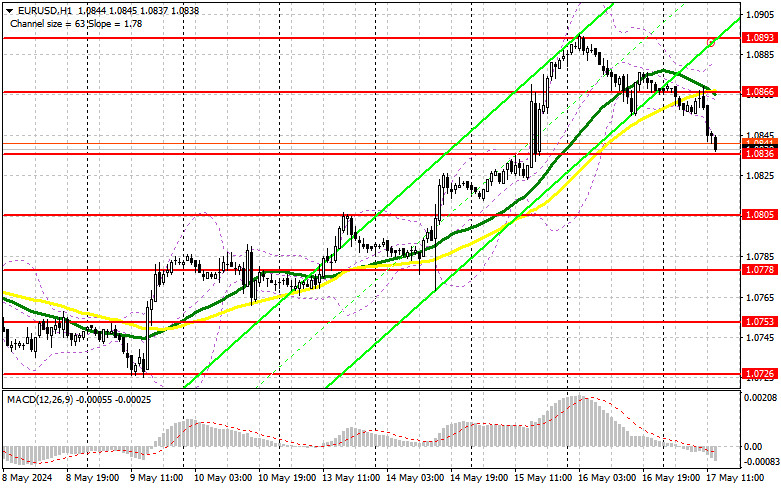

I focused on the 1.0866 level in my morning forecast and planned to make market entry decisions from there. Let's look at the 5-minute chart and see what happened. The rise and the formation of a false breakout at this level provided an excellent entry point for short positions, resulting in another significant drop in the pair with a renewal of support at 1.0863. Since we remained trading within the channel, the technical picture for the second half of the day remains unchanged.

To open long positions on EUR/USD:

The inflation data in the Eurozone for April this year completely matched economists' forecasts, which renewed pressure on the euro. The chances of buyers making a significant move by the end of this week are rapidly diminishing. There is absolutely no statistical data in the second half of the day that could lead to a serious spike in volatility, so buyers have only one hope left, and that is the 1.0836 level. The formation of a false breakout will be a suitable option for entering the market, anticipating a rise in the pair and a return to the morning high of 1.0866. A breakout and consolidation above this range will strengthen the pair and give it a chance to surge to 1.0893, the monthly high. The furthest target will be the 1.0918 high, where I will be taking profits. In the case of a decline in EUR/USD and the absence of activity around 1.0836 in the second half of the day, pressure on the pair will only increase, leading to a larger fall. In that case, I will only enter long positions after forming a false breakout around the next support at 1.0836. I plan to open long positions immediately on a rebound from 1.0805 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Sellers are making quite successful attempts, continually recovering their losses. Given how much we have fallen, I will act after a failed attempt to break through the morning resistance at 1.0866. Protection and the formation of a false breakout there, similar to what I analyzed above, will be a suitable scenario for opening short positions with the prospect of a decline in the euro and a renewal of support at 1.0836. A breakout and consolidation below this range and a reverse test from bottom to top will provide another selling point, targeting a move to the 1.0805 low. The furthest target will be the 1.0778 area, where I will take profits. Testing this level will indicate the pair is locked in a sideways channel. If EUR/USD moves upward in the second half of the day and bears are absent at 1.0866, and since there are no reasons for them to be there today, buyers will get a chance to rise by the end of the week. In that case, I will postpone selling until testing the next resistance at 1.0893. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0918, aiming for a downward correction of 30-35 points.

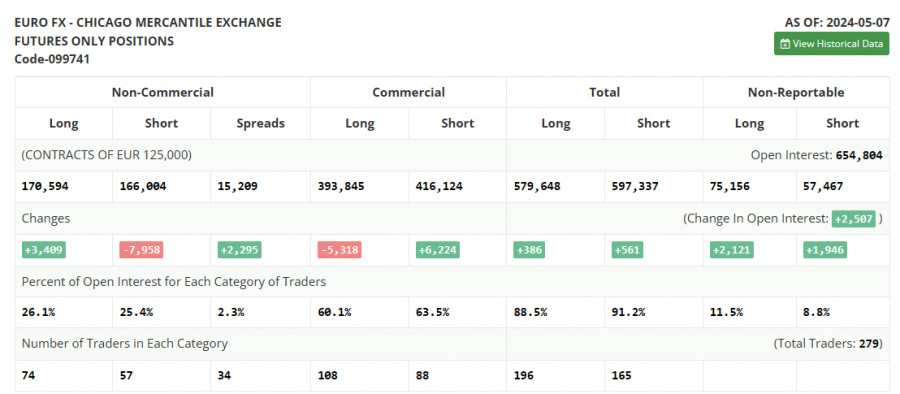

In the COT report (Commitment of Traders) for May 7, there was a reduction in short positions and an increase in long ones. This indicates that demand for risky assets, although still present, is rather weak after the central bank meetings. The fact that the number of long and short positions is almost equal also indicates a lack of advantage for either side, which the chart confirms. Now, traders will await new statistics and benchmarks while trading continues in a sideways channel with a slight advantage for risk asset buyers. The COT report indicates that long non-commercial positions increased by 3,409 to 170,594, while short non-commercial positions fell by 7,958 to 166,004. As a result, the spread between long and short positions increased by 2,295.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of the moving averages on the hourly H1 chart, which differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0836, will act as support.

Description of indicators:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.