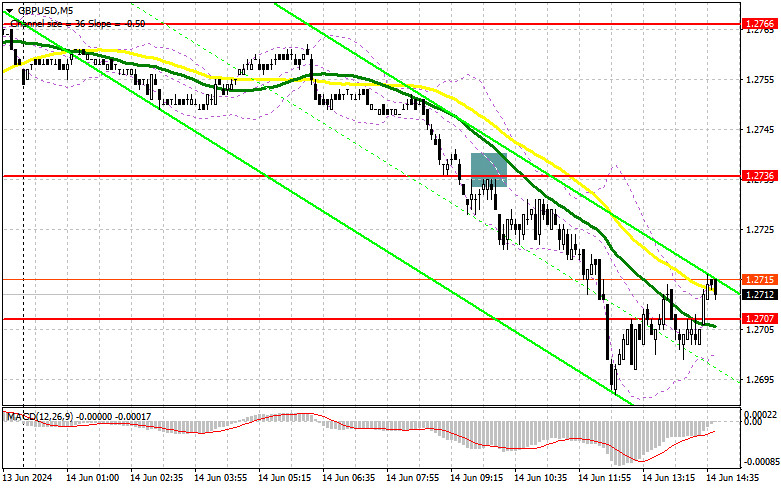

In my morning forecast, I paid attention to the 1.2736 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The breakout and the reverse bottom-up test led to another sell-off of the pound with a movement of 50 points. In the afternoon, the technical picture was slightly revised.

To open long positions on GBP/USD, you need:

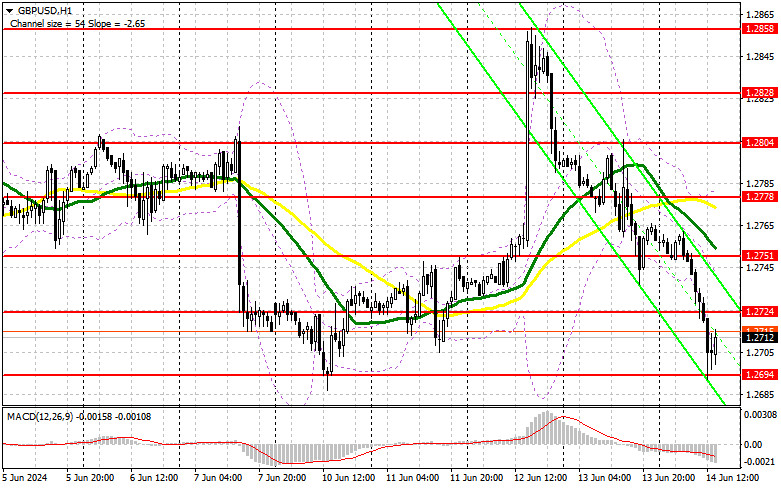

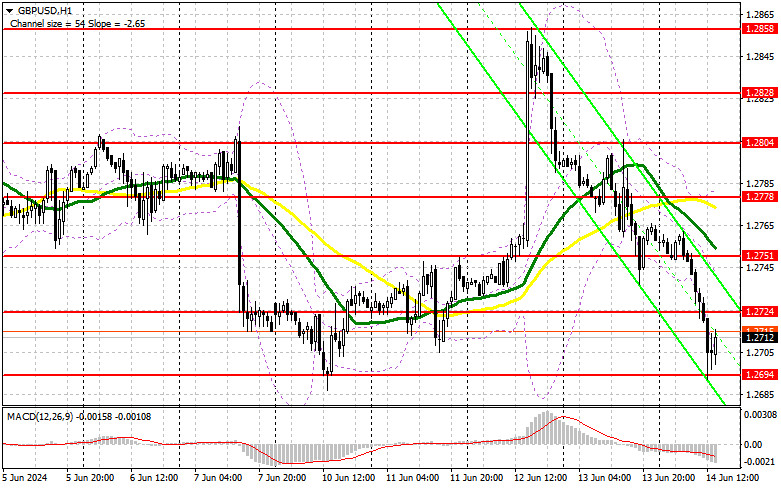

Ahead, we have data on the United States, which will be able to drop the pound even lower and allow us to update the weekly lows. Figures on the consumer sentiment index from the University of Michigan and inflation expectations are expected. Despite the deplorable nature of the pound, I expect active actions by buyers after the release of statistics, as well as profit-taking on short positions. A decrease and the formation of a false breakout in the area of 1.2694 will give an entry point to long positions in order to return to the level of 1.2724. A breakout and a reverse test from top to bottom of this range will be suitable conditions for buying already based on the update 1.2751, where the moving averages are located, playing on the sellers' side. The farthest target will be the area of 1.2778, where I'm going to take profits. In the scenario of a decline in GBP/USD and a lack of activity on the part of the bulls at 1.2694 in the afternoon, the pound risks entering the bear market stage, which will only increase pressure on the pair. This will also lead to a decrease and update of the next support 1.2674. Only the formation of a false breakout will be a suitable condition for opening long positions. I'm going to buy GBP/USD immediately on a rebound from the low of 1.2646 in order to correct by 30-35 points within the day.

To open short positions on GBP/USD, you need:

Sellers control the market, and the protection of 1.2724 is enough for them to continue the development of the bearish trend. The formation of a false breakdown after weak statistics on the United States will be a suitable option for opening short positions in order to reduce the new support area of 1.2694. A breakout and a reverse test from the bottom up of this range will deal another blow to the positions of buyers, leading to the demolition of stop orders and opening the way to 1.2674 – a new weekly low. The farthest target will be the 1.2646 area, where I will record profits. A test of this level will also indicate the formation of a new bear market. With the option of GBP/USD growth and lack of activity at 1.2724 in the afternoon, buyers will try to stop the bearish madness that has been observed for the second day. In this case, I will postpone sales until a false breakout at the level of 1.2751. In the absence of a downward movement, I will sell GBP/USD immediately for a rebound from 1.2778, but I am counting on a correction of the pair down by 30-35 points within the day.

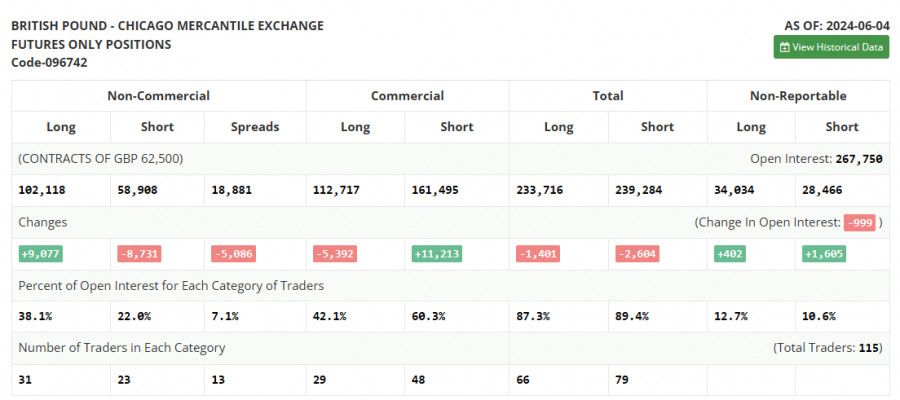

In the COT report (Commitment of Traders) for June 4, there was an increase in long positions and a reduction in short ones. Many economists continue to bet that the Bank of England will cut interest rates in late summer and early autumn of this year. However, the key moment for determining the direction of the pound is likely to be the results of the next meeting of the Federal Reserve System, which will give the pair momentum for the next month. The fact that the buyers of the pound quite steadfastly endured the sell-off observed after recent data on the US labor market indicates the presence of major players betting on further growth of GBP/USD. Therefore, the hope for a bull market for the pound remains. The latest COT report says that long non-profit positions increased by 9,077 to 102,118, while short non-profit positions decreased by 8,731 to 58,731. As a result, the spread between long and short positions fell by 5,086.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating a further decline in the pair.

Note: The author examines the period and prices of moving averages on the H1 hourly chart, differing from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2695, will act as support.

Description of Indicators:

- Moving Average: Defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average: Defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long Non-Commercial Positions: Represent the total long open position of non-commercial traders.

- Short Non-Commercial Positions: Represent the total short open position of non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.