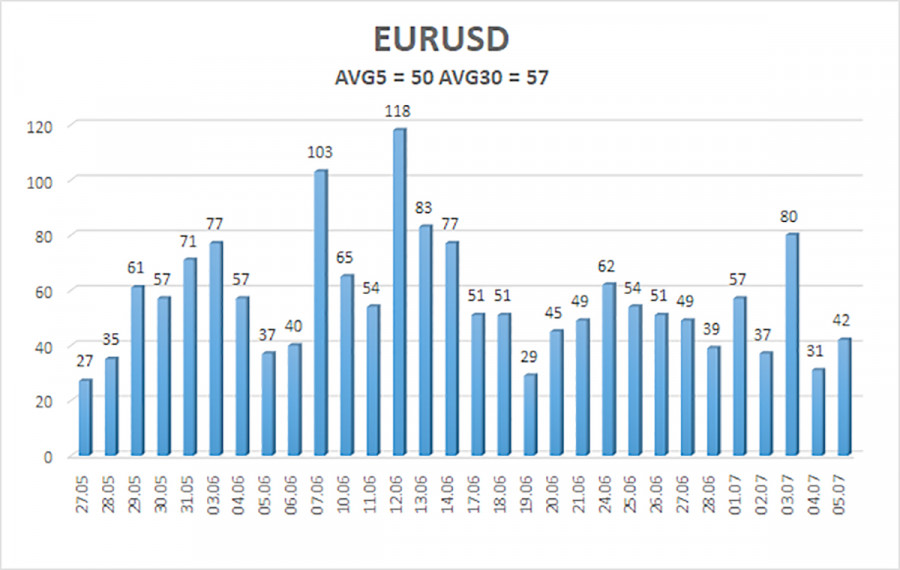

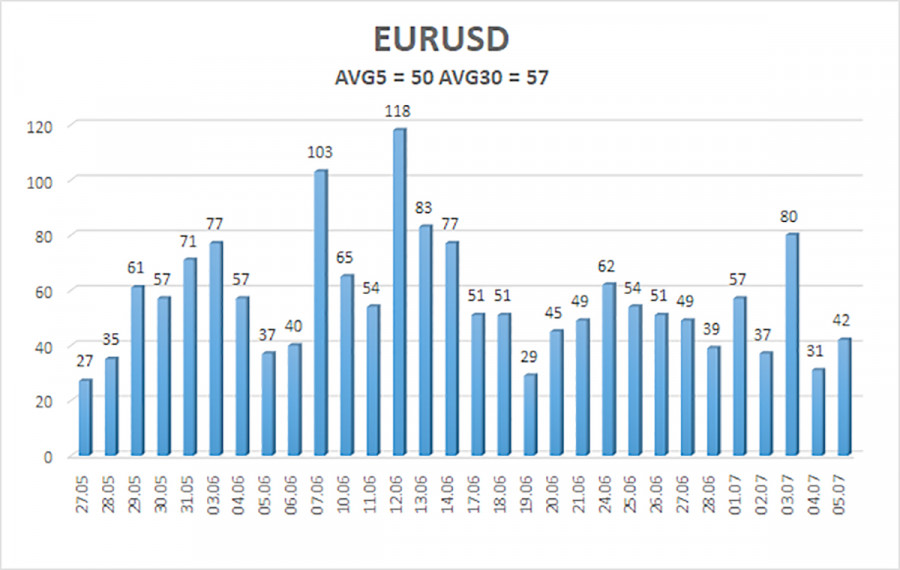

EUR/USD held gains on Friday. First of all, we would like to draw your attention to the pair's volatility last week. Some readers might be wondering why we constantly mention this indicator, but we consider this an important factor at the moment. Last week, crucial reports on ISM business activity, labor market, wages, and unemployment were released in the US. Furthermore, there were speeches by Christine Lagarde and Jerome Powell. Despite the abundance of fundamental and macroeconomic data, the average volatility of the pair was only 50 pips, which is slightly above the lowest level. In other words, the market still does not want to trade the pair. Basically, it is very difficult to work with the current movements. We have repeatedly mentioned that it is extremely inconvenient to work with intraday movements of 20-30 pips.

Let's also look at last week from the perspective of fundamental and macroeconomic background. In fact, we saw the pair move in one direction, which could be executed and traders could earn about 120 pips. This amount of pips in a week with the pair constantly moving in one direction... But is it really that straightforward? We have already mentioned that there were a huge number of important events last week. And the vast majority of them were not in favor of the US dollar. Thus, we saw one-sided movement only because all the data were similar. If at least some of the reports had supported the US currency, we would not have seen a 120-pip rise. Instead, we would have seen several corrections.

In the new week, there are virtually no significant events scheduled in the Eurozone. We can only highlight the second estimate of the German inflation report for June. This is a secondary indicator that will not affect the prospects of the European Central Bank's monetary policy regardless of its value. Currently, the single currency is rising again based on weak economic reports from the US. If the market continues to receive such disappointing US macro data, the dollar may fall further. The market no longer focuses on the growing divergence between ECB and Federal Reserve rates.

In any case, there shouldn't be as many negative news items for the dollar in the next five days, so the dollar has a good chance of recovering. On the 24-hour timeframe, it's clear that a bearish bias has persisted over the past six months, but the downward movement has been quite weak and the pair often moves sideways. The price has been trading between the levels of 1.0650 and 1.1000 all this time. Therefore, we probably shouldn't wait for the euro to show a significant rise beyond this range. Given the fact that the fundamentals support the dollar while the macroeconomics work against it, we believe that the pair will continue to fluctuate within the specified range. Long-term targets remain unchanged.

The average volatility of the EUR/USD pair over the last five trading days as of July 8 is 50 pips, which is considered a low value. We expect the pair to move between 1.0789 and 1.0889 on Monday. The higher linear regression channel is directed upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but it has already been worked out by a bullish correction.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, while it continues to rise on the 4-hour timeframe. In previous reviews, we said that we are waiting for the continuation of the downward trend. However, at this time we can't deny that the euro is rising again due to quite understandable factors. Unfortunately, both the market and economic reports are against the dollar at the moment. We believe that the euro can't start a new global trend right now when the ECB eases its monetary policy, so most likely the pair will continue to stay around between the levels of 1.0650 and 1.1000. Traders may continue to opt for short positions in the upper part of this range and after the price consolidates below the moving average. Targets are around the 1.07 level.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.