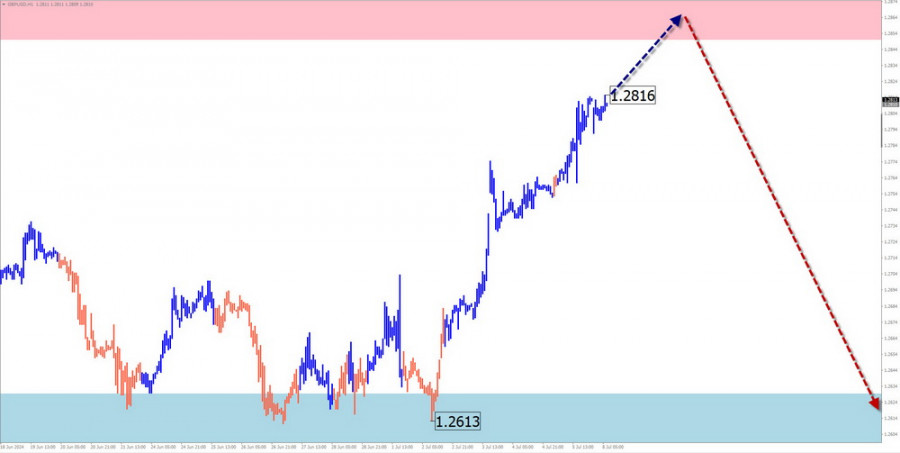

GBP/USD

Analysis:

The downward wave of the British pound chart from July of last year continues to correct the pair's main trend. Quotes are within a powerful potential reversal zone. Currently, the wave structure appears incomplete. Since last month, the pair's quotes have been drifting mostly sideways, forming the wave's middle part (B).

Forecast:

Throughout the upcoming week, the pair is expected to complete the current bullish movement of the British pound. Subsequently, a reversal will likely form near the resistance zone, initiating a downward movement. The support zone indicates the expected lower boundary of the pair's weekly movement.

Potential Reversal Zones

Recommendations:

- Purchases: Have limited potential. It is advisable to reduce the trading lot.

- Sales: It is safer to refrain from trading until confirmed reversal signals appear near the resistance zone.

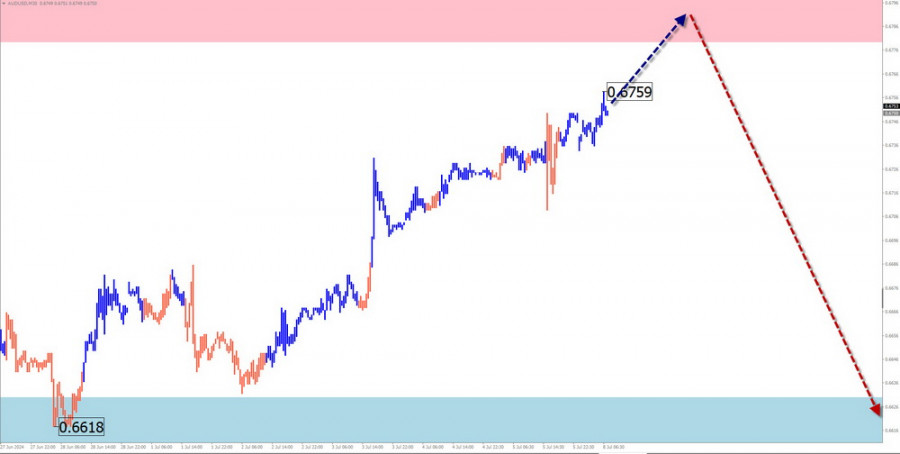

AUD/USD

Analysis:

The currently incomplete upward wave of the Australian dollar chart has been forming since April 19. In its structure, the corrective part (B) has been forming as a shifting plane in the last four weeks. It lacks the final segment.

Forecast:

The pair is expected to complete the bullish movement in the coming days. Within the calculated resistance boundaries, a reversal can be expected, followed by the resumption of the bearish movement. The calculated support levels limit the downside potential.

Potential Reversal Zones

Recommendations:

- Purchases: Carry a high degree of risk and may become unprofitable.

- Sales: This will become possible after reversal signals appear. It is advisable to reduce the trading lot.

USD/CHF

Analysis:

The price rise of the major Swiss franc pair resulted in contact with the lower boundary of a powerful resistance zone. Since early May, quotes have declined, forming the first part of a corrective wave. Recently, a horizontal pullback has formed within it, nearing completion.

Forecast:

The flat movement is expected to be fully completed at the beginning of the upcoming week. Near the resistance zone, a reversal is expected, with the resumption of the bearish movement. The highest activity is likely at the end of the week.

Potential Reversal Zones

Recommendations:

- Purchases: Have no potential and are highly risky.

- Sales: Conditions for short-term trades will arise after reversal signals appear near the resistance zone.

EUR/JPY

Analysis:

An upward trend dominates the euro/yen cross chart. The incomplete wave of the short-term trend has been forming since December of last year. A month ago, the final segment of wave (C) began, with the price forming a horizontal pullback in recent days. Its structure is nearing completion.

Forecast:

Next week, the price rise will continue until it is fully completed near the resistance zone. A sideways movement or brief decline to the support zone is more likely in the next couple of days. The highest volatility is expected at the end of the week.

Potential Reversal Zones

Recommendations:

- Purchases: Can be used with a fractional lot within individual trading sessions.

- Sales: Carry a high risk and may become unprofitable once confirmed signals from your trading systems appear.

AUD/JPY

Analysis:

Since December of last year, the direction of price movement in the Australian dollar cross has been set by an upward trend. The price is approaching the lower boundary of the large-scale potential reversal zone. The structure's analysis shows it nearing completion, necessitating the beginning of a correction.

Forecast:

The price is expected to move towards the resistance zone throughout the upcoming week. A breakout beyond the calculated resistance is unlikely. In the second half, a change in direction and a gradual price decline are expected.

Potential Reversal Zones

Recommendations:

- Purchases: Can be used intraday with a fractional lot.

- Sales: Carry a high risk and may become unprofitable once confirmed reversal signals appear near the resistance zone.

US Dollar Index

Analysis:

The incomplete short-term wave of the dollar index is directed north on the chart. A correction (B) has been forming in the last two weeks. The structure of this wave appears complete, but there are no reversal signals on the chart.

Forecast:

At the beginning of the week, a brief decline in dollar quotes to support levels can be expected. Subsequently, the likelihood of a reversal and the resumption of the upward movement increases. The calculated resistance shows the upper boundary of the week's movement.

Potential Reversal Zones

Recommendations:

The market for major pairs awaits the end of the dollar's decline. Subsequently, conditions for a trend change and the beginning of a weakening of national currencies can be expected.

Explanations: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed on each timeframe. Expected movements are shown with dashed lines.

Note: The wave algorithm does not account for the duration of movements of instruments over time.