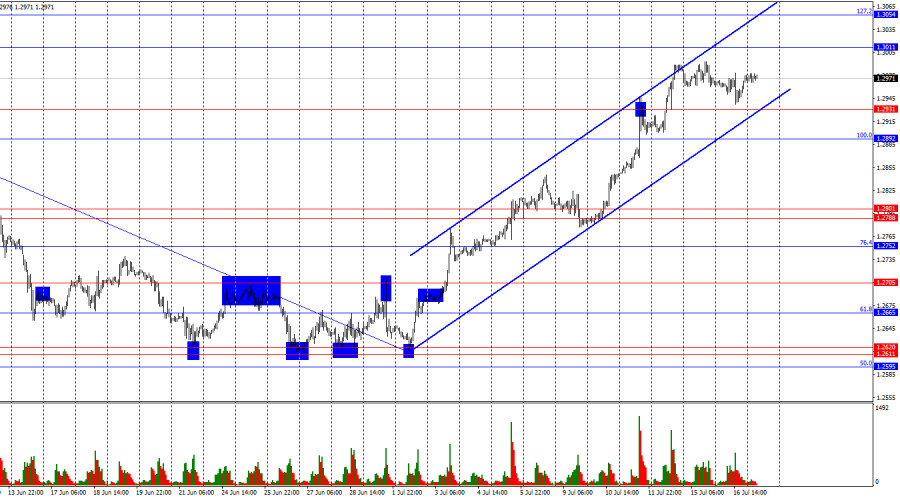

On the hourly chart, the GBP/USD pair also attempted to fall to the nearest level of 1.2931 on Tuesday. However, the bears could not push the British pound down to this target, after which they retreated from the market. Today, the direction of movement is still undefined, as no buy or sell signals have been formed in the last few days. The ascending trend channel continues to characterize traders' sentiment as "bullish."

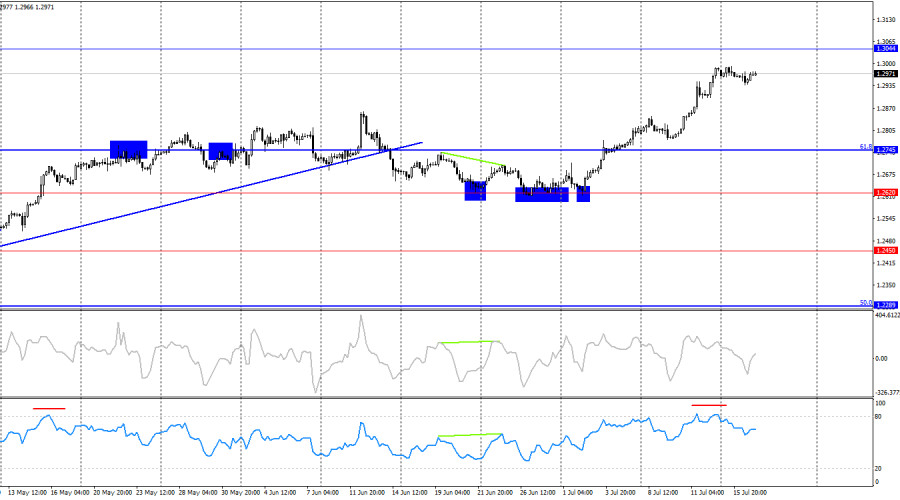

The wave situation changed last week. The last downward wave (which started forming on June 12) managed to break the low of the previous downward wave, and the new upward wave (which is still forming at this time) was able to break the peak of the previous upward wave. Thus, we received the first sign of a trend change to "bullish" after a "bearish" trend that did not materialize. The growth of the pound may continue. I have many doubts about the sustainability of such a trend, but graphical analysis shows what to expect soon.

The informational background on Tuesday allowed the bears to counterattack, but the background was not strong enough, and the bears were not eager to attack. As a result, the pound lost almost nothing and remains poised for growth. Today, a report on June inflation was released in the UK, showing that contrary to forecasts, there was no slowdown at the end of the month. Core inflation also did not change. The lack of inflation slowdown, along with statements by BoE members about a possible acceleration in the second half of the year, means that rates may remain unchanged in August. The Bank of England decided not to rush such a decision at the last meeting and may take a pause in August. However, the pound continues to grow in any case. There was no pressure on it today. Traders may even consider the absence of an inflation slowdown as a reason for new pound purchases.

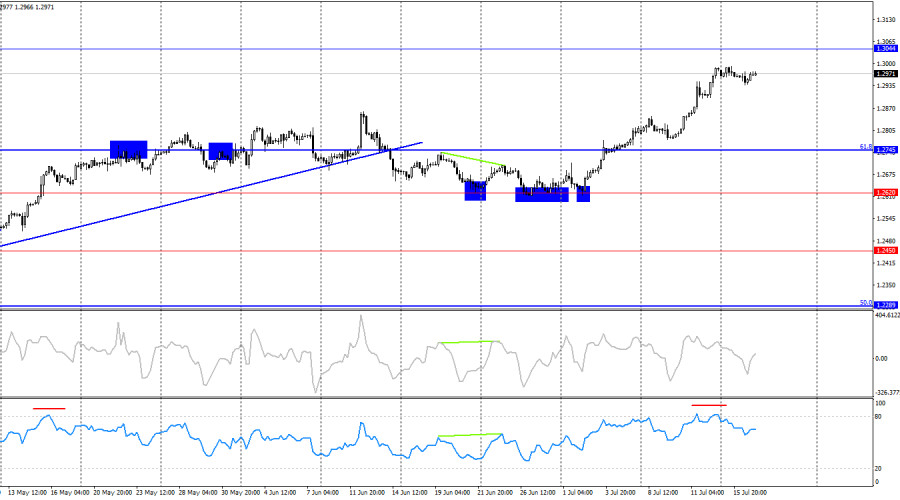

On the 4-hour chart, the pair reversed in favor of the British currency after four rebounds from the 1.2620 level, followed by consolidation above the corrective level of 61.8%-1.2745. Looking at the 4-hour chart, there are no obstacles to further growth of the pound up to the 1.3044 level, towards which the price continues to move. Currently, the pound has good graphical growth prospects.

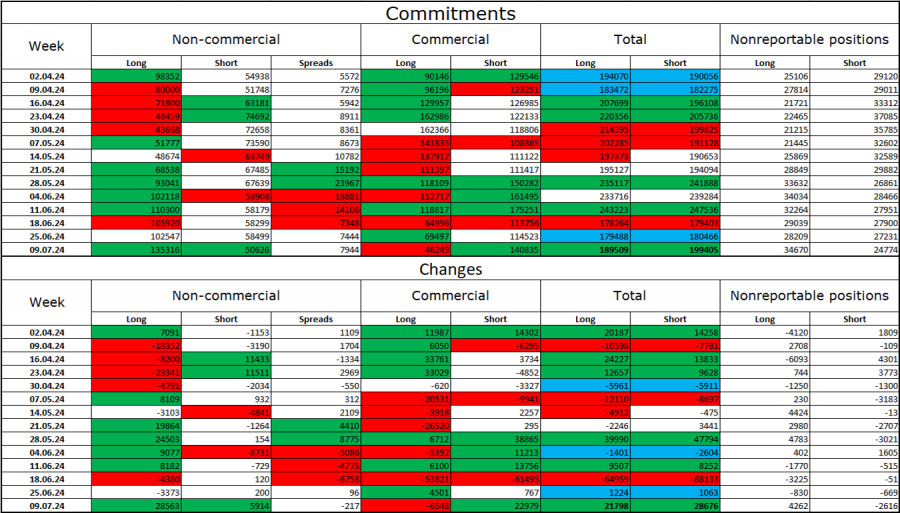

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became even more "bullish" during the last reporting week. The number of long positions held by speculators increased by 28,563 units, while the number of short positions increased by 5,914 units. The bulls still hold a solid advantage. The gap between the number of long and short positions is now 85,000: 135,000 versus 50,000.

In my opinion, the pound still has prospects for decline, but COT reports and graphical analysis suggest otherwise. Over the past 3 months, the number of long positions has increased from 98,000 to 135,000, while the number of short positions has decreased from 54,000 to 50,000. I believe that over time, major players will start to shed long positions or increase short positions, as all possible factors for buying the British pound have already been realized. However, it is important to remember that this is just a hypothesis. Graphical analysis still indicates the weakness of the bears, who couldn't even "take" the 1.2620 level.

News Calendar for the US and UK:

- UK – Consumer Price Index (06-00 UTC).

- US – Number of Building Permits Issued (12-30 UTC).

- US – Number of Housing Starts (12-30 UTC).

- US – Industrial Production Change (12-30 UTC).

On Wednesday, the economic events calendar contains four entries, and the most important one is already available to traders. The impact of the informational background on market sentiment today can be moderate.

Forecast for GBP/USD and Trading Recommendations:

Sales of the pound are possible today with a rebound from the 1.3011 level on the hourly chart or from the 1.3044 level on the 4-hour chart, targeting the lower boundary of the ascending channel. Purchases could have been considered upon consolidation above the 1.2931 level, with targets at 1.3011 and 1.3044. These trades can now be kept open.

Fibonacci level grids are built on 1.2892–1.2298 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.