The pound in the GBP/USD pair reached its yearly price high the day before yesterday, hitting 1.3043. The release of inflation growth data in the UK drove the upward price impulse. Almost all report components were in the "green zone," reflecting the stubbornness of British inflation. The published figures reduced the likelihood that the Bank of England would start easing monetary policy at its next meeting (scheduled for August). Against the backdrop of dovish statements from Powell and slowing inflation in the US, GBP/USD buyers felt more than confident. All the prerequisites for testing the 1.31 level were present.

But yesterday, the pair unexpectedly turned south. The rise in risk-off sentiment allowed the US dollar to assert itself again. The US dollar index has risen confidently for the second day, from 103.33 to 104.04. The major currency pairs adjusted accordingly. The GBP/USD pair was no exception: the price dropped by more than 100 points in two days.

Additional pressure on the pound came from today's retail sales data. The total volume of retail sales in June decreased by 1.6% month-on-month, compared to the forecasted decline of 0.6%. Year-on-year, the figure was -0.2% against a forecasted growth of 1.2%. Retail sales excluding fuel also decreased by 1.5% year-on-year and 0.8% month-on-month.

The dollar, in turn, strengthened its position amid the publication of secondary macroeconomic reports, which presented a rather contradictory picture. For example, the Philadelphia Fed manufacturing index, based on a survey of manufacturing companies in the region, surged yesterday: the forecast was 2.7, but it came in at 13.9.

However, the US labor market report came out in the "red zone." Initial jobless claims rose to 243,000 for the week (forecast—229,000), the fastest growth rate since early June. The indicator had been gradually decreasing but has now accelerated again. While this is not catastrophic, the trend is important. The indicator stayed above the 230,000 mark throughout June. In early July, it was at 223,000, but the second week of July showed a growth of 243,000.

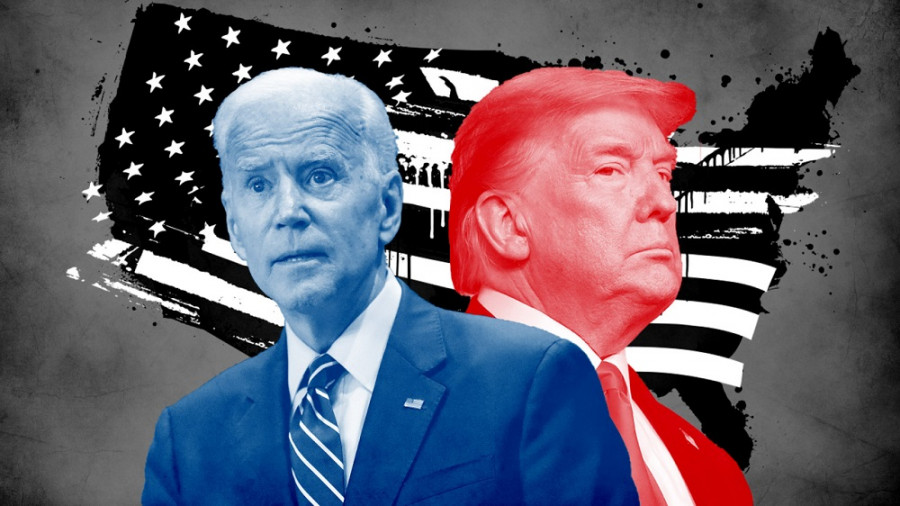

The US dollar ignored this report, strengthening its positions amid rising risk-off sentiment. Rumors that Biden is about to leave the presidential race have unsettled the markets, especially since this step, according to some analysts, would increase Trump's chances of winning the election.

Donald Trump made several important statements in a recent interview with Bloomberg Businessweek. Specifically, he mentioned that he "would allow Jerome Powell to finish his term, especially if he acts correctly."

Remember that the current Fed chairman's term expires in less than two years – in May 2026. However, there's no doubt that Trump, as president, would continue the practice of public (and probably private) pressure on the central bank, as he did during his first term.

Trump also "strongly advised" the Fed not to cut the interest rate in September, as such a step, in his opinion, would have a political context, suggesting that the central bank would be favoring the current president. It is worth noting that Powell has always assured the markets that the body he heads is independent, so the central bank may ignore Trump's words. However, this "warning" from the Republicans could still play a role if the regulators' members are genuinely concerned that their decision might appear to support the Democratic candidate.

While the topic with the Fed is debatable, the prospects of resuming the trade war with China are very real. In the Bloomberg Businessweek interview, the Republican leader effectively announced the start of "hostilities" after his victory: he said new tariffs on Chinese goods would range from 60% to 100%. Additionally, Trump said he would impose a 10% tariff on imports from other countries as they "buy too few American goods."

Despite Donald Trump advocating for a weaker national currency (though it needs to be clarified how), most experts believe that his actions in foreign economic affairs will only strengthen the greenback, as high tariffs will raise inflation and result in higher taxes for American households. Therefore, along with the rise in the Republican's ratings, the dollar is also growing as traders evaluate the prospects of the approaching "Trump 2.0" era.

Thus, the downward movement of the GBP/USD pair is more likely driven by emotional fluctuations. However, it should be noted that there are still more than three months until the elections. This means the market will inevitably get used to Trump's return to the White House (if he continues to lead the Democratic candidate in swing states). Traders will soon return to "classic" fundamental factors, and in this environment, the pound has certain advantages.

As mentioned above, the latest inflation growth report reflected stagnation in both overall and core inflation: the overall consumer price index was at 2.0% year-on-year (as in the previous month), and core inflation was at 3.5% year-on-year. CPI inflation in the services sector remained high (5.7% year-on-year). The labor market report published the next day reflected high wage growth rates – 5.7%. All this suggests that the Bank of England will likely maintain the status quo on August 1 and may use more hawkish language in the accompanying statement and monetary policy report. The GBP/USD pair grew on this "fuel" until the "Trump factor" appeared.

Given the current fundamental background, taking a wait-and-see position on the pair is advisable. Over the weekend, Biden may likely withdraw from the race, and the market will react to this event early next week. Classic fundamental factors will then come to the forefront again (for example, the US GDP growth report for the second quarter will be published on Thursday). Once emotions subside, the dollar may lose its footing – in which case, the pound will be back in favor, as it has stronger fundamental arguments. But it is better to stay out of the market until these passions calm down (regarding Biden's withdrawal or not).