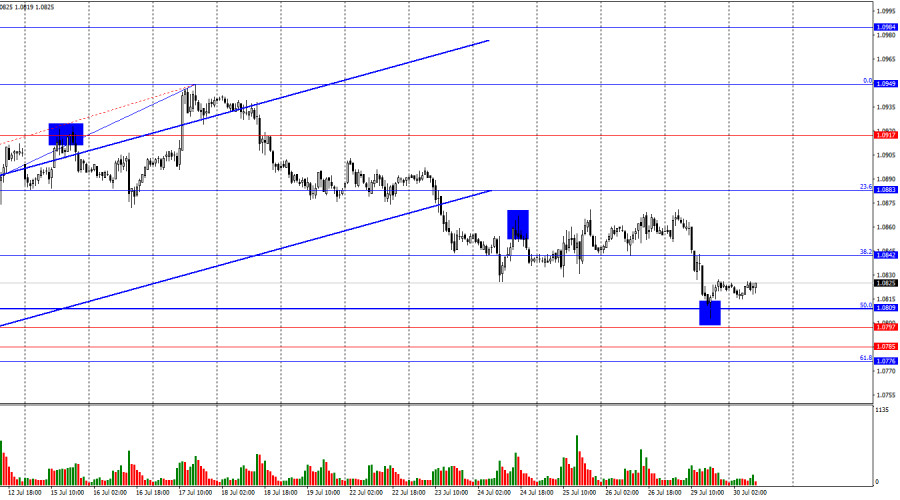

On Monday, the EUR/USD pair reversed in favor of the U.S. dollar and fell to the 50.0% corrective level at 1.0809. A rebound from this level worked in favor of the euro and initiated growth towards the Fibonacci level of 38.2% – 1.0842. The 1.0776–1.0809 area is very important for the pair. Consolidation below it will significantly increase the likelihood of a further decline of the euro.

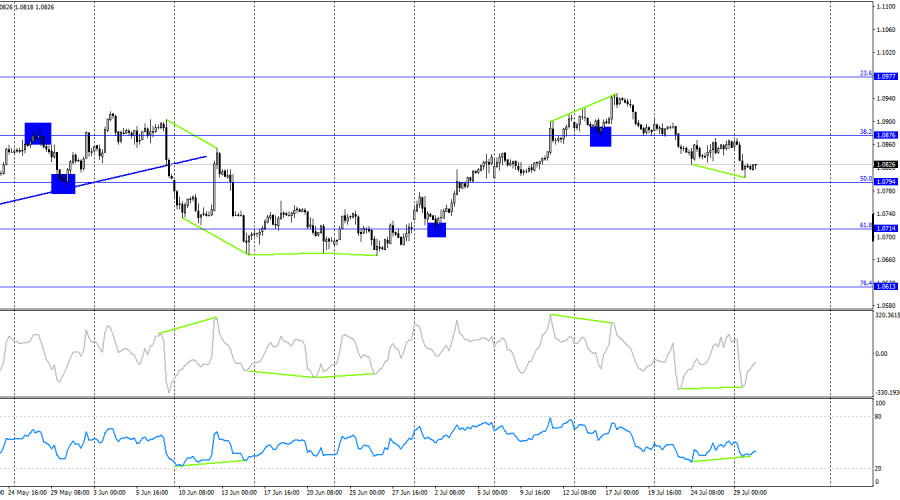

The wave situation has become a bit more complex but remains clear overall. The last upward wave broke the peak of the previous wave and can be considered complete. Thus, the bears have started forming a corrective wave. For the "bullish" trend to be canceled, the bears need to break the low of the previous downward wave, which is around 1.0668. They need to drop another 170-180 points downwards for this. Given the current trader activity, this may take 2-3 weeks, one of which has already passed. Clearly, a quick fall is not expected.

There was no informational background on Monday, and the bears desperately need information support. Today, they can rely on GDP data from the Eurozone and Germany. The German economy may grow by only 0.1% in the second quarter, and the European economy by 0.2%. Therefore, values above these levels will allow the bulls to slightly improve their positions. However, in the case of exceeding forecasts, I do not expect strong growth of the euro today. Euro growth may begin, lasting several days or even a week if the informational background supports the bulls. By the end of the week, many important reports and events will be released. Thus, the bulls have a good chance of rising by 60-80 points if the news is in their favor. The bears, on the other hand, will find it very difficult. The Fed is unlikely to strengthen its "hawkish" stance, and economic data from the U.S. may again be weaker than expected. Not all reports may be weak, but even if half of them are weak, it will not allow the bears to continue their attacks.

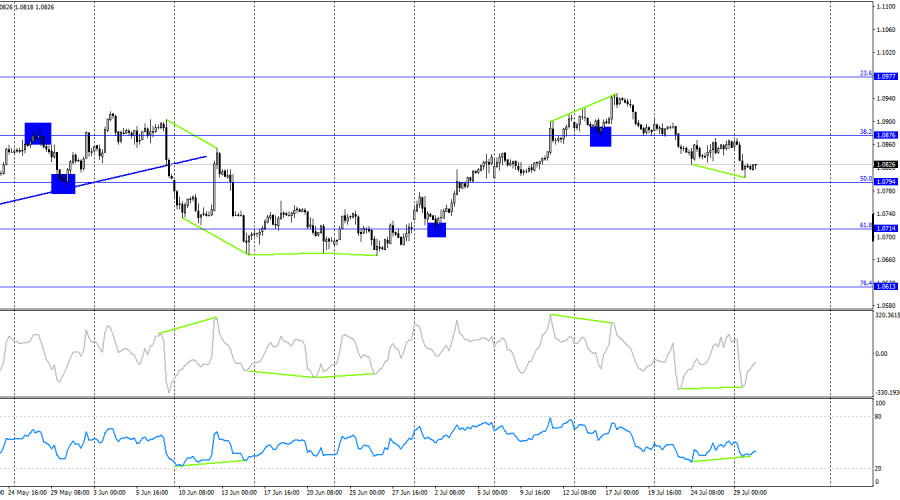

On the 4-hour chart, the pair reversed in favor of the U.S. dollar and consolidated below the 38.2% corrective level at 1.0876. Thus, the decline process may continue towards the Fibonacci level of 50.0% – 1.0794. Today, a "bullish" divergence has formed on the CCI and RSI indicators, which allows for some growth towards 1.0876. Consolidation below 1.0794 will allow for a further decline in expectations.

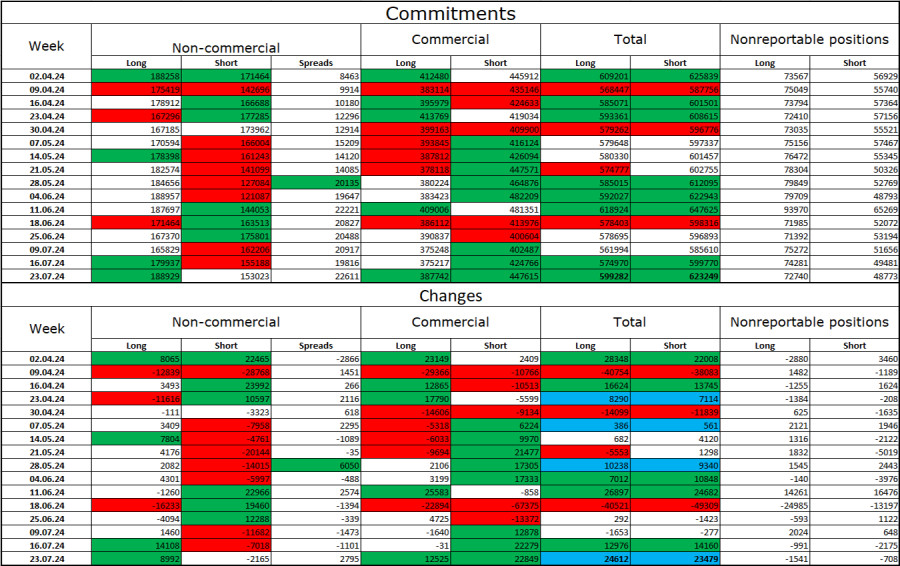

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 8,992 long positions and closed 2,165 short positions. The sentiment of the "Non-commercial" group turned "bearish" a couple of months ago, but currently, the bulls are dominant again. The total number of long positions held by speculators is now 189,000, while short positions total 153,000.

The situation will continue to change in favor of the bears. I do not see long-term reasons to buy the euro since the ECB has started easing its monetary policy, which will lower the yields on bank deposits and government bonds. In America, they will remain high for several more months, making the dollar more attractive to investors. The potential for the euro to decline, even according to COT reports, looks significant. However, it should not be forgotten that graphic analysis currently does not allow for a confident statement about a strong fall in the euro.

News Calendar for the U.S. and the Eurozone:

Eurozone – GDP for the second quarter in Germany (08:00 UTC).

Eurozone – GDP for the second quarter (09:00 UTC).

Eurozone – Consumer Price Index in Germany (12:00 UTC).

USA – JOLTS Job Openings (14:00 UTC).

On July 30, the economic event calendar contains four important entries. The impact of the informational background on trader sentiment will be present today.

Forecast for EUR/USD and trading advice:

Selling the pair will be possible with a rebound from the level of 1.0842 on the hourly chart, targeting 1.0809. Purchases can be considered with the target of 1.0842, as there was a rebound from the level of 1.0809. The informational background may affect the pair's movement today.

Fibonacci levels are built from 1.0668 – 1.0949 on the hourly chart and from 1.0450–1.1139 on the 4-hour chart.