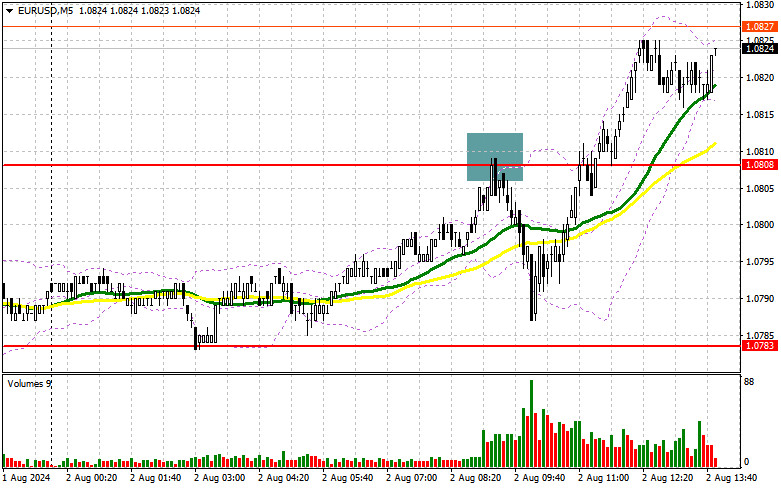

In my morning forecast, I focused on the 1.0808 level and planned to base my market entry decisions on this level. Let's look at the 5-minute chart and see what happened. The rise and subsequent false breakout at this level created an entry point for short positions, leading to a decline of more than 20 points. The technical picture for the second half of the day was minimally revised.

To open long positions on EUR/USD:

In the second half of the day, we expect quite important data on unemployment in the U.S., which has been rising for the last three months, and the number of non-farm employment, which is decreasing. This could be a strong hit for buyers of the U.S. dollar. Therefore, be very cautious with EUR/USD sales. In the event of weak statistics, the euro may rise quite strongly, and a decline followed by a false breakout around 1.0808 after the release of the data would be an ideal signal for increasing long positions with a target of rising to 1.0834. A breakout and subsequent consolidation above this range will strengthen the pair with a chance of rising to 1.0850. The furthest target will be the peak at 1.0870, where I plan to take profits. If EUR/USD declines and there is no significant activity around 1.0808 in the second half of the day, sellers will regain the initiative and proceed with further construction of the downward trend. In this case, I will open positions only after a false breakout forms around 1.0783. I plan to open long positions immediately on a rebound from 1.0761 with a target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Sellers have ceded the initiative, which is quite understandable. Only exceptionally strong statistics will enable bears to re-enter the market in the second half of the day. The ideal scenario for opening short positions involves defending the 1.0834 level and a false breakout at this level. In this case, the target support level will be 1.0808. A breakout and consolidation below this range, as well as a reverse test from below to above amid a sharp increase in the number of new jobs and average earnings in the U.S. in July this year, will provide another selling point with movement towards the 1.0783 area, where I expect to see more active buyer presence. The furthest target will be the area of 1.0761, where I will take profits. If EUR/USD moves up in the second half of the day and there is no bear activity at 1.0834, buyers will get a good chance for a larger upward move – especially in case of uncertainty within the Bank of England as to when to further lower rates. In that case, I will delay selling until there is a false breakout at the 1.0850 level. I will also sell, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.0870 with a target of a downward correction of 30-35 points.

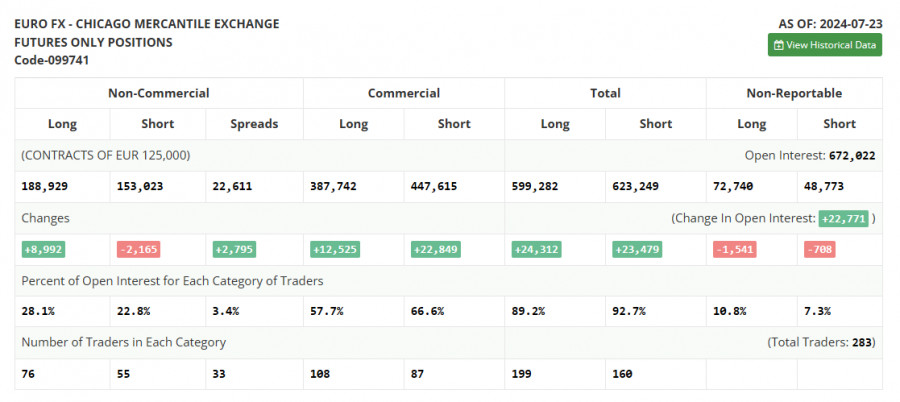

In the COT report (Commitment of Traders) for July 23, there was a decrease in short positions and an increase in long positions. However, if you look closely, nothing significant has changed in the balance of power, and no new priorities were set even before the Federal Reserve meeting, despite talks that it is clearly time for the U.S. regulator to lower interest rates, as recent economic data have been suggesting. While the market remains balanced, you can take advantage of cheaper risky assets, including the euro, by buying them back in anticipation of the Fed lowering rates this year. The COT report indicated that long non-commercial positions increased by 8,992 to a level of 188,929, while short non-commercial positions fell by 2,165 to a level of 153,023. As a result, the spread between long and short positions increased by 2,795.

Indicator Signals:

Moving Averages: Trading is conducted above the 30 and 50-day moving averages, indicating a rise in the euro. Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands: In the event of a decline, the lower boundary of the indicator, around 1.0775, will act as support.

Description of Indicators:

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders — speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.