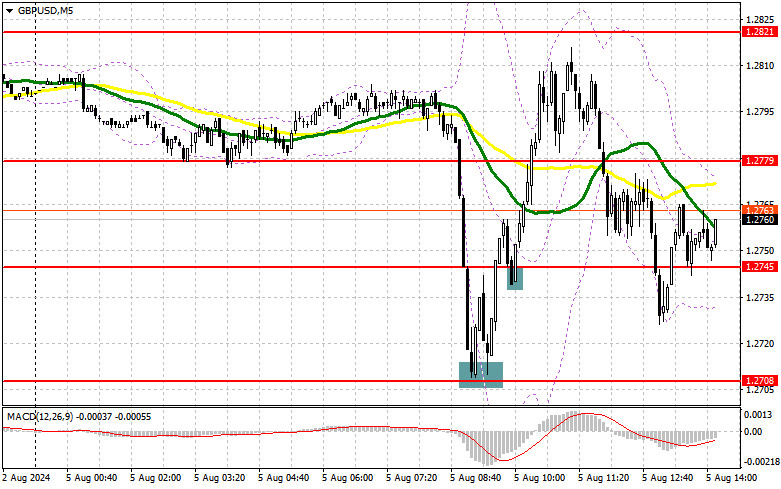

In my morning forecast, I focused on the level of 1.2708 and planned to make market entry decisions from there. Let's look at the 5-minute chart and understand what happened. The decline and formation of a false breakout at 1.2708 allowed entry into the market, resulting in the pair rising more than 50 points. A breakout and retest of 1.2745 provided another entry point for buying the pound with an upward movement of more than 60 points. The technical picture for the afternoon has been slightly revised.

For opening long positions on GBP/USD:

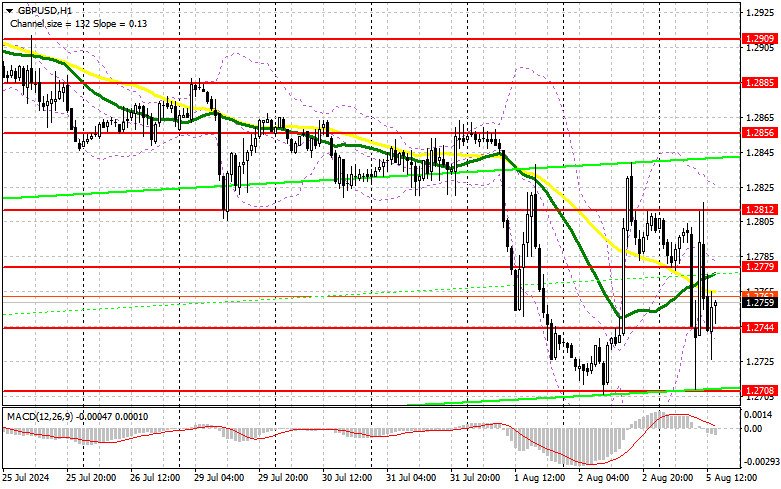

Quite good data on service sector activity in the U.K. allowed the pound to pull away from the weekly low, but it didn't lead to active growth. We await similar figures from the ISM U.S. service sector index and the composite PMI. In the case of weak indicators, the pound may still return to the daily maximum, but this won't be enough for a breakout, so I plan to rebound from the previous levels. In the case of a decline in the pair, I expect active buying around 1.2744, where the formation of a false breakout similar to what I discussed earlier will provide an entry point into the market with the target of returning to 1.2779 – new resistance, where the moving averages are located. A breakout and retest from above to below this range will increase the chances for the pound's growth, leading to an entry point for long positions with the possibility of reaching 1.2812. The farthest target will be the area of 1.2856, where I plan to fix profits. In the scenario of further decline in GBP/USD and lack of activity from the bulls at 1.2744 in the second half of the day, and this level has already proven itself today, all this will lead to a decline and updating of the next support at 1.2708, which will increase the chances of a more significant drop in the pair. Therefore, only forming a false breakout there will be suitable for opening long positions. I plan to buy GBP/USD immediately on a rebound from the minimum of 1.2679, with a target of 30-35 points correction within the day.

For opening short positions on GBP/USD:

Sellers continue to fight actively for market direction. In case of a bullish reaction to the ISM data, I plan to sell only after a false breakout forms near the new resistance at 1.2779, which will provide an opportunity to open new short positions, continuing the bearish trend with the target of updating the weekly minimum and support at 1.2708, which has already worked itself out today. A breakout and retest from below to above this range will strike buyers' positions, triggering stop orders and opening a path to 1.2679. The farthest target will be the area of 1.2640, where I will fix profits. Testing this level will only strengthen the new bearish trend. Buyers will have a good chance of a larger upward spike if GBP/USD increases and there is a lack of activity at 1.2779 in the second half of the day. In that case, I will postpone selling until a false breakout at 1.2812. In the absence of downward movement, I will sell GBP/USD immediately after a rebound from 1.2856, but only with the calculation of a downward correction of 30-35 points within the day.

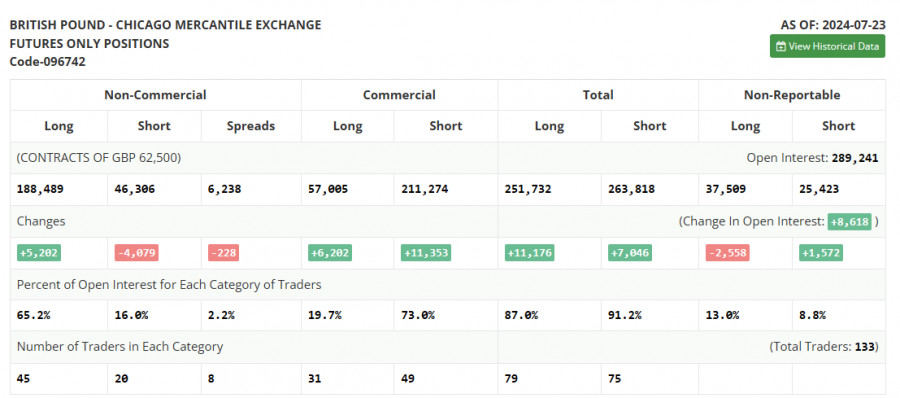

In the COT report (Commitment of Traders) dated July 23, there was growth in long positions and a reduction in short ones. The focus is on the Federal Reserve meeting, where rates will not change, but investors hope to hear more arguments toward their reduction in September this year. However, the upcoming decision by the Bank of England, which will also be published soon, may cause much noise. Economists expect the British regulator to lower rates this summer, which theoretically should weaken the British pound against the U.S. dollar even more, so expecting a return to the bullish market observed in June is not forthcoming soon. The latest COT report states that long non-commercial positions grew by 5,202 to 188,489, while short non-commercial positions fell by 4,079 to 46,306. As a result, the spread between long and short positions fell by 228.

Indicator signals:

Moving averages:

Trading is around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of the moving averages on the hourly chart H1, which differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In the event of a decrease, the indicator's lower boundary at 1.2744 will act as support.

Description of indicators:

- Moving average: Smoothes volatility and noise to define the current trend. Period 50. Marked yellow on the chart.

- Moving average: Smoothes volatility and noise to define the current trend. Period 30. Marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- The total net non-commercial position: The difference between the short and long positions of non-commercial traders.