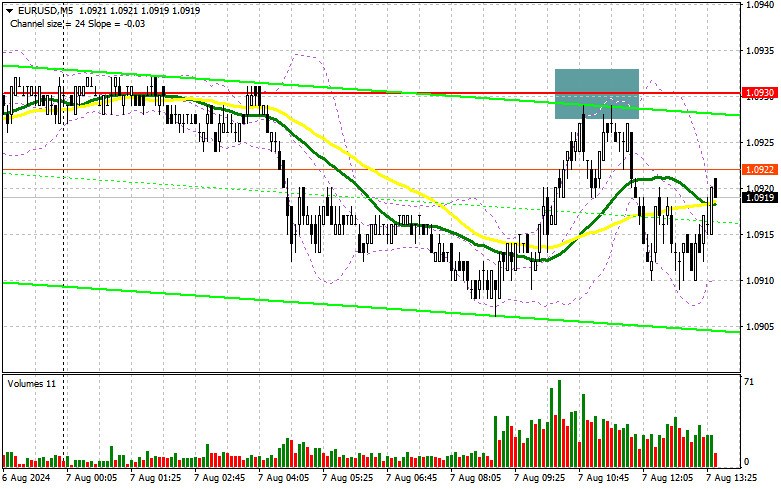

In my morning forecast, I highlighted the level of 1.0930 and planned to make decisions about market entry from that point. Let's look at the 5-minute chart and analyze what happened. The rise and the formation of a false breakout led to a short position entry, resulting in a 20-point drop in the pair, after which volatility ended. The technical picture for the second half of the day was not reviewed.

For Opening Long Positions on EUR/USD:

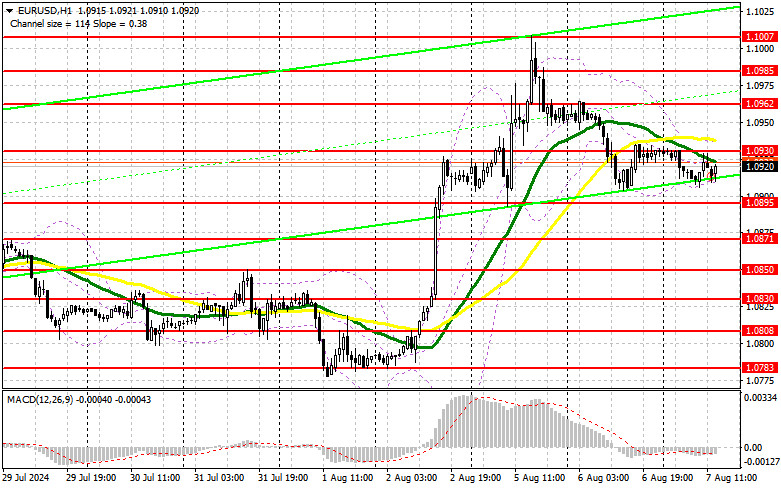

Given the lack of important statistics, no one is in a hurry to do anything with the euro. The picture is exactly the same as yesterday afternoon, and there are no significant U.S. statistics either. Lending data will pass unnoticed by the market as they are released near the close of the U.S. session. Thus, I will stick to the previous scenario. In case the pair declines, the main focus will be on the nearest support at 1.0895, which we did not reach in the first half of the day. A false breakout at this level will be a suitable option for increasing long positions with the target of returning to the new resistance at 1.0930, formed from yesterday. The moving averages are also located there, playing on the sellers' side. A breakout and update from top to bottom of this range will strengthen the pair with a chance to rise towards 1.0962. The furthest target will be the 1.0985 high, where I will take profit. In case of a decline in EUR/USD and a lack of activity around 1.0895 in the second half of the day, sellers will regain initiative at this level, which is quite important from a technical perspective. They will then begin to build a downward trend. In this case, I will enter only after forming a false breakout around 1.0871. I plan to open long positions immediately on a rebound from 1.0850, targeting a 30-35 point upward correction during the day.

For Opening Short Positions on EUR/USD:

Sellers continue to maintain initiative, but they acted quite sluggishly in the first half of the day. Considering the absence of U.S. statistics, one can expect sellers to return to the market. Defending 1.0930 with a false breakout, similar to what I discussed above, will be suitable for opening short positions, targeting a decline to the 1.0895 support formed yesterday. A breakout and consolidation below this range, along with a reverse test from bottom to top, will give another selling point, targeting 1.0871, where I expect to see more active buyer participation. The furthest target will be the 1.0850 area, where I will take profit. Testing this level will thwart euro buyers' plans to establish an upward trend. In case EUR/USD rises in the second half and lacks sellers at 1.0930, buyers will get a chance to regain initiative. In this case, I will postpone sales until testing the next resistance at 1.0962. I will also act, but only after a failed attempt at consolidation. I plan to open short positions immediately on a rebound from 1.0985, targeting a 30-35 point downward correction during the day.

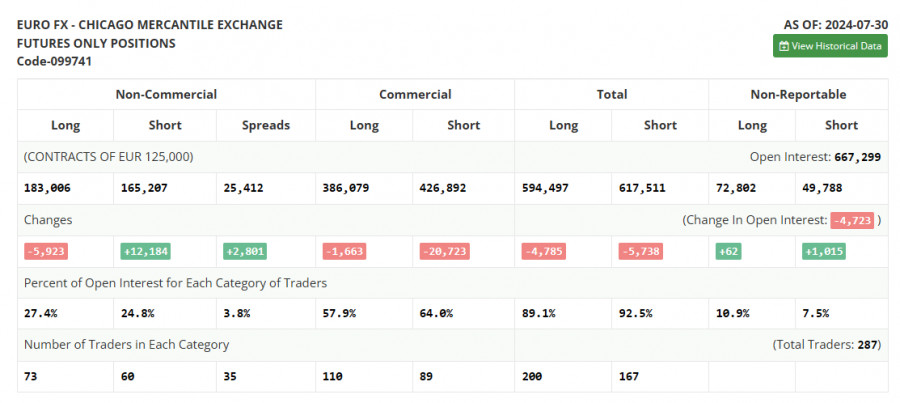

In the COT report (Commitment of Traders) for July 30, a reduction in long positions and a sharp increase in short positions were observed. The ECB's decision to leave rates unchanged, with a clear hint of a cut in September, coincided with the relatively soft stance of the Federal Reserve. The Fed also indicated that it would not keep rates unchanged at the beginning of autumn this year. Given the recent data on the US economy, the regulator should have acted much earlier, leading to the current panic observed in the stock market and the risk of a recession next year, which is detrimental to the strength of the US dollar. The COT report indicated that long non-commercial positions decreased by 5,923 to 183,006, while short non-commercial positions increased by 12,184 to 165,207. As a result, the spread between long and short positions increased by 2,801.

Indicator Signals:

Moving Averages:

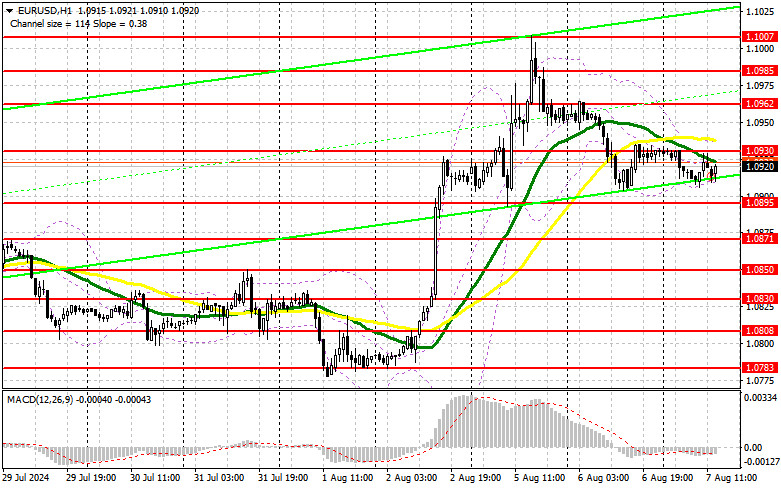

Trading is conducted around the 30 and 50-day moving averages, indicating problems for euro buyers.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.0910 will act as support.

Description of Indicators:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Quick EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.