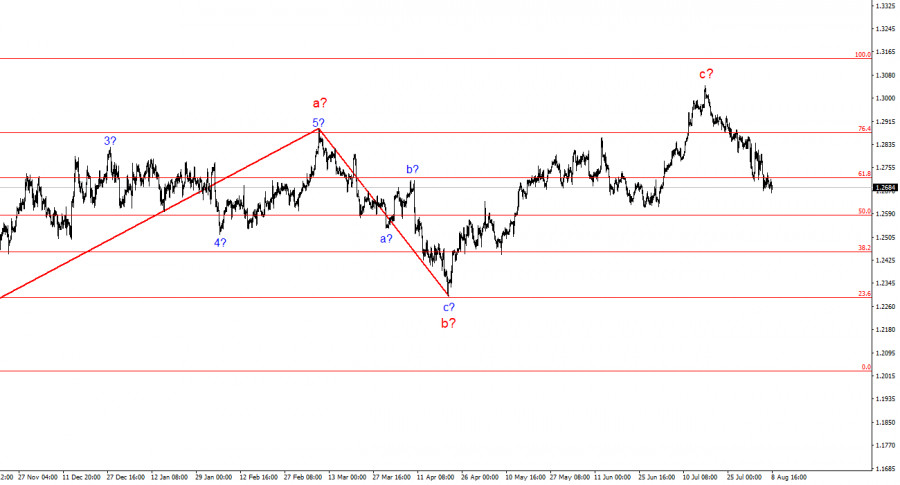

The Elliott wave pattern for the GBP/USD pair remains complex and ambiguous. For a time, it looked convincing, suggesting a formation of downward waves targeting below the 23rd level. However, in practice, the demand for the US dollar grew too strong for this scenario to be realized.

Currently, the wave pattern has become completely unreadable. I remind you that in my analysis, I try to use simple structures, as complex ones have too many nuances and ambiguous moments. Now we see an upward wave that overlapped a downward wave, which overlapped the previous upward wave, which overlapped the previous downward wave. The only assumption that can be made is an expanding triangle with the upper point around the 30th figure and the balancing line around the 26th figure. The upper line of the triangle has been reached, and the unsuccessful attempt to break it indicates the market's readiness to form a downward set of waves. The unsuccessful attempt to break the 1.2822 mark, corresponding to 23.6% on the Fibonacci scale, suggests a possible resumption of decline in the near future.

The GBP/USD rate decreased by another 10 basis points on Thursday. The losses of the pound today were small, but the market could have started forming a corrective wave this week, but it did not. For me, this is a very important point, indicating that the decline of the pair may continue up to the 26th figure, after which the formation of the expected wave 2 or b may begin.

If this is indeed the case, then the wave pattern will finally appear well-formed and convincing. We saw five waves up, after which at least three waves down should be built. The first wave already amounts to almost 400 basis points, so the third wave may be no less. All this allows us to expect the instrument to decline in the coming months below the 26th figure. In my opinion, this is logical.

I believe the key factor in the decline of the British currency is the beginning of the easing of monetary policy in the UK. There are now quite a few rumors about the pace at which the BoE will lower the rate further. Some believe the regulator will wait for a decrease in service sector inflation and core inflation before lowering the rate a second time. Others believe the regulator will make decisions based on the main consumer price index. However, the fact remains: the British central bank has begun easing, unlike the Fed. While some might argue that the Fed only promises rate cuts without action, this is incorrect! The market itself decides when the American regulator should lower the rate, and it is always wrong.

General Conclusions

The Elliott wave pattern for the GBP/USD instrument still suggests a decline. If the upward trend section started on April 22, it has already acquired a five-wave appearance. Therefore, in any case, we should now expect at least a three-wave correction. The unsuccessful attempt to break the upper line of the triangle indicates the market's readiness to form a downward set of waves. In my opinion, in the near future, sales of the instrument should be considered with targets around the 1.2627 level, which corresponds to 38.2% on the Fibonacci scale.

On a larger wave scale, the wave pattern has transformed. Now we can assume the construction of a complex and extended upward corrective structure. At the moment, this is a three-wave structure, but it can transform into a five-wave structure, which will take several more months, if not longer.

Basic Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play out, and they often undergo changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% certainty in the direction of movement. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.