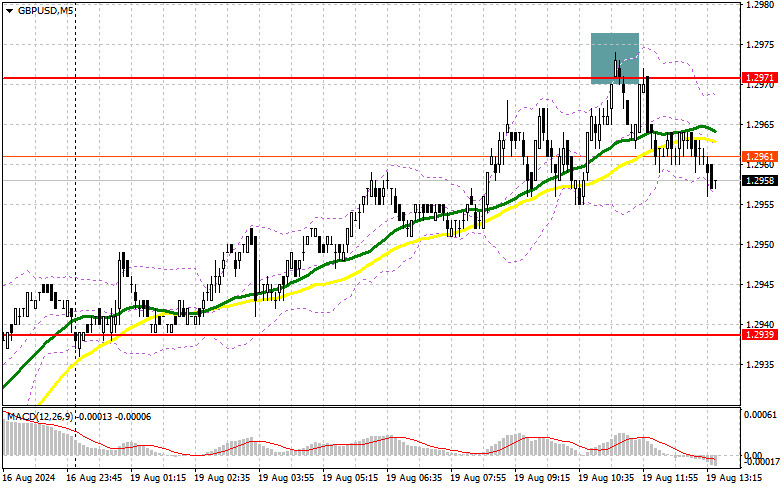

In my morning forecast, I focused on the 1.2971 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and see what happened. The rise and formation of a false breakout provided a suitable entry point for short positions, but after a 15-point decline, the sellers' momentum faded. The technical outlook has not been revised for the second half of the day.

For opening long positions on GBP/USD:

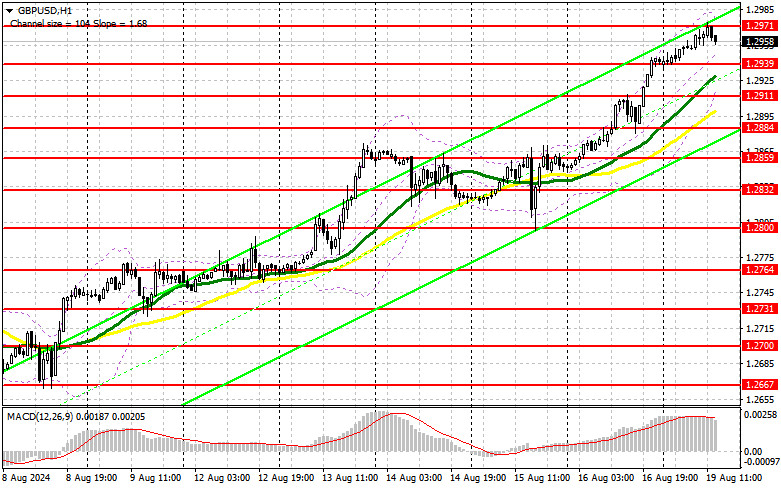

The bullish market for the pound remains intact, but a small pause seems necessary for its continuation. The U.S. Leading Indicators Index data and FOMC member Christopher Waller's speech are unlikely to carry much weight today, so the focus can remain on the continued growth of risk assets, including the British pound. It's best to trade with the trend and buy on dips after a false breakout around the support level of 1.2939, which wasn't reached in the first half of the day. This will provide an entry point for long positions, aiming for another test of 1.2971, a level that has yet to be broken. Only a breakout and subsequent retest of this range from top to bottom will strengthen the chances of developing an upward trend, leading to the removal of sellers' stop orders and providing a good entry point for long positions with the possibility of reaching 1.3009. The final target will be the 1.3040 level, where I will secure profits. If GBP/USD declines and there is no bullish activity around 1.2939 in the second half of the day, pressure will increase at the start of next week. This could also lead to a drop and a retest of the next support level at 1.2911. Only a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2884 low, targeting a 30-35 point intraday correction.

For opening short positions on GBP/USD:

Sellers have shown their presence, but significant selling activity hasn't followed. If the pair rises again, only another false breakout around 1.2971, similar to what I discussed earlier, will restore downward pressure on the pair, providing an opportunity to open short positions, targeting a correction and a retest of the 1.2939 support level. A breakout and retest of this range from the bottom up at the start of next week will deal a blow to the buyers' positions, leading to the removal of stop orders and opening the way to 1.2911, where I expect more active participation from large players. The moving averages, which support the buyers, are also located there. The final target will be the 1.2884 level, where I will secure profits. Testing this level would significantly undermine the pound's bullish potential. If GBP/USD rises and there is no bearish activity at 1.2971 in the second half of the day, the initiative will remain with the buyers, who will have a chance to continue building a bullish market. In this case, I will postpone selling until I see a false breakout at 1.3009. If there is no downward movement, I will sell GBP/USD immediately if it rebounded from 1.3040, targeting a 30-35 point intraday correction.

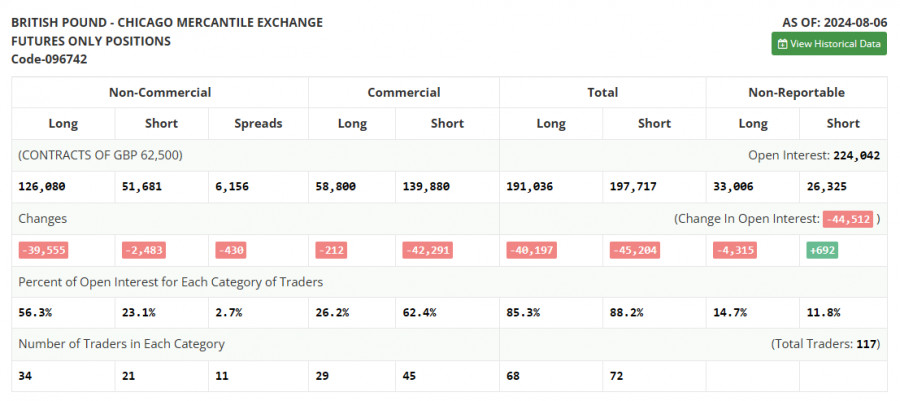

The COT report (Commitment of Traders) for August 6 showed a sharp reduction in long positions and a slight decrease in short positions. This shift in market positioning is not surprising, as the Bank of England made it clear after its meeting that it plans to lower interest rates, especially now when the economy needs special support after dealing with inflation. Much will depend on the upcoming inflation and labor market statistics, but it seems likely that the British regulator will cut rates at least once this fall, which limits the pound's medium-term bullish potential. The latest COT report indicates that non-commercial long positions fell by 39,555 to 126,087, while non-commercial short positions decreased by 2,483 to 54,681. As a result, the spread between long and short positions fell by 430.

Indicator Signals:

Moving Averages:

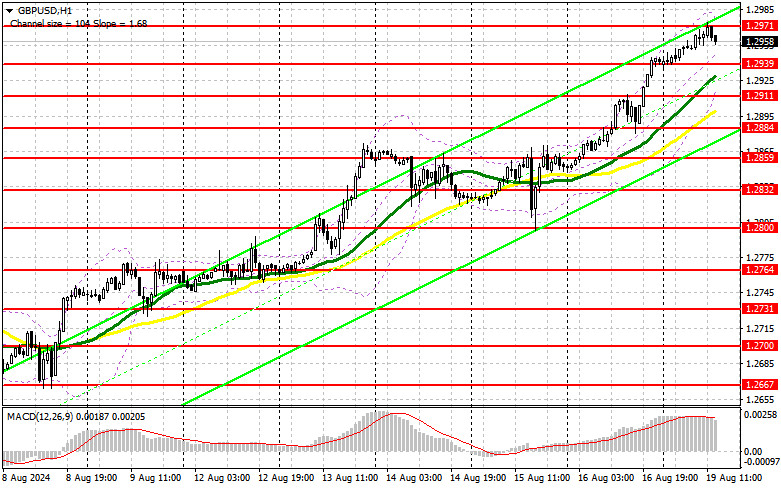

Trading is above the 30 and 50-day moving averages, indicating the potential for further growth in the pound.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2911 will act as support.

Indicator Descriptions:

- Moving Average: Defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average: Defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.

- Long Non-Commercial Positions: The total long open position of non-commercial traders.

- Short Non-Commercial Positions: The total short open position of non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.