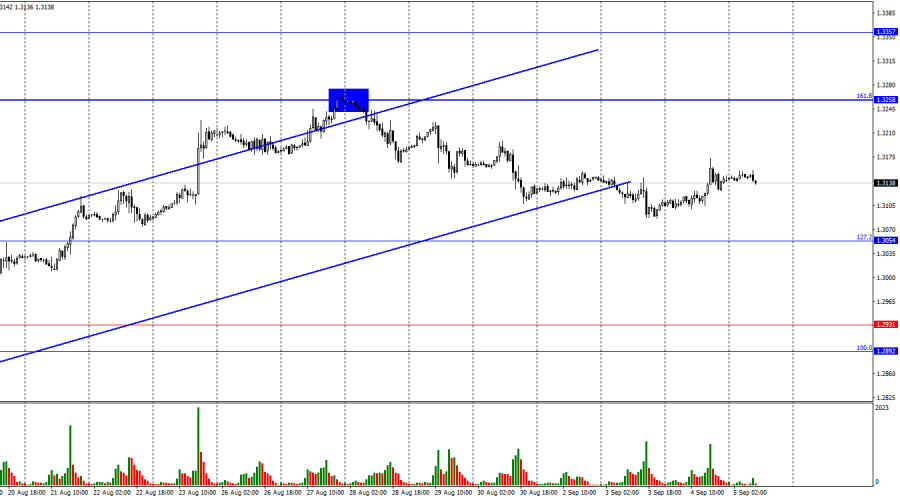

On the hourly chart, the GBP/USD pair showed a slight rise on Wednesday, but the trend of declining toward the corrective level of 127.2% – 1.3054 remains. A rebound of the pair from this level could signal a reversal in favor of the British currency and a slight rise toward the Fibonacci level of 161.8% – 1.3258. Consolidation below the 1.3054 level will increase the likelihood of a continued decline toward the next level of 1.2931.

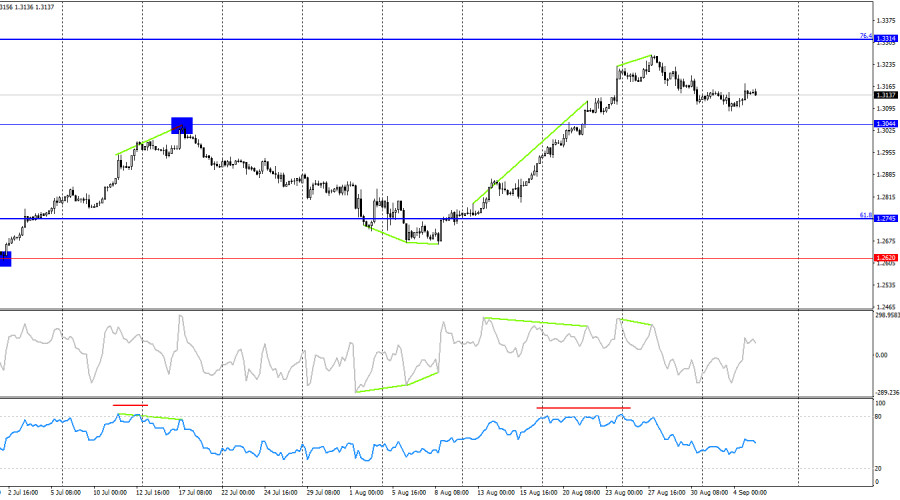

The wave pattern is clear. The last completed downward wave was unable to break below the low of the previous wave, while the last upward wave managed to surpass the previous peak. Thus, we are still dealing with a "bullish" trend, but the waves are so large that identifying a trend change will come with a significant delay. I do not observe any internal waves that could be used to identify a trend reversal.

On Wednesday, the overall news did not provide any support for the dollar. The JOLTS report was weaker than traders expected, marking the second important U.S. report this week that has created additional problems for the dollar. Traders expect the FOMC to ease monetary policy at all meetings in 2024, with even one or more 50 bps rate cuts being considered. Thus, it is currently very difficult for the dollar to count on growth. If economic data for key indicators consistently points to deterioration, dollar bulls will have no opportunity to push for growth. Both today and tomorrow, the news is expected to work against the dollar. Traders simply do not expect any positive information from the U.S. If their expectations are confirmed, bulls may once again seize the initiative, and the "bullish" trend will continue. Consolidation below the upward trend channel says a lot, but this week's news is more important than chart analysis.

On the 4-hour chart, the pair consolidated above the 1.3044 level. However, the CCI indicator had been signaling a "bearish" divergence for over a week, while the RSI indicator was in the overbought zone for a week, which rarely happens. As a result, a pullback occurred in favor of the U.S. dollar, and the pair began to decline toward the 1.3044 level. A rebound from this level could signal an expected return to the 76.4% corrective level at 1.3314.

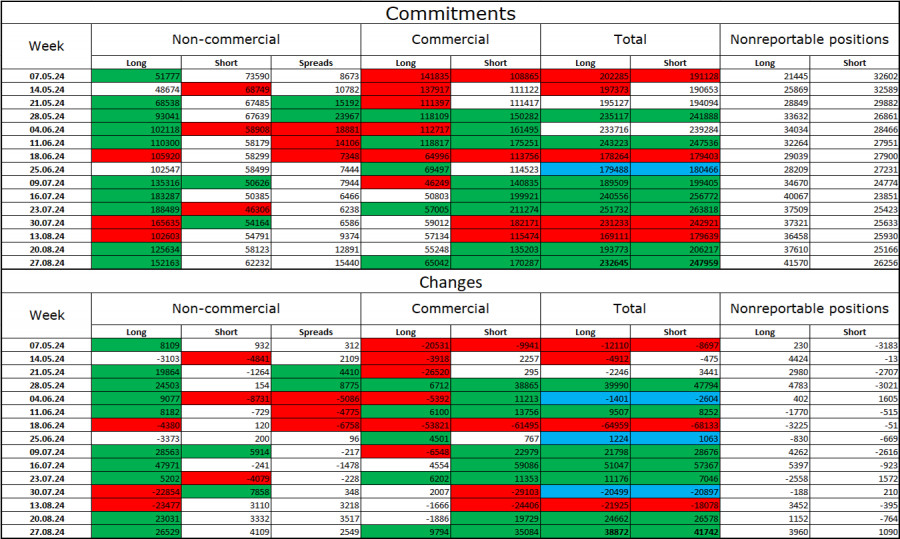

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became much more "bullish" over the last reporting week. The number of long positions held by speculators increased by 26,529, while the number of short positions rose by 4,109. Bulls still hold a significant advantage. The gap between the number of long and short positions is almost 90,000: 152,000 against 62,000.

In my view, the pound still has room to fall, but COT reports currently suggest otherwise. Over the last three months, the number of long positions has risen from 51,000 to 152,000, while the number of short positions has decreased from 74,000 to 62,000. I believe that over time, professional players will start reducing long positions or increasing short positions, as all possible factors for buying the pound have already been priced in. However, it's important to remember that this is only a hypothesis. Chart analysis points to a likely decline in the near future, but for now, a clear "bullish" trend persists.

News Calendar for the U.S. and U.K.:

- U.K. – Construction PMI (08:30 UTC).

- U.S. – ADP Non-Farm Employment Change (12:15 UTC).

- U.S. – Initial Jobless Claims (12:30 UTC).

- U.S. – Services PMI (13:45 UTC).

- U.S. – ISM Services Index (14:00 UTC).

Thursday's economic calendar contains several important events. The news could have a strong influence on market sentiment today, especially in the second half of the day.

Forecast for GBP/USD and Trading Tips:

Sales of the pair were possible after the bounce from the 1.3258 level on the hourly chart, targeting 1.3054. These trades can remain open for now. I wouldn't rush to open new buy positions until the 1.3054 level is reached. The news today and tomorrow will have a strong impact on the pair's movement.

Fibonacci retracement levels are drawn between 1.2892–1.2298 on the hourly chart and between 1.4248–1.0404 on the 4-hour chart.