The EUR/USD pair showed no interesting movement on Friday but remained above the moving average line. In principle, one event spoiled everything last week—or, more precisely, the market's reaction. On Thursday, the European Central Bank concluded its latest meeting in 2024, and it was announced that all three key interest rates were lowered, as expected. Of course, the market had anticipated this in advance. One could even say that the recent downward correction was the market's preparation for the ECB's rate cut. However, an intriguing question arises: Will the U.S. dollar rise after the Federal Reserve lowers its rates this week? And another question: Why did the British pound rise?

As repeatedly mentioned, the market reacts one-sidedly to incoming data and fundamentals. Factors that support the dollar lead, at best, to a correction, while those that support the euro result in a new growth trend. If the market has been pricing in the ECB's rate cut in recent weeks, how long has it been pricing in the Fed's rate cut? Or does this not matter at all?

This week, we might find the answer to the question: Is the market trading logically and reasonably? If, on Wednesday evening, we witness another dollar collapse (regardless of the Fed's decision), it will mean that the market continues to use any formal reason to sell the U.S. currency. A logical outcome would be a rise in the dollar, as it has been falling for two years now, so the entire cycle of the Fed's monetary policy easing should already have been priced in.

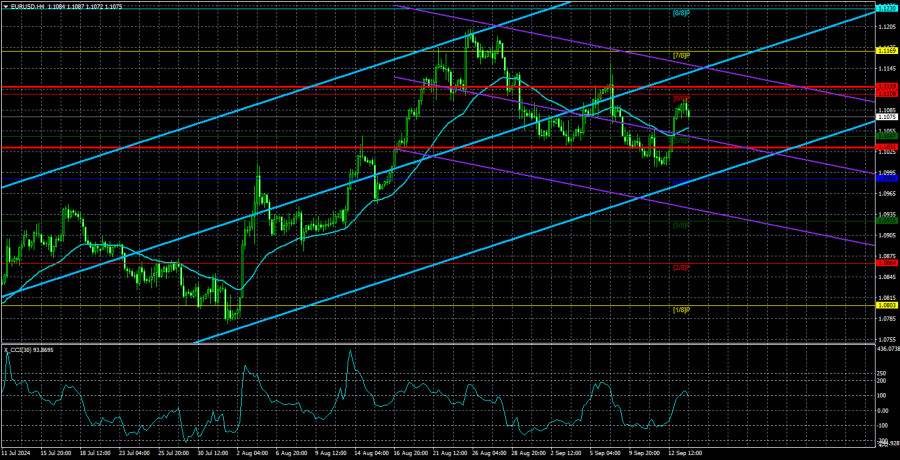

It will also be possible to gauge the market sentiment by observing Monday and Tuesday. No important reports are scheduled for these days. If the dollar manages to depreciate even during this period, then there should be no questions about which direction the market is leaning. The pair failed to consolidate below the critical line in the daily time frame, indicating that the medium-term upward trend remains intact. Numerous instances of the CCI indicator entering the overbought zone and several "bearish" divergences have only led to a minor correction.

In principle, the market can continue selling the dollar for a long time, as it is only a matter of willingness. For two years, it has been reacting to the decline in inflation, which was bound to lead the Fed to ease monetary policy. Now, it could be pricing in the actual easing of monetary policy. This scenario cannot be ruled out either. Therefore, as before, we believe that a long and robust rise in the U.S. dollar is logical and natural. However, at this moment, even on the 4-hour time frame, there are no grounds to expect a decline in the pair. The correction is weak, the price is above the moving average again, and overbought conditions no longer seem to matter.

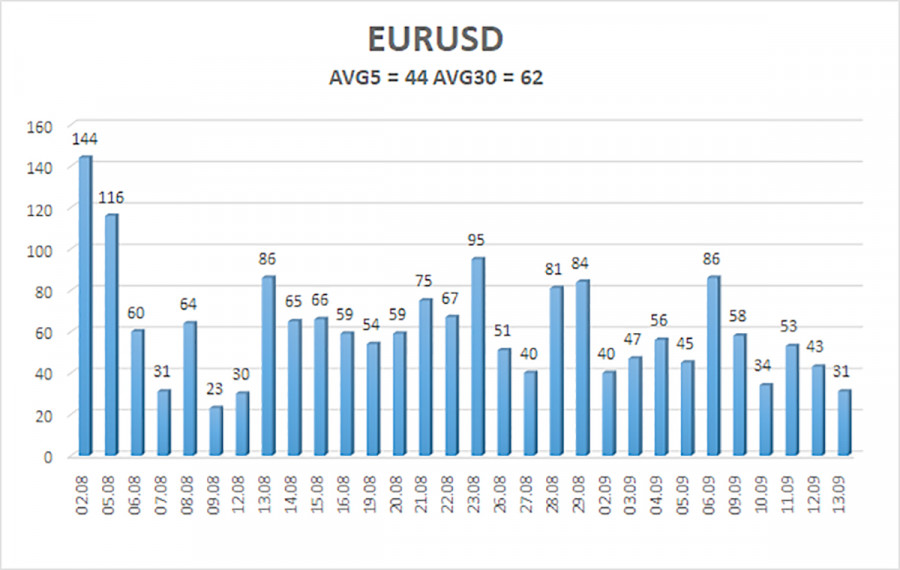

The average volatility of EUR/USD over the past five trading days as of September 16 is 44 pips, which is considered average. We expect the pair to move between levels of 1.1031 and 1.1119 on Monday. The upper linear regression channel points upward, but the overall downtrend remains intact. The CCI indicator entered the overbought area three times, signaling a potential shift to a downtrend and highlighting how the recent rise is illogical. However, for now, we only see a mild correction.

Nearest Support Levels:

- S1 – 1.1047

- S2 – 1.0986

- S3 – 1.0925

Nearest Resistance Levels:

- R1 – 1.1108

- R2 – 1.1169

- R3 – 1.1169

Trading Recommendations:

The EUR/USD pair continues to move weakly to the south. In previous reviews, we mentioned that we expect the euro to decline in the medium term, as any new upward movement would seem absurd. There is a possibility that the market has already priced in all future rate cuts by the Fed. If so, the dollar has no further reason to fall. Short positions can be considered as long as the price remains below the moving average, with targets at 1.0986 and 1.0925. U.S. macroeconomic data continue to create difficulties for the dollar, and the market is still hesitant to buy it.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it indicates a strong trend.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction.