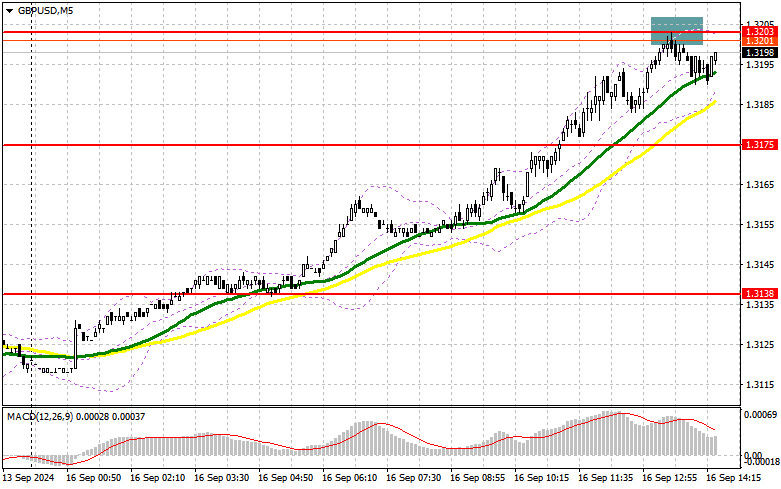

In my morning forecast, I focused on the 1.3203 level and planned to use it as a basis for market entry decisions. Let's look at the 5-minute chart and break down what happened. The rise and formation of a false breakout at 1.3203 created an opportunity to sell the pound, but only led to a 15-point correction before demand returned. I didn't make any purchases at the 1.3175 level because, after the breakout, there was no retest. The technical outlook for the second half of the day was adjusted.

To open long positions on GBP/USD:

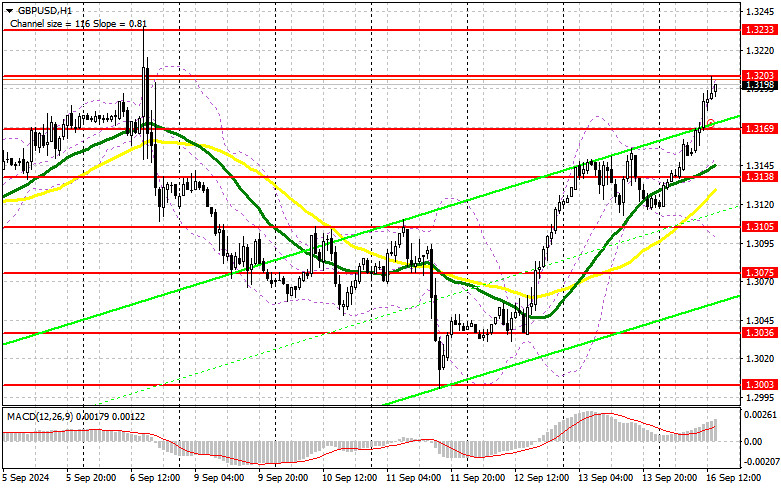

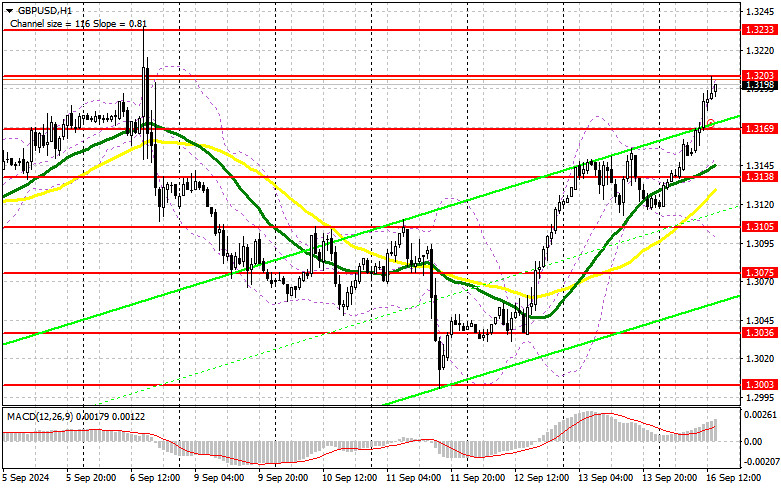

The absence of UK statistics allowed the pound to rise significantly. In the second half of the day, the Empire Manufacturing Index for August is expected, which could cause a spike in volatility, though it is unlikely to have a major impact on the market. In the event of a negative reaction to the data, I will consider returning to long positions only after a decline and the formation of a false breakout around the new support at 1.3169. This will create an opportunity for further growth with a recovery target at 1.3203. A breakout and retest of this range from top to bottom will improve the chances of an upward trend, triggering the removal of sellers' stop orders and providing an entry point for long positions targeting 1.3233. The ultimate target is the 1.3260 level, where I intend to take profits.

If GBP/USD declines and there is no bullish activity around 1.3169 in the second half of the day, pressure on the pair will increase, leading to a drop and a test of the next support at 1.3138, which would nullify buyers' plans. Only a false breakout formation there will provide a good opportunity to open long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3105 low, aiming for a 30-35 point correction within the day.

To open short positions on GBP/USD:

Sellers have lost control of the market, and now is the time to consider how to act around the monthly high. US statistics and defending the nearest resistance at 1.3203 may help, where a false breakout will be an acceptable scenario for opening new short positions, aiming for a correction and a test of support at 1.3169. A breakout and retest from below this range will weaken buyers' positions, leading to the removal of stop orders and opening the way to 1.3138, where the moving averages are located, supporting the bulls. The ultimate target will be the 1.3105 level, where I intend to take profits.

If GBP/USD rises and sellers fail to show activity at 1.3203 in the second half of the day, buyers will get a chance to drive the pair into a correction. Therefore, bears will have no choice but to retreat toward resistance at 1.3233. I will sell there only after a false breakout. If there is no downward movement, I will look for short positions on a rebound around 1.3260, targeting a 30-35 point downward correction within the day.

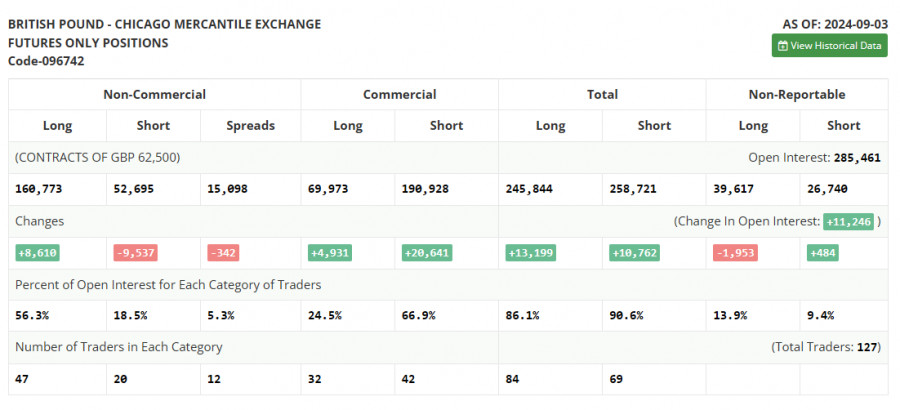

In the COT report (Commitment of Traders) for September 3, there was an increase in long positions and a reduction in short positions. Despite the pair's correction, traders are confident that the U.S. interest rate cut is a more significant event than similar actions by the Bank of England. The market is likely now pricing in the future borrowing cost reduction in the UK, and demand for the pound will likely return soon, as the medium-term upward trend remains intact. The lower the pair goes, the more attractive it becomes for new purchases. The ratio of long to short positions, where long positions outnumber short positions by 3:1, speaks for itself. The latest COT report indicated that long non-commercial positions increased by 8,610 to 160,773, while short non-commercial positions fell by 9,537 to 52,695. As a result, the gap between long and short positions decreased by 342.

Indicator Signals:

Moving Averages:

Trading is above the 30- and 50-day moving averages, indicating further growth for the pair.

Note: The periods and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3105 will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise): Period 50, marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing out volatility and noise): Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain criteria.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.