On Friday, the EUR/USD pair was unable to continue its decline, nor could it initiate a correction. The euro is trading around the 1.0929–1.0946 zone, which currently cannot be considered a support or resistance zone. With trader activity down to zero, these levels have no influence on the price. There is no reaction from traders, as volumes are absent.

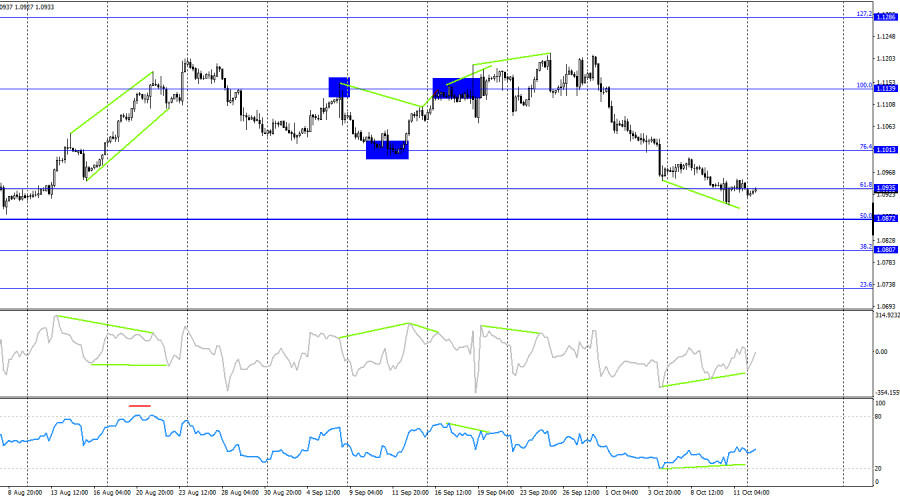

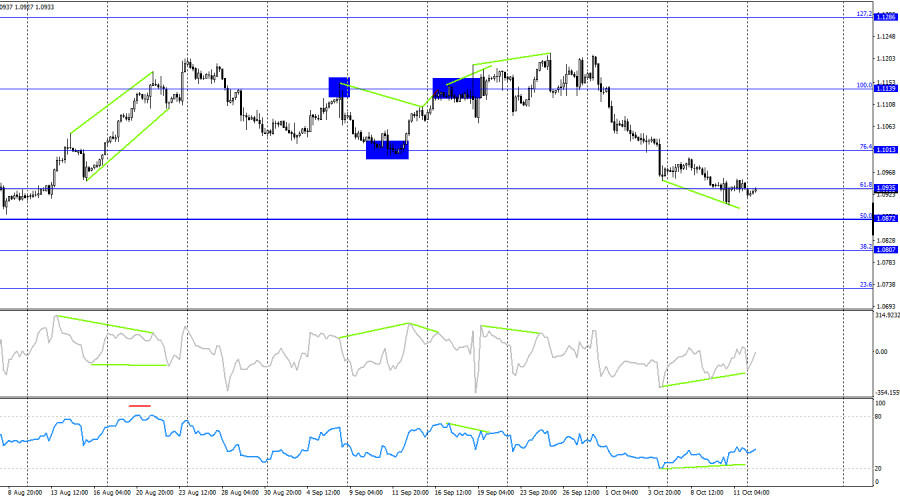

The wave situation has become slightly more complex in recent weeks, but overall, it remains understandable. The last completed upward wave (September 25-30) did not break the previous wave's peak, and the new downward wave (which is still forming) broke the lows of the previous three waves. Thus, the pair is currently forming a new bearish trend. We may see a corrective wave soon, but the bulls have already lost control of the market. Regaining it will require considerable effort.

Friday's information background was not taken seriously by traders. The Producer Price Index (PPI) was released a day after the Consumer Price Index (CPI), which is much more significant. Even on Thursday, traders were inactive, so Friday's consumer confidence and PPI data didn't spark much reaction. According to the University of Michigan, consumer confidence in October fell from 70.1 points to 68.9. However, this didn't pose an issue for the dollar. While there was a slight decline during the day, it had no lasting effect. Neither the bulls nor the bears had the upper hand on Friday, and there was little interest in making trades. The euro remains at a local bottom and cannot seem to recover. I don't believe this is the bottom from which the pair won't fall any further. A correction is more likely, but the ECB meeting this week, with a likely rate cut, could pose new challenges for the euro, which has been overly strong for too long.

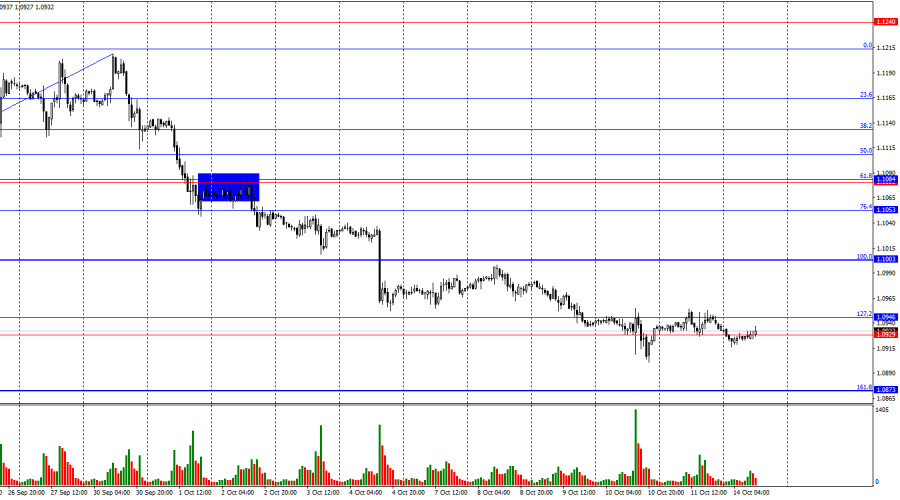

On the 4-hour chart, the pair reversed in favor of the U.S. dollar after forming a series of bearish divergences on the RSI and CCI indicators. Currently, the pair has fallen to the 61.8% corrective level at 1.0935. A consolidation below this level will allow traders to expect further declines toward the next Fibonacci level at 50.0% – 1.0872. Both indicators are now showing signs of bullish divergences, but they only suggest a potential correction, as the trend has shifted to bearish.

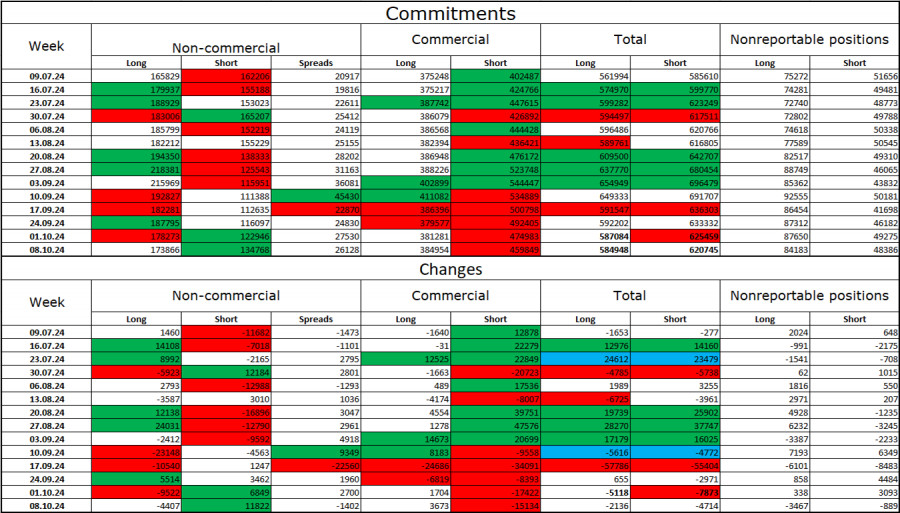

Commitments of Traders (COT) Report:

In the latest reporting week, speculators closed 4,407 long positions and opened 11,822 short positions. The sentiment of the Non-commercial group shifted to bearish in recent months, but currently, bulls are dominating again. The total number of long positions now stands at 174,000, while short positions amount to 135,000.

However, for the fifth consecutive week, large players have been reducing their holdings of the euro. In my opinion, this could be a precursor to a new bearish trend or at least a strong correction. The key factor that caused the dollar's decline – expectations of FOMC monetary policy easing – has already played out, and there are currently no clear reasons for the dollar to continue falling. Technical analysis also indicates the start of a bearish trend. Therefore, I anticipate a prolonged decline in the EUR/USD pair.

News Calendar for the U.S. and the Eurozone:

The economic calendar for October 14 contains no significant events. The information background will not influence trader sentiment today.

Forecast for EUR/USD and Advice for Traders:

Selling the pair was possible after closing below the 1.1139 level on the 4-hour chart with targets at 1.1081, 1.1070, 1.1013, and 1.0984. All targets have been reached. I do not see any new signals for selling at the moment. I would consider buying the pair after a rebound from the 1.0873 level.

Fibonacci levels are built between 1.1003 and 1.1214 on the hourly chart and between 1.1139 and 1.0603 on the 4-hour chart.