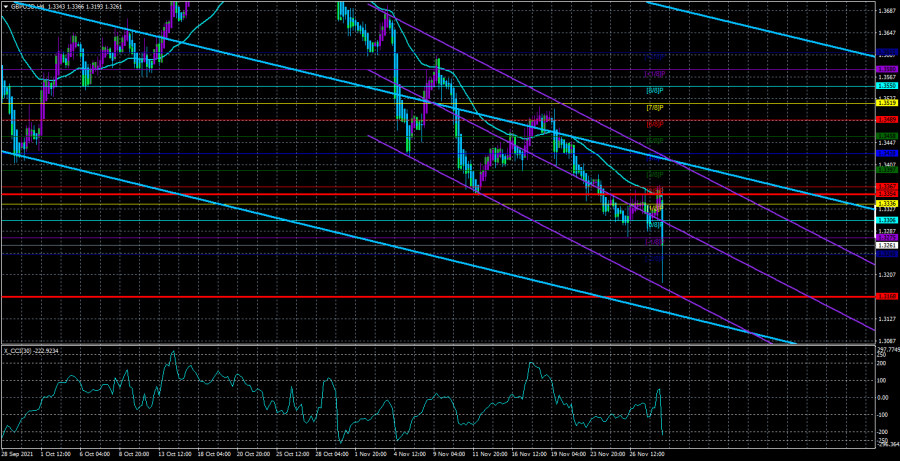

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

The GBP/USD currency pair started trading with an increase on Tuesday, but it grew at the same time much more strained than the EUR/USD pair. And in the afternoon, it fell like a cannonball thrown from a ship. By and large, the pound/dollar pair has not managed to overcome the moving average, so the difference between it and the euro/dollar remains. The British currency continues to remain in a single-digit downward trend, with all indicators pointing downwards. And the euro currency has chances, based on the current technical picture, to grow. In principle, not much news has been coming from the UK in the last few days. It is possible to note only another heat of relations between France and Britain, this time on the migration issue. The fact is that from France, which is more loyal to migration than the UK, migrants are constantly trying to move to other EU countries and even Britain. Last Wednesday, 27 migrants drowned in British waters while trying to cross the English Channel by boat. Against this background, Boris Johnson sent a letter to French President Emmanuel Macron with a proposal to "take back all his migrants," clearly hinting at France's loyalty to the issue of migration, which is why neighboring countries suffer. The most interesting thing is that the letter was made public, and not sent personally to the President of France. As a result, a diplomatic scandal broke out, and the French Foreign Ministry has already canceled an invitation to a diplomat from Britain, Priti Patel, to meet with her French counterpart. If we also recall the "fish issue", relations between the countries are deteriorating very quickly. Recall that according to the latest information, French fishermen are going to block the tunnel under the English Channel and disrupt shipping traffic through the strait in protest of London's refusal to issue licenses for fishing in British waters.

Jerome Powell: the economic situation in the United States may worsen because of Omicron.

While France and the UK conflict migrants and fishing, Fed Chairman Jerome Powell spoke before the Senate Banking Committee on Monday. And his speech should have strained the markets a little since there was little positive in it. Jerome Powell said that the new strain of omicron could worsen failures in the supply chains of goods around the world, which would lead to an even stronger increase in inflation. According to Powell, manufacturers are already unable to meet demand, which is why prices are rising. In addition, inflation is also rising due to rising energy prices. He also noted that due to the spread of the new strain, people may quit their jobs or go on vacation, not wanting to be in crowded places or offices during the next "wave". This could worsen the state of things in the issue of production and supplies around the world, as well as slow down the recovery of the American labor market. In addition, Powell said that "he and most experts" still expect that the imbalance between supply and demand will weaken next year, which will lead to a slowdown in inflation. However, "there is a feeling that the factors that are now provoking price increases will continue for most of next year."

From our point of view, the statement is rather pessimistic and considering that the new strain of omicron was discovered only last Friday, it is somehow very strange to observe how the first economists of the USA and the EU are thinking hard about the prospects of the economy due to the influence of the new strain. At the same time, if Powell has all the information that allows him to make such statements, then the economy in the States may indeed continue to slow down in the fourth quarter. Recall that at the end of the third quarter, it slowed down by about three times compared to the second quarter. And if so, the QE program may be reactivated instead of continuing to shrink. And the issue of raising rates can be shelved.

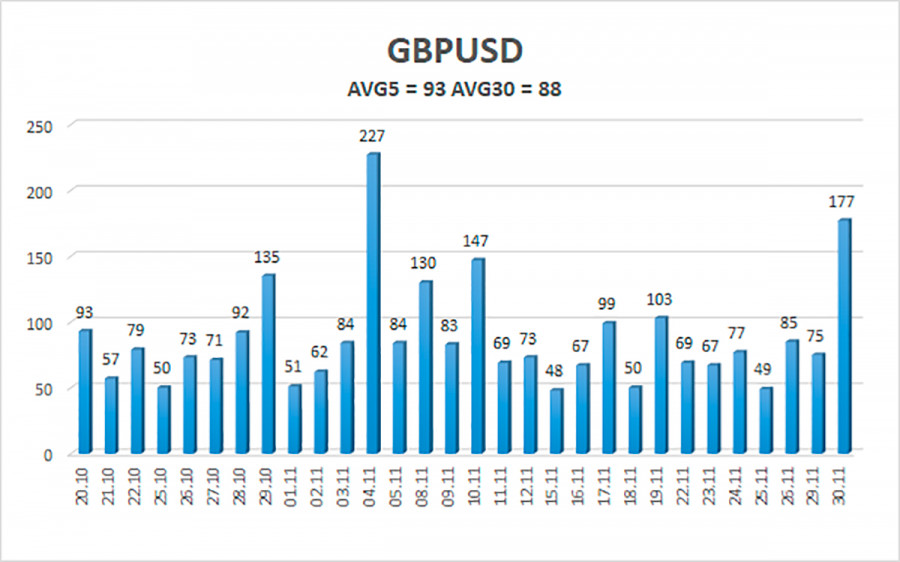

The average volatility of the GBP/USD pair is currently 93 points per day. For the pound/dollar pair, this value is "average". On Wednesday, December 1, we expect movement inside the channel, limited by the levels of 1.3168 and 1.3354. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.3245

Nearest resistance levels:

R1 – 1.3275

R2 – 1.3306

R3 – 1.3336

Trading recommendations:

The GBP/USD pair continues to move downwards on the 4-hour timeframe. Thus, at this time, it is necessary to remain in short positions with the targets of 1.3245 and 1.3168 levels until the Heiken Ashi indicator turns upwards. Buy orders can be considered in the case of a confident consolidation of the price above the moving average with targets of 1.3397 and 1.3428 and keep them open until the Heiken Ashi turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.