Ether fell slightly after a good strengthening this Wednesday. Bitcoin remains trading in one place, testing the strength of the 46,900 level and the nerves of investors.

Before talking about the technical picture, I would like to say a few words about cryptocurrency scams. DeFi has become a key scam area this year.

According to data from Chainalysis, crypto investors lost more than $2.8 billion in 2021 due to cryptocurrency scams. This year, scammers accounted for 37% of the total illicit proceeds from crypto scams exceeding $7.7 billion. For example, in 2020 this amount was at the level of $5 billion.

The largest fraudulent scheme was the Turkish crypto exchange Thodex, accounting for most of the lost funds. The founders disappeared with the sum of $2 billion. In April 2021, this exchange ceased to function. This was followed by dogecoin AnubisDAO with $58 million, and the Uranium Finance exchange with $50 million also evaporated. Smaller companies Meerkat Finance, Evolved Apes, and Polybutterfly also took their rightful place in this list.

Thodex was the only centralized exchange, while all the others belonged to the category of decentralized finance (DeFi). DeFi projects are based on smart contracts that are offered to users as financial services, such as trading, lending, or borrowing.

Apparently, it's not for nothing that Senator Elizabeth Warren talked a lot about the risks associated with DeFi during her speech on Thursday. Let me remind you that, in her opinion, decentralized finance is the most dangerous part of the cryptocurrency world. It is there that a huge number of scammers are now concentrated, who are trying to attract large investors and traders to themselves.

Brazil Passes New Cryptocurrency Bill

The new cryptocurrency bill has been approved by the Brazilian Chamber of Deputies and is currently awaiting consideration by the Senate for approval. If the project is approved, a central body will be created to regulate all brokerage activities in the field of cryptocurrencies - allegedly the Central Bank of Brazil - where responsibility for crimes related to cryptocurrencies will also be established.

The bill is intended to clarify the regulation of cryptocurrencies in the country. The draft, designated as Bill 2303/15 and proposed by Deputy Aureo Ribeiro, establishes definitions for exchanges and digital currencies. Supervision will be carried out by the central bank and this applies to all transactions related to cryptocurrency. The new law does not clearly distinguish cryptocurrencies by name, but instead uses the term "digital currencies." However, the draft clarifies that it does not affect the national digital currency, which is backed by real money. A digital currency is defined as a "value" that can be used electronically for payments or for investment purposes.

As for the fines

The text includes specific penalties for crimes related to cryptocurrency, and establishes a new fine for exchanges or market participants who illegally manage cryptocurrency portfolios from third parties. This crime is classified as embezzlement and is punishable by imprisonment for a term of four to eight years and a fine.

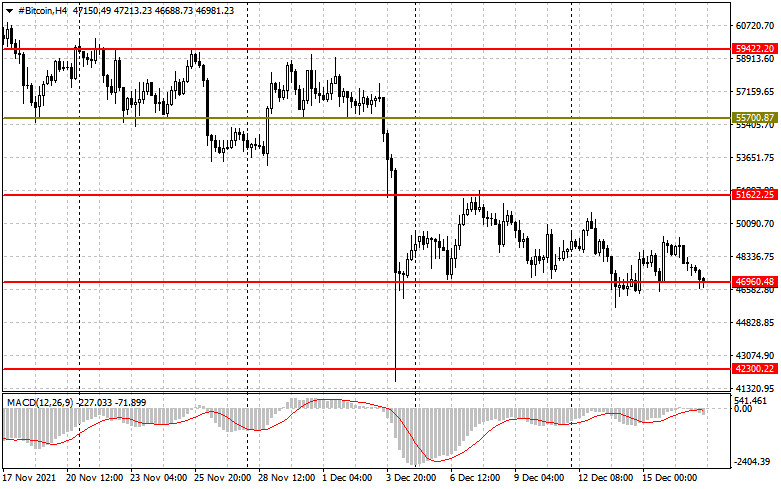

As for the technical picture of Bitcoin

Trading remains in a fairly clear side channel, where I recommend taking action. The main task of buyers now is to grow to the level of $51,660 and its breakthrough, going beyond which will provide a good recovery to the area of $55,730, and there it is just around the corner to $59,400, which will put a fatal point to the fall of the cryptocurrency on December 3. It will be possible to talk about the return of pressure on BTC after its breakthrough of the $46,900 level, which will open the way for $42,300. However, active purchases around $46,900 and its retention will attract new investors to the market – a bullish signal for Bitcoin.

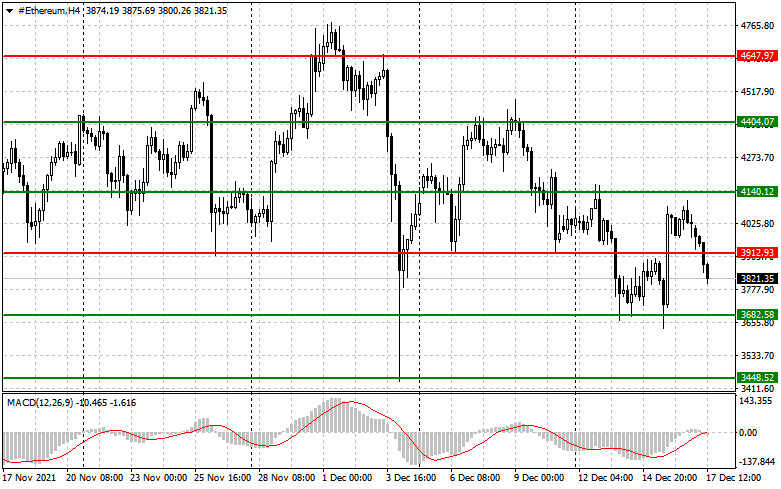

As for the technical picture of Ether

The growth of Ether quickly fizzled out, even falling short of the resistance of $4,140, which buyers had been counting on. Now the trade has moved below the $3,912 level, which creates certain problems for further upward correction. If the bulls fail to regain control of this level in the near future, it is possible that ETH will return to the support area of $3,680. In this case, the key task of the bulls will be to protect this particular range, since a breakthrough of this level is a very bad call for buyers at the end of this year. If buyers cope with the task and return the Ether above $3,912, then a new support will be formed in the area of $3,830, which will allow us to count on another attempt to grow above $4,140. A break in this range will open a direct road to the highs: $4,404 and $4,647.