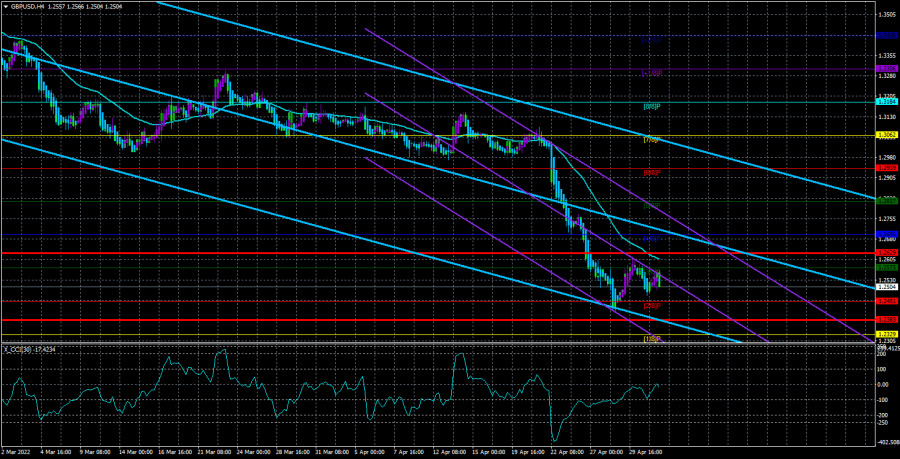

The GBP/USD currency pair made another attempt to start an upward correction on Tuesday. However, so far it remains below the moving average line. Moreover, the moving is moving towards the price much faster than the price is moving towards the moving. This once again proves the fact that the bears completely hold the initiative in their hands. The euro and the pound are still experiencing serious problems, but these problems are already raising some questions. In our recent articles, we have raised the question based on which the euro and the pound continue to fall. Yes, most factors remain on the side of the US currency. The United States is very far from the military conflict in Ukraine, and its economy practically does not depend on Ukraine or Russia in any way. Therefore, it is not surprising that the British and European economies are in a much more serious risk zone, although one way or another many states will suffer because of the conflict in Ukraine. But it should also be noted that the European economy showed minimal growth in the first quarter of 2022, while the American economy fell by 1.4%. This was very unexpected since recently there has been a popular opinion about the strength of the US economy. But, as practice shows, this is not quite true, and this fall may lead to the Fed's refusal to aggressively tighten monetary policy. And the tightening of monetary policy, which Fed members have been talking about in recent months, was one of the main factors in the growth of the US currency.

Next is the conflict in Ukraine. It can last for many years, but this does not mean that all these years the euro and the pound will be in free fall against the dollar. From our point of view, the market has already more than played out all the factors, so the correction (at least) should begin. Unfortunately, logical conclusions are not always the truth. We are dealing with a market with a huge number of participants. And it is the position of the majority of market participants that will determine the exchange rate of the euro and the pound. If traders continue to sell off European currencies, then whatever the fundamental or geopolitical background, both currencies will continue to fall.

What is more important for the pair: the Fed meeting or the BA meeting?

We have repeatedly said that we do not expect any surprises from the Fed. However, after the latest GDP report, these surprises are still possible. The fact is that the Fed was set up to raise the rate to 2.5% as quickly as possible, and from June it expected to start reducing its balance sheet - the QT program. Now, perhaps, the pace of rate hikes will have to slow down a little, but the market, which has been desperately buying dollars in recent months, may take this news very negatively. Therefore, from our point of view, the rhetoric of the statements made will be of great importance at today's announcement of the results. If the Fed members note the contraction of the economy in the first quarter and weaken the "hawkish" attitude, this could be a serious reason for the fall of the US currency.

In the UK, the situation is a little simpler, since no one in BA shouted about the need to raise the rate to 2.5% or even higher. Therefore, every rate increase is not taken for granted. The market is confident that on Thursday it will witness a fourth consecutive increase, but the previous three did not help the British currency to start growing. Therefore, it is far from a fact that this Thursday we will see the strengthening of the British currency, although usually, the tightening of monetary policy leads to an increase in the national currency. In general, Wednesday and Thursday may be the days when the downward trend is completed. Or at least on the day of the beginning of a tangible correction. However, we are counting more on the factor of saturation of the market with dollar purchases than on the reaction to the meetings of the BA or the Fed. From our point of view, the dollar is heavily overbought, and the euro and pound are undervalued. Unfortunately, it is not only the actions of central banks that play a role in the market. If the conflict between Ukraine and Russia enters a new phase of escalation, it can easily provoke new collapses of European currencies.

The average volatility of the GBP/USD pair over the last 5 trading days is 123 points. For the pound/dollar pair, this value is high. On Wednesday, May 3, thus, we expect movement inside the channel, limited by the levels of 1.2383 and 1.2629. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.2451;

S2 – 1.2329;

S3 – 1.2207.

Nearest resistance levels:

R1 – 1.2573;

R2 – 1.2695;

R3 – 1.2817.

Trading recommendations:

The GBP/USD pair failed to adjust on the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2451 and 1.2383 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.2695 and 1.2817.

Explanations of the illustrations:Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.