The GBP/USD currency pair also showed very strong growth on Tuesday, more than 200 points. Such volatility does not surprise anyone anymore, since the pair has been regularly passing 150 points a day or even more in recent weeks. More surprising is the fact that the growth began unexpectedly and sharply. Of course, quite important reports were published in the UK yesterday morning, but we believe that they were not the reason for such a strong growth of the pound sterling. Yes, the unemployment rate has decreased, wage levels have increased, and the number of applications for unemployment benefits has decreased. However, if the pair showed an increase of 50-100 points, we probably wouldn't even be surprised. But 200 points is too much. Thus, we assume that a new upward trend has begun, which we warned about earlier. We said that many new trends begin with a sharp and strong movement in the opposite direction. That's what we're seeing right now. The pound, which in recent weeks could not even grow by 100 points, is suddenly growing by 200. We have already figured out that there were no fundamental or geopolitical reasons for this, and macroeconomics was not strong enough to provoke such growth. It turns out that "technology" is to blame for everything.

It is also worth noting that American statistics turned out to be completely neutral yesterday, as the retail sales report showed an increase of 0.9%, which is lower than forecasts, and the industrial production report showed an increase of 1.1%, which is higher than forecasts.

And again geopolitics

Unfortunately, geopolitics remains extremely difficult right now. Yesterday we already talked about why international diplomats are needed if they cannot agree on anything. If, when a truly pivotal situation arises, then the only question that matters is who is on whose side? Now, when Ukraine and Russia have already suffered huge losses and may suffer, even more, it's time to sit down at the negotiating table, hear all sides of the conflict and come to a consensus. But instead, peace talks fail, and all parties directly or indirectly involved in the conflict continue to toughen their rhetoric. In particular, Russia claims that the withdrawal of troops to the borders of Ukraine from 1991 is impossible. In Ukraine, they say that the AFU will launch a counteroffensive in the summer, with the Crimea and the whole Donbas being the target. This means that there will be new bloody battles, and human, financial and infrastructural losses. No matter how hard Hungary tries, it alone will not be able to resist the position of 26 other EU member states. This means that the oil embargo will most likely be accepted. Yesterday it became known that the EU is actively preparing to refuse to import gas from Russia. Gas embargo? NATO is going to strengthen Finland and Sweden, fearing that the Kremlin will order a new "special operation". What does all this mean for the British pound?

Although the UK is far enough away from military operations, its economy is going through hard times right now. Inflation is growing and today it may become known about its next acceleration, and by the end of April, it may be higher than in the United States. Britain will completely abandon the import of oil and gas from Russia by the end of this year, but it cannot affect prices. If the entire European Union imposes an oil and gas embargo, it will mean that hydrocarbons will rise in price again on the markets. And Russia will be forced to get rid of its volumes of energy carriers with significant discounts, sending them to India or China. But both of these countries cannot buy back the entire volume of hydrocarbons produced, which was previously sent to the EU. And wells can't just be put on pause until better times. They need to be either preserved or filled with their storage facilities, which are also not rubber. In general, it's bad for everyone, and it can get even worse. If we assume that the pound has been falling in recent months precisely because of geopolitics, then nothing has changed now. The "technique" now signals the possible beginning of an upward trend, but if all other factors continue to put pressure on risky currencies, in particular, on the pound, then the fall may resume.

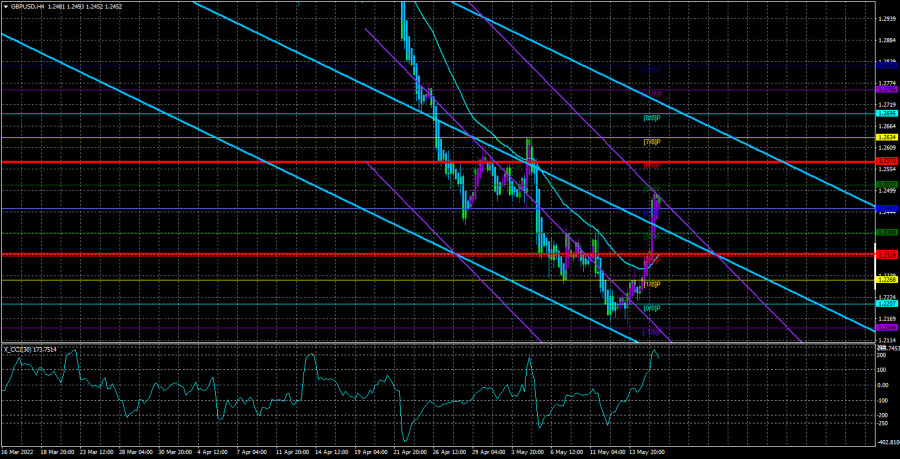

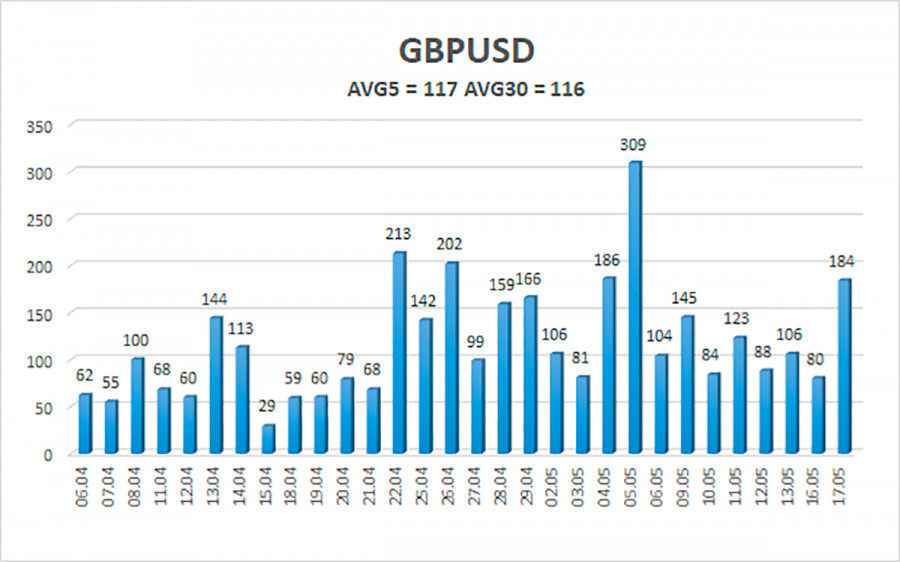

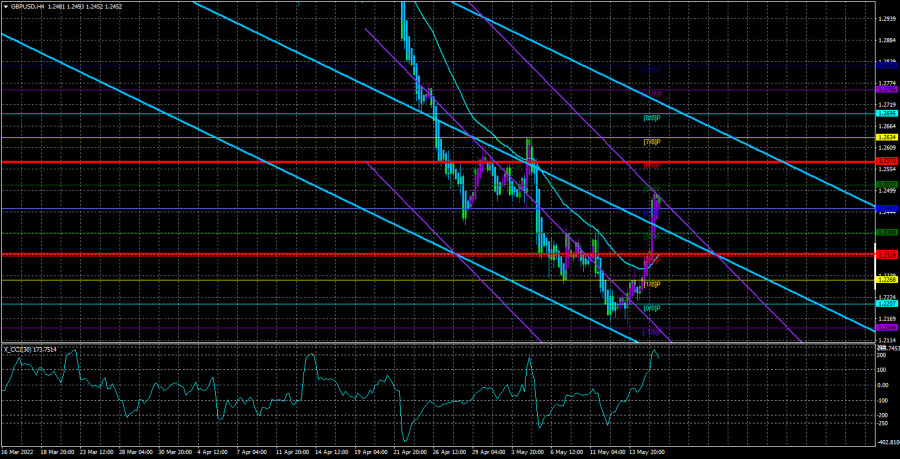

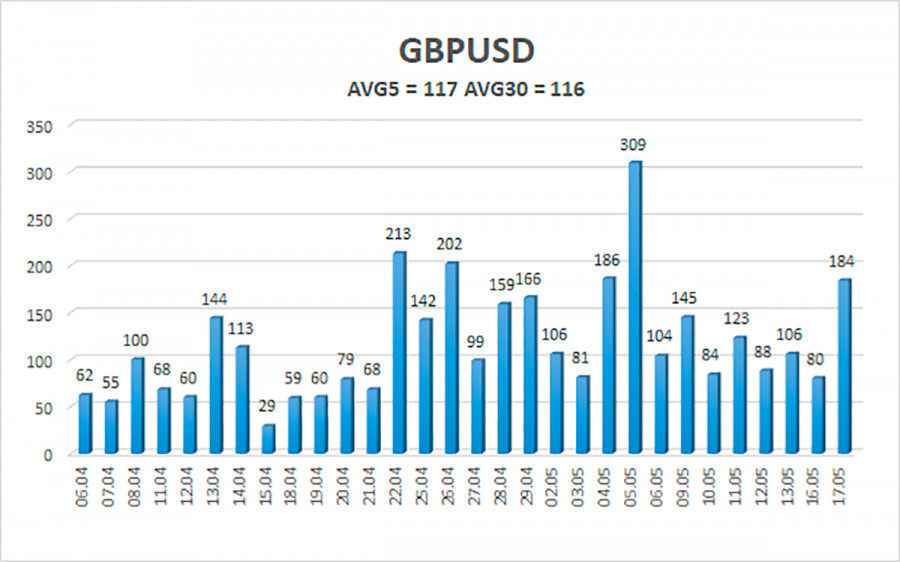

The average volatility of the GBP/USD pair over the last 5 trading days is 117 points. For the pound/dollar pair, this value is "high". On Wednesday, May 18, thus, we expect movement inside the channel, limited by the levels of 1.2336 and 1.2571. A reversal of the Heiken Ashi indicator back down will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2451

S2 – 1.2390

S3 – 1.2329

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2573

R3 – 1.2634

Trading recommendations:

The GBP/USD pair has started forming a new upward trend on the 4-hour timeframe. Thus, at this time, you should stay in buy orders with targets of 1.2512 and 1.2571 until the Heiken Ashi indicator turns down. It will be possible to consider short positions if the price is fixed below the moving average line with targets of 1.2268 and 1.2207.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that the trend reversal in the opposite direction is approaching.