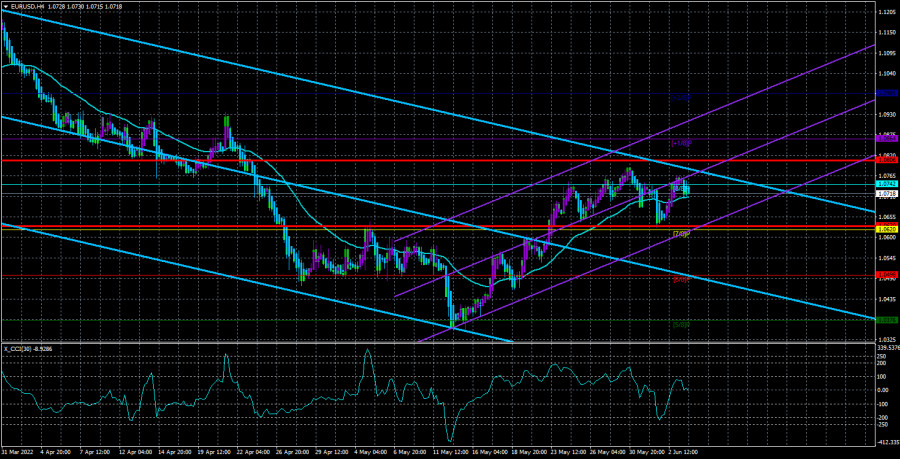

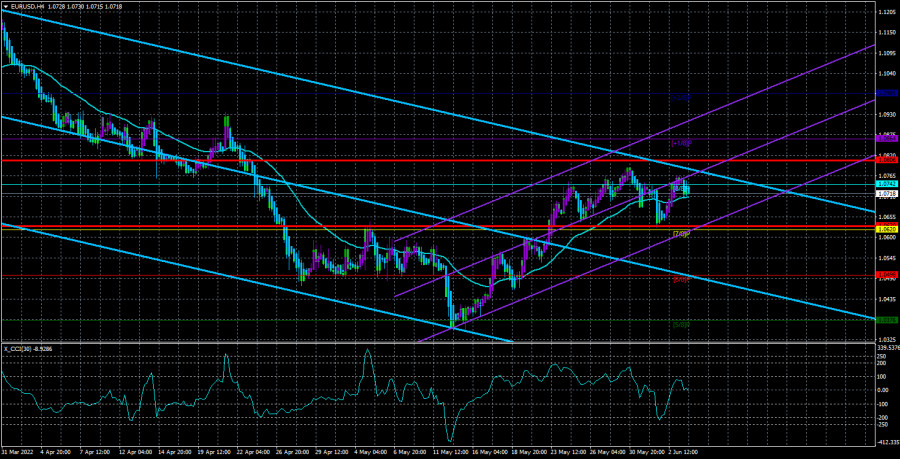

The EUR/USD currency pair managed to stay above the moving average line during Friday, so the short-term upward trend persists. Literally, on Wednesday, the pair was even lower than the moving average but then found the strength to recover all the losses. However, in the last week, it is visible that the upward momentum is weakening, and the pair are preparing either for consolidation or for the resumption of the downward trend. Recall that the pound sterling paired with the dollar has already consolidated below the moving average, and in recent weeks both currencies have been trading almost identically. Based on this, we can assume that the upward movement in the last month is a purely technical correction against the global downward trend. Even if we take the last turn of this trend, which on the 4-hour TF does not even fit completely into the illustration, then the correction looks very weak. Therefore, the euro still has purely technical reasons to show growth for a couple of weeks. But given the fact that almost all factors are now talking against the European currency, we do not rule out a resumption of the downward trend this week. Yes, the euro currency has been falling for a very long time and strength, and as a result, it turned out to be near its 20-year lows, but what should traders do if there were no grounds for buying euros now?

Of course, it is necessary, as before, to focus on moving. If the pair fixes below it for the second time (especially on Monday or Tuesday), this will be a signal for the resumption of the downward trend or for a transition to a flat, which may drag on for several weeks. It is not particularly necessary to count on the macroeconomic background of the euro currency now, because it is the European Union that is now at the forefront of the geopolitical conflict between Ukraine and Russia. It is Europe that is already suffering and will continue to suffer from this conflict and any escalation of it. For a long time, the public has been discussing the problem of the shortage of some food products due to the blocking of Ukrainian ports and unprecedented sanctions against Russia. In addition, inflation is rising in the EU, and the ECB has so far refused to do anything about it.

Maybe Christine Lagarde will still announce the exact timing and size of the rate increase?

There will be practically no important publications and events in the European Union in the new week. On Wednesday, the GDP for the first quarter will be released in the third estimate. The first and second estimates signaled the growth of the European economy by 0.3% in quarterly terms. Therefore, it is unlikely that the third assessment will be very different from the first two. The European economy surprisingly showed more growth than the American one in the first quarter, but do not pay too much attention to this point. In the States, the economic situation is fundamentally much more favorable.

On Thursday, the ECB will hold its first "summer" meeting, and we are wondering whether it is worth following this event at all? The deposit rate is 100% likely to remain unchanged, -0.5%. The loan rate is 100% likely to remain unchanged - 0%. The APP program should be fully completed only by the beginning of the third quarter. That is, no changes in monetary policy are expected. Therefore, the most important event will not be the ECB meeting itself, but the speech of its head Christine Lagarde. For several weeks, market participants have been waiting for her to announce clear deadlines for raising the rate in 2022, their number. But Lagarde, who at the end of last year and at the beginning of this time repeatedly stated that the rate would not be raised at all, is now watching with horror the growing inflation in the Eurozone, as well as the growing criticism of the regulator. Therefore, it seems that she and the monetary committee will have to raise the rate. Moreover, few people believe that an increase "to positive values" (that is, up to 0.25%) can at least stop the acceleration of prices, not to mention a decrease in inflation. Nevertheless, the tightening of Lagarde's rhetoric may at least slightly support the euro.

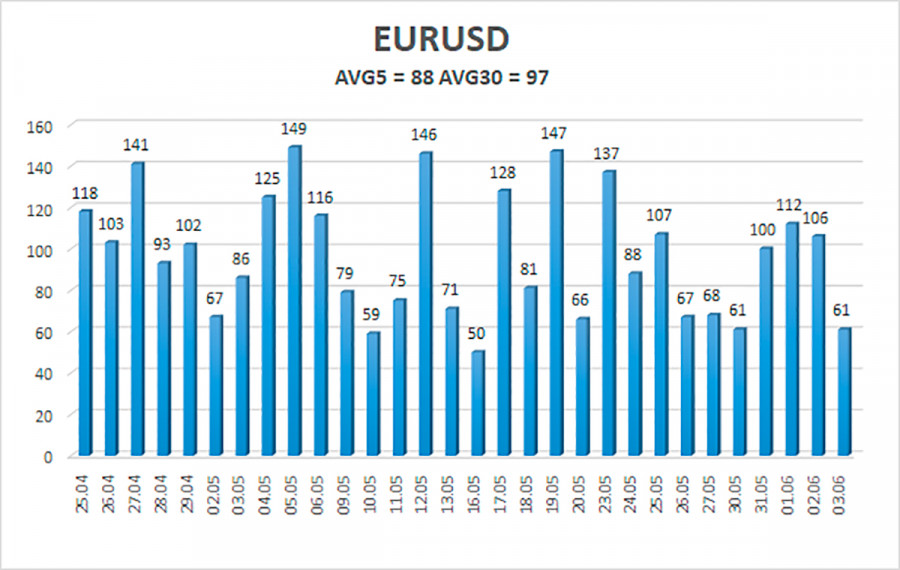

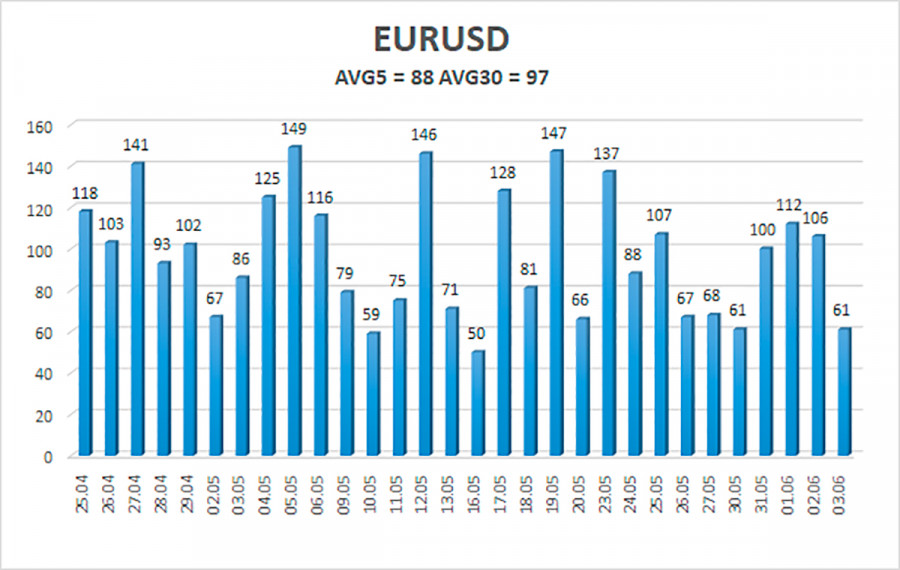

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 6 is 88 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0630 and 1.0806. A reversal of the Heiken Ashi indicator back up will signal a possible new round of upward movement.

Nearest support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to consolidate back above the moving average and may resume the formation of an upward trend. Thus, now it is possible to stay in long positions with targets of 1.0806 and 1.0864 until the price is fixed below the moving average. Short positions should be opened with a target of 1.0620 if the price is fixed below the moving average line. At this time, there is a probability of the beginning of a "swing".

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.