On Monday, the EUR/USD currency pair attempted to initiate an upward trend. Remember that the pair have spent the last few weeks in the absolute flat between the Murray levels "3/8" and "4/8" (even if this is evident in the preceding image). Neither the Fed meeting nor the ECB meeting could remove it from this side channel. The highest limit of 1.0254 was tested again, but without much result. On Monday, the United States and the European Union were set to release only the most negligible business activity indexes in the production sectors. Among them was the ISM index, but for a number of consecutive weeks, the pair overlooked much more crucial macroeconomic data. It would be correct to say that it did not ignore them but instead reacted extremely oddly. After all, volatility was not zero throughout this period, as the pair traded rather vigorously but within a narrow range. However, the market did not react logically to all the news.

Consequently, the euro remains near its 20-year lows and cannot surpass the crucial Kijun-sen line on a 24-hour timescale. It fully reflects the current desires of traders from our perspective. There is no interest in purchasing the euro currency among them. It is doubly unusual to watch a very confident rise in the value of the British pound simultaneously as the currency has been trading practically equally with the euro in recent months. However, the pound has at least some cause to rise, as the Bank of England meeting will conclude on Thursday, and the key rate will likely increase by 0.5 percent. It is an excellent reason to purchase British currency.

The US dollar can again be supported by geopolitics.

Currently, there is a sense that each year attempts to "surpass" the previous year's "accomplishments." The entire world fought for two years against the "coronavirus"; in 2022, a military conflict broke out in Ukraine, and "monkeypox" arrived. In addition, on the geopolitical map of the world, about a dozen possible flashpoints have emerged, where armed confrontations may soon break out. We have already discussed Transnistria, the ambition of Sweden and Finland to join NATO, and the most belligerent against Russia of the Baltic republics. In the last few days, however, two additional hotspots have emerged.

Yesterday, Serbia and Kosovo might have initiated hostilities. In the area of Kosovo, which is not recognized by all nations, a significant proportion of ethnic Serbs continue to utilize Serbian documents, passports, citizenship, and currency. Serbs who wished to remain on Kosovo territory were given a five-year deadline to transfer to Kosovo currency and documentation, but many failed to comply. Today, a rule was intended to go into effect in Kosovo that would require everyone to utilize only local currency and documentation. It instantly sparked protests and discussions about "oppression" and "denazification" in Belgrade. On the border between Kosovo and Serbia, barriers were erected, and machine gun fire could be heard. Only Washington was successful in delaying the implementation of a new legislation so as to avoid a confrontation. Nevertheless, the delay is only one month.

China, which has certain claims to Taiwan and considers it part of its territory, began to withdraw armed forces from the island's coast simultaneously. Simultaneously, Congressional Speaker Nancy Pelosi departed Washington to visit Taiwan as the United States' position is to support Taiwan's independence and prohibit a military takeover by China. However, the Chinese authorities threatened Washington and prohibited Nancy Pelosi's plane from landing in Taiwan immediately. Joe Biden has already warned that, in the event of China's military assault on Taiwan, the United States will quickly employ its troops and enter into conflict. There may not be an open conflict between the United States and China, but Taiwan will be supplied with weaponry, which Beijing would prefer to avoid. Pelosi's jet will attempt to land in Taiwan, and the potential for violence is as great as conceivable.

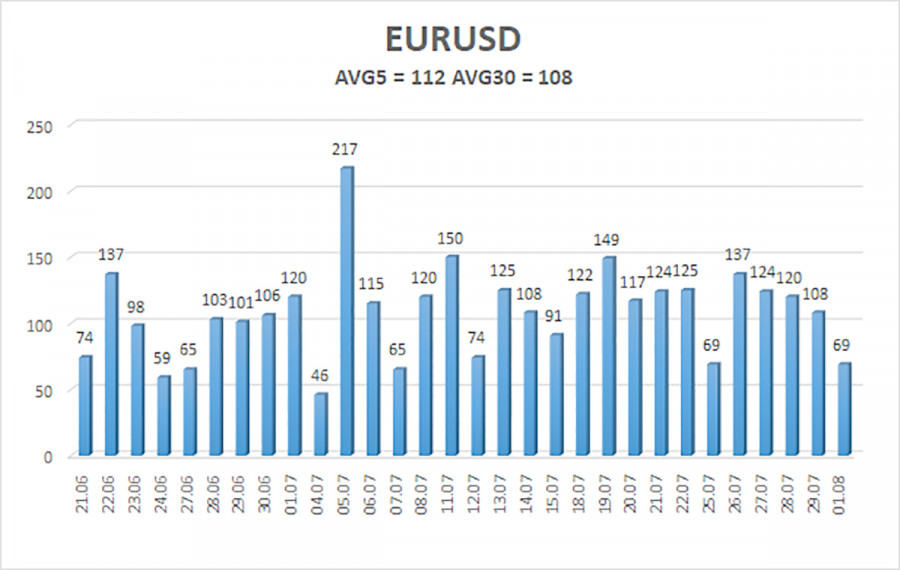

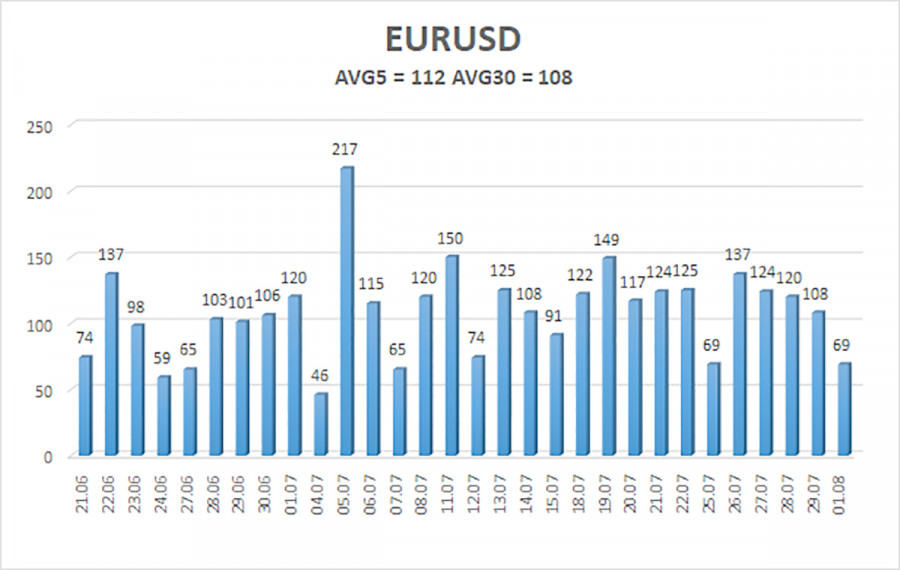

As of August 1, the average volatility of the euro/dollar currency pair for the previous five trading days was 112 points, which is considered "high." Thus, we anticipate the pair to trade between 1.0156 and 1.0378 today. The Heiken Ashi indicator's downward reversal signifies a new round of downward movement.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Recommendations for Traders:

The EUR/USD pair attempts to continue its upward movement but drifts sideways. Thus, it is now viable to trade on Heiken Ashi reversals between 1.0132 and 1.0254 until the price exits this channel.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.