The GBP/USD currency pair was trading quite calmly again during the European trading session on Monday. However, during the day, it still moved to a fall, which, we believe, is very logical on the eve of the Fed meeting, at which the rate is 99% likely to be increased by 0.75% for the fourth time in a row. Recall that the euro and the pound were actively growing last week before the ECB meeting; then, on Thursday and Friday (after the meeting), the euro currency has already begun to decline, but the pound has not because now a meeting of the Bank of England has appeared on the horizon. However, now the Fed meeting is in the first place regarding importance. Therefore, the dollar should grow.

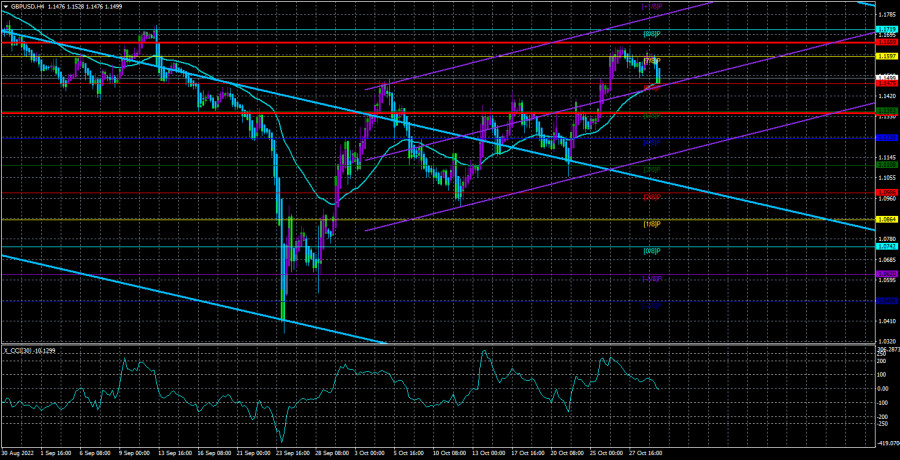

We have already said that the market can demonstrate almost any movement this week. Sharp reversals, and high volatility, this is unlikely to be avoided. Therefore, it is pointless to forecast which direction the movement will continue. Nevertheless, we suggest continuing to focus on technical analysis. It is when nothing is clear that it helps to sort everything out. At least until Wednesday, when the "hit parade of the most important events" begins, you should trade relative to the moving average, keeping in mind that the pair has not managed to gain a foothold above the Senkou Span B line on the 24-hour TF.

Consequently, the fall of the pound sterling, which has grown by 1300 points in recent weeks, is very likely. We also recall that if you remove the recent collapse and growth by 1000 points, it turns out that the pound has moved away from its 37-year lows by only 300 points. The current technical picture looks quite favorable for the British currency, but the dollar's strength may still force the bears to return to the market again.

Labor demands a general election.

No sooner had Rishi Sunak assumed the prime minister post than he immediately faced the first difficulties. After he spoke to Parliament for the first time, the leader of the Labor Party, Keir Starmer, demanded that he hold a general parliamentary election. Starmer noted that Sunak won the election, in fact, without a single competitor; that is, he was appointed prime minister by his own Conservative Party. He also recalled that he was defeated in the only elections in which Sunak had a competition. "Even the conservatives know that he (Sunak) does not represent the interests of workers. He was defeated by Liz Truss, who wanted to ease the fate of ordinary Britons. Why then not find out what opinion the working people of Great Britain hold by holding a general election?" asks the leader of the Labour Party.

There is certainly logic in Starmer's words. Sunak was indeed elected without a single real competitor. At the same time, Boris Johnson could also participate in the elections, for whom many Tories were ready to vote. However, there is a big force behind the Conservative Party, which remains invisible but strongly influences political circles. Johnson refused to participate in the election. Does anyone remember when a candidate for the post of head of state voluntarily refused to participate in elections if he had a real chance to win them? It should also be understood that the ruling party's leader is a person with real power. If the British voted for the Conservatives led by Johnson in 2019, this does not mean that they support the Conservatives led by Sunak. Therefore, if the elections that Starmer is talking about were held now, the Conservatives would surely lose them.

Sunak speaks almost openly about the lost trust in the Conservative Party and calls it his mission to restore this trust. In other words, Sunak wants to make his party win again before the next parliamentary elections. Consequently, the government's actions may be populist in the near future. The political pun in the UK continues; somewhere in Edinburgh, Nicola Sturgeon is watching all this chaos, who next year wants to hold a consultative referendum on Scotland's withdrawal from the United Kingdom.

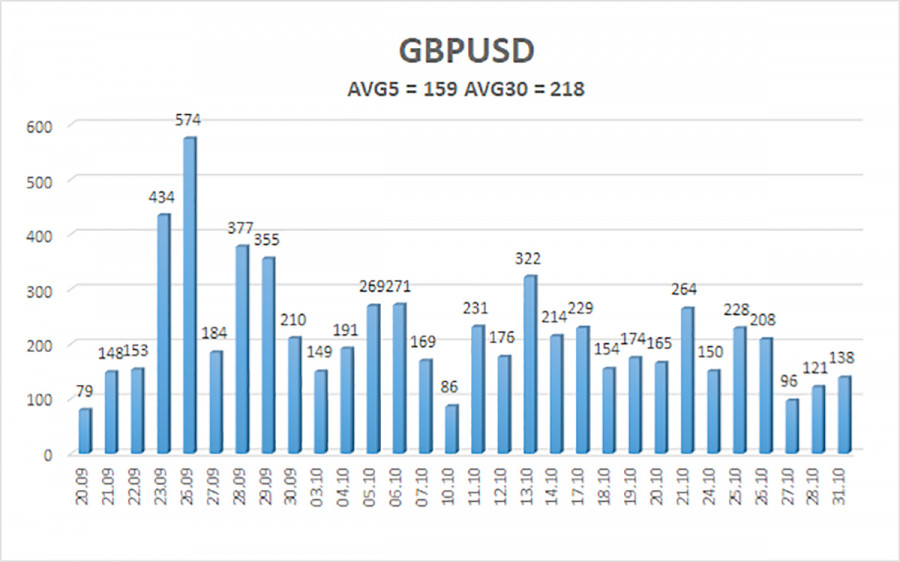

The average volatility of the GBP/USD pair over the last five trading days is 159 points. For the pound/dollar pair, this value is "very high." On Tuesday, November 1, thus, we expect movement inside the channel, limited by the levels of 1.1343 and 1.1659. A reversal of the Heiken Ashi indicator to the top will signal the resumption of movement to the north.

Nearest support levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair began to adjust in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1719 and 1.1775 should be considered in the event of an upward reversal of the Heiken Ashi indicator. Open sell orders should be fixed below the moving average with targets of 1.1353 and 1.1230.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.