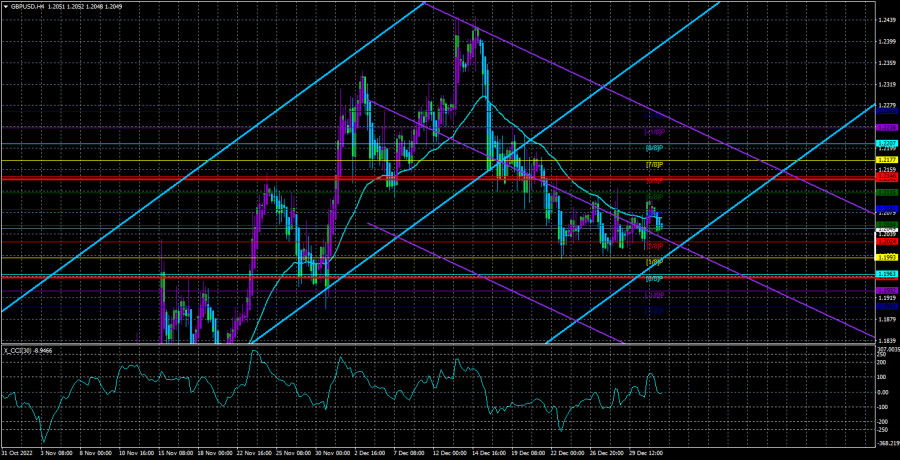

On Monday, the GBP/USD currency pair kept trading in the side channel. The British pound has adjusted very well over the past few weeks, but a week or so before the new year, it decided that enough was enough and that it was important to wait for fresh data and a "basis" before indicating a new increase or decline. That's all right, but this week in the UK, there are essentially no scheduled data or events. In our opinion, business activity indices across various industries are incapable of causing a significant movement and exit from the flat. The American data from Friday are a different story. Depending on how new it turns out to be, the pound might stay in the side channel. However, if it comes as a surprise, then the motions are pretty real. Now, the side channel can only reach levels 1.2010 and 1.2115.

Currently, there is nothing new to say about the UK. First of all, the Christmas and New Year's holidays remain. There are no significant remarks because a large number of BA politicians and officials are on vacation. We previously predicted that there wouldn't be many of them this week based on macroeconomic statistics. It would be unusual to anticipate news from Nicola Sturgeon, who is scheduled to organize a referendum in Scotland this year to keep her election promise. What do we have, then? Nothing is happening: there are no publications, speeches, news, or movements. All that is left to do is wait for at least one item on this list to emerge or for the lower TF to trade flat.

I'd want to draw attention separately to the 24-hour TF, where the pair was fixed below the critical line. Although it could seem like a good cause to keep adjusting, the price has fallen so far below this line that it will be easy for it to start going north again. Conclusion? This week, the pound should start to decline; by then, it might be too late. You must depart the side channel through its lower boundary to accomplish this. Our wait is over.

The British economy's health could cause the pound to decline.

In 2023, the British economy can go through a lot of challenging times. The British economy could have the strongest and darkest recession, to start. These worries might just be confirmed by this week's business activity indicators, which will be released. For instance, today's report on business activity for December could show a decrease of 44.7 points. Even more significant than this number itself is the fact that company activity in the production sector has been declining since May 2021, or for 18 months. It had a value of roughly 66 points when it started its descent into the abyss. This is not shocking considering how many central banks have used monetary stimulus to boost their economies to excellent levels. The Bank of England is also no different. Following a brief delay brought on by the rejection of monetary initiatives, a progressive drop to dangerous values began at the start of the year. Since the indicator has now fallen below the "waterline" of 50.0 for five consecutive months, the business climate in the industry has slowed and worsened. Given that the third quarter marked the official beginning of the recession, things can only get worse.

The Bank of England can tighten monetary policy considerably more gradually than it is now doing, notwithstanding significant inflation. It might not be able to increase the rate at each meeting, even at 0.5%. Several committee members opposed the increase at the previous two "monetary meetings." This shows that a large number of BA officials are concerned about the British economy and believe that it will weaken over the next two years, necessitating the introduction of new QE initiatives to reverse the downward trend. However, inflation won't go down unless new monetary policy tightening occurs. There is nearly a deadlock, and the pound sterling might be the loser. It has increased significantly during the last three months, gaining 2000 points. The market can now begin to gradually recoup this unjust growth. As previously stated, the pound's increase over the previous three to four months accounts for almost half of its loss over the previous two years.

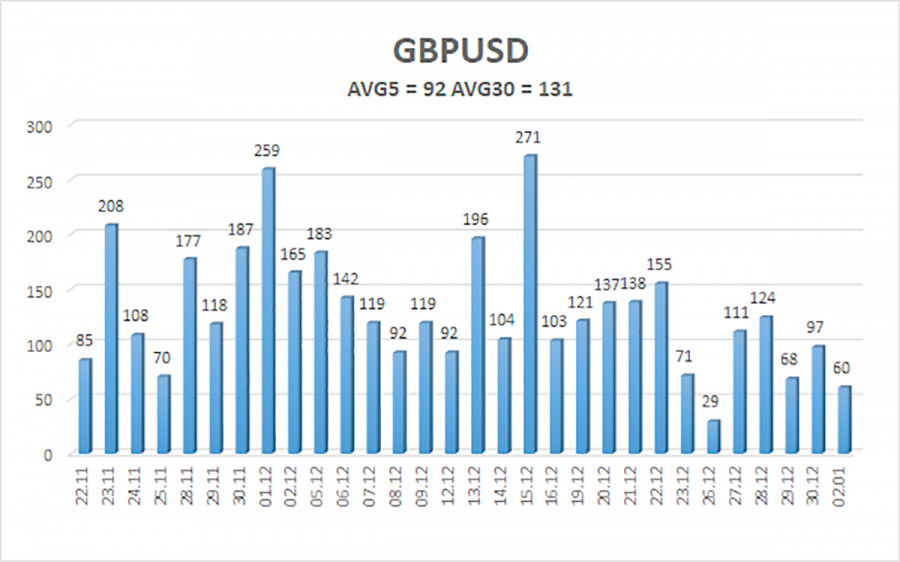

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 92 points. This number is the "average" for the dollar/pound exchange rate. Thus, on Tuesday, January 3, we anticipate movement that is contained inside the channel and is constrained by the levels of 1.1957 and 1.2141. The Heiken Ashi indicator's upward reversal portends the possibility of fresh upward action inside the side channel.

Nearest levels of support

S1 – 1.2024

S2 – 1.1993

S3 – 1.1963

Nearest levels of resistance

R1 – 1.2054

R2 – 1.2085

R3 – 1.2115

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair entered a side channel. As a result, at this time, we should think about trading in anticipation of a recovery from the levels of 1.1993 (1.2024) and 1.2115.

Explanations for the illustrations:

The use of linear regression channels enables the identification of the current trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.