The positive sentiment continues to strengthen. The PMIs for the US and the euro zone were better than expected, which gives reason to believe that the almost inevitable recession will be shallow and short-lived. Commodity prices have at least stopped rising, if not declined, which should lower global inflation and accelerate the growth of household incomes.

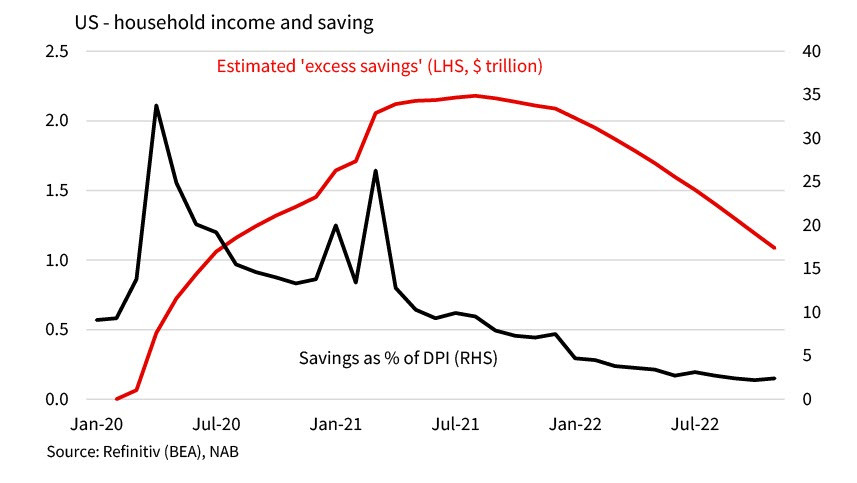

The U.S. foreign trade balance has been improving in recent months, primarily due to a strong decline in imports, which also indirectly indicates a decline in consumer demand. Household savings rates are trying to stabilize, but at a very low level.

US wage growth slows, this is an important marker for the US Federal Reserve as the results of the 2022 rate hikes are already showing, and the forecast for the next two Fed meetings is a 25 bps hike and the fed funds rate is expected to peak at 4.75/5.00% range. A higher rate is no longer expected, which in turn reduces the demand for the dollar as well.

Industrial production also recorded another big drop in December. Consumer behavior normalizes, spending gradually returns to prepandemic trends between goods and services, and the U.S. dollar records a 14% rise between mid-2021 and October 2022. These factors have been holding the sector back, but the current dollar weakness suggests that this GDP contraction factor may also be short-lived and shallow.

All signs show that the U.S. will enter the recession in 2023 in a controlled manner without major shocks. The dollar under such conditions objectively loses momentum for growth, but its weakening is unlikely to be strong and long-term.

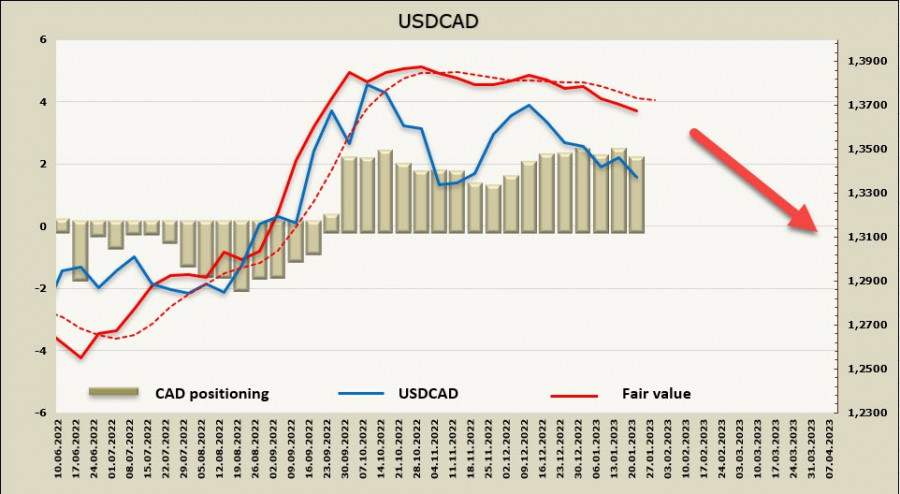

USDCAD

The Bank of Canada will hold another meeting today, markets are pricing in a 25bp hike and the probability of any unexpected decision is low. At the previous meeting on December, the Bank of Canada deputy governor expressed the view that "we are still prepared to act decisively if ... a very strong shock occurs." No shock news has followed since then, unless you count the strong labor market report with over 100,000 jobs created in December and the upward revision to U.S. GDP forecasts, which creates a number of implicit factors for the Canadian economy.

While the fundamentals support the positive, Q4 GDP growth promises to be strong, again a sharp increase in jobs, the debt market is resilient, the downside risk to the global economy is thought to have become less pronounced as well.

The net short position in CAD is down 270 million for the week, bearish positioning, no momentum. At the same time, the settlement price is going down, which increases the chances for further USDCAD decline.

The loonie is trading near the bottom of a converging triangle with no clear direction. Chances of a succeeding decline look more preferable, and assumes that after the Bank of Canada meeting the direction will still be indicated. The support area of 1.3220/30 will be the target, but a pronounced movement is possible only if the central banks shows a bit more hawkish mood than the market expects. At the moment, uncertainty is too high.

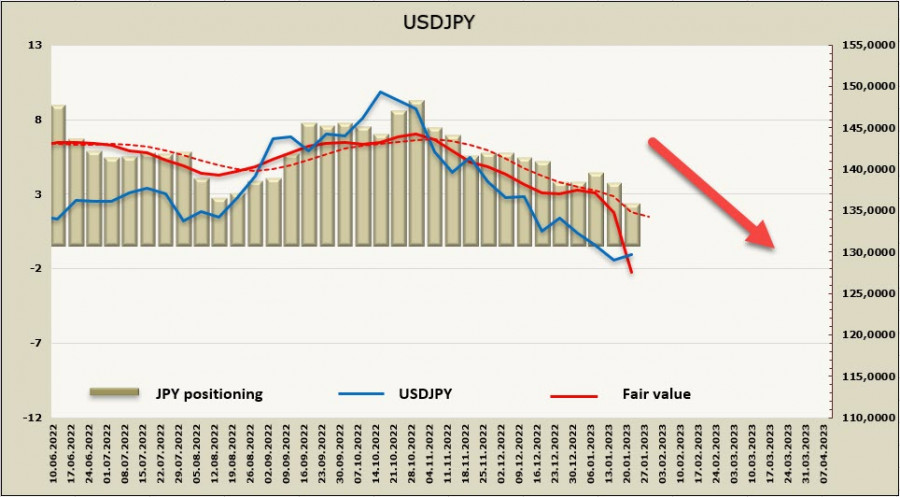

USDJPY

Consumer inflation in Japan accelerated to 4% y/y in December, the highest since 1981. Such strong inflation is unusual for Japan, as it has been struggling with deflation for decades, and the Bank of Japan has shied away from responding by raising rates, as a move in that direction could lead to financial disaster.

The gap between inflation and the rate level is so high that it makes no sense for foreign investors to buy Japanese government debt, leading to an exodus of capital to other markets. But the BOJ cannot raise the rate either, as Japan's debt has almost reached 1100 trillion yen, or 240% of GDP, and its servicing will be simply impossible if the rate level is brought in line with market realities. As a consequence, the BOJ continues to buy the government's debt, without which bankruptcy is imminent. In the first 20 days of 2023, the BoJ bought 14.4 trillion worth of government bonds, an all-time high, and with the foreign trade deficit on the rise, the pace of purchases will not slow down. We don't know how the country's financial authorities will get out of this situation, as there are no market proven mechanisms.

The yen is strengthening because the market has bet that the BOJ will be forced to capitulate sooner or later and expand its target band. The near future will show whether it will take this step or not.

The short position in JPY is shrinking fast, during the reporting week, it decreased by 1.1bn to -2.24bn, the settlement price is steadily going south, the direction is obvious.

Attempts to pull USDJPY upward are considered as corrective, there are no grounds for the reversal of the yen so far. The most likely scenario is movement to the support area of 126.35/55.