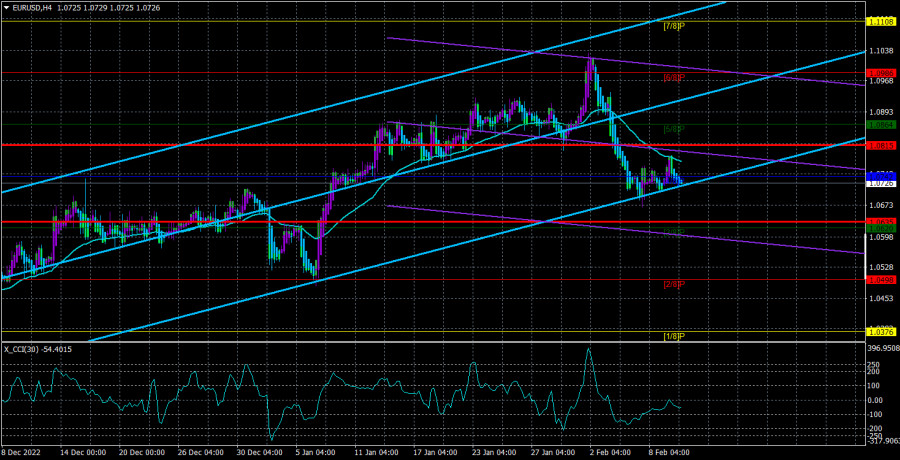

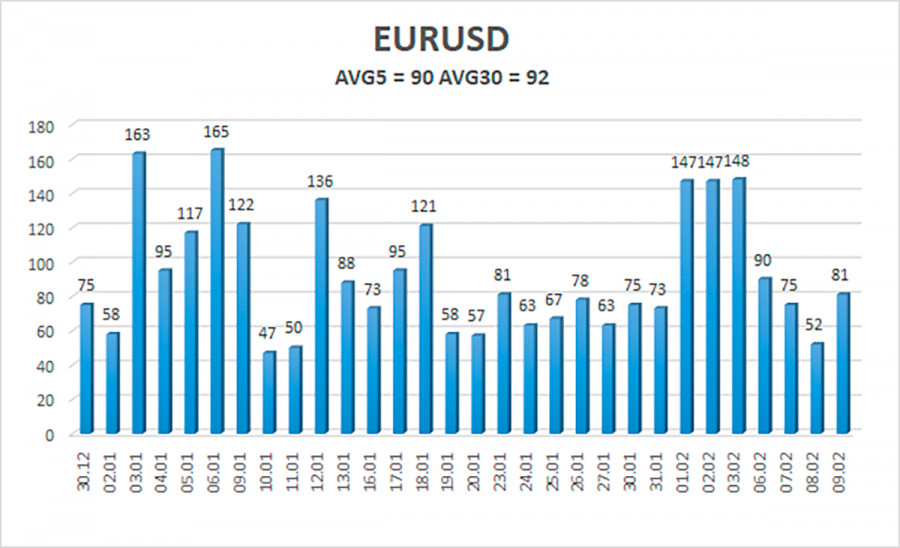

The EUR/USD pair is trading in a narrow range in the morning. Traders wanted to facilitate a further correction but there were no drivers for it. This is hardly surprising as the economic calendar has been uneventful this week. Thus, market participants simply have nothing to react to. Volatility has sharply decreased this week. It can be seen on the chart below. I stressed once that after a few days of a flat market, a correction would begin. The correction is still weak. The euro is likely to drop lower. It may resume a downward movement next week. Overall, there are no fundamental reasons for an uptrend. However, on the 24-hour chart, the pair broke through the physiologically important level. Yet, its consolidation there is questionable. So, if the pair settles above the moving averages, it may rebound.

It appears investors are now puzzled as they are uncertain about what to expect from the ECB and the Fed in the near future. Everything seems to be clear after the speeches of Christine Lagarde and Jerome Powell last week. The Fed will raise the key rate again by 0.25 basis points in March, while the ECB rate will hike its benchmark rate by 0.50 basis points. Nevertheless, it is quite difficult to predict what will happen next. Policymakers of both central banks stress the need for further tightening but they cannot hike rates indefinitely. Besides, central banks want to undertake rate hikes and avoid a deep and prolonged recession. In the US, the economic situation looks better thanks to positive macroeconomic reports on GDP for the fourth and third quarters. As for the EU, the economy is still in dire straits. Its GDP reports for the same quarters are negative. Powell also noted this week that under certain circumstances the rate could be hiked to 6%. ECB policymakers are just discussing the need to continue monetary tightening.

USD fate to depend on inflation and Nonfarm Payroll reports

These two reports have been affecting the market sentiment for the last two weeks. Inflation fell sharply for the sixth time in a row. It reinforced hopes for a pause in monetary tightening. The Nonfarm Payroll report exceeded forecasts. Powell said that the rate could be raised higher amid the tight labor market. Traders got confused. If inflation is declining at a good pace, why raise the rate more than planned? So, inflation may start to slow down and the economy is unlikely to add 500,00 jobs every month. It means that these two reports contradict each other. Speculators anticipate a further rate increase. However, they are well aware that the ECB could undertake a sharper rate hike

Therefore, a correction looks more likely now. Besides, it is still not completed. So, the pair could decline by 200-300 pips. If the pair rises above the moving averages, it may resume an uptrend. It will be another confirmation that traders ignore fundamental factors. The euro has been growing for several months lacking any drivers. There is a chance it may keep rising in February-March. One should pay attention now to the Kijun-sen line on the 24-hour chart. If the pair fails to consolidate below this level, it is sure to advance. The movements of the pair will also depend on inflation data for the EU and the rhetoric of ECB policymakers. A slowdown in inflation may increase the likelihood of an aggressive tightening. However, the ECB will hardly hike the rate another 5-7 times. The European economy is already one step away from a recession. Further rate increases could trigger a prolonged downturn.

The volatility of the euro/dollar pair over the last 5 days has totaled 90 pips. This is an average indicator. The pair is projected to move between the levels of 1.0635 and 1.0815 on Friday. An upward reversal of the Heiken Ashi indicator will signal an upward correction.

Support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair is trying to resume its downward movement after a slight correction. At this time, one may keep short positions with target levels of 1.0635 and 1.0620 until the Heiken Ashi indicator points upward. It would be wise to open long positions if the price settles above the moving averages with target levels of 1.0864 and 1.0986.

What we see on the charts:

Linear regression channels help to determine the current trend. If channels are moving in the same direction, it means that the trend is strong.

Moving average (20-period, smoothed) determines the short-term trend and the potential price movement.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) show the potential price channel where the pair could move the next day based on current volatility indicators.

The CCI indicator. If it enters the oversold zone (below -250) or the overbought zone (above +250), it means that a trend reversal may take place.