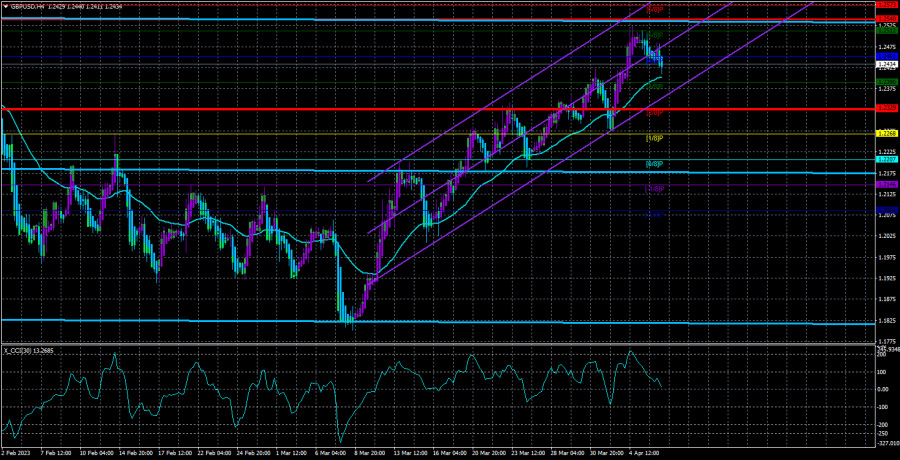

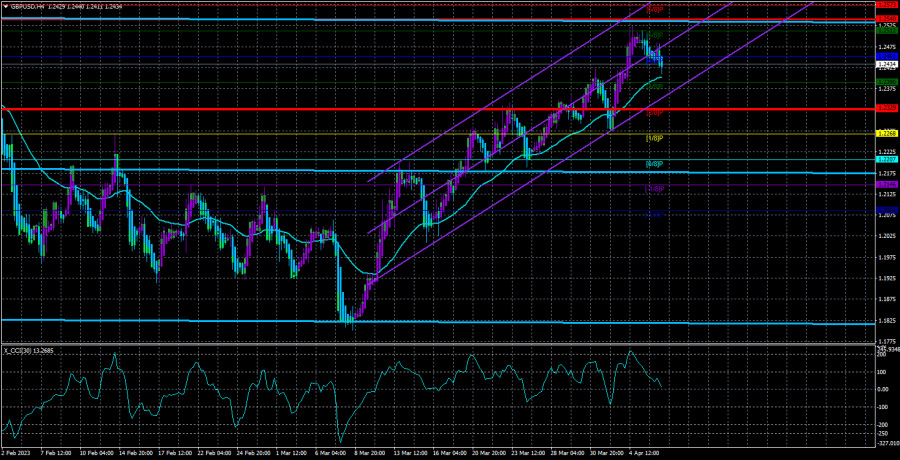

On Thursday, the GBP/USD currency pair also continued its downward correction with great difficulty. However, it barely reached the moving average line in two days of correction. Thus, there is no significant correction happening at the moment. Buyers took a short break and fixed profits on a few long positions, leading to a minimal pullback. There is no point in expecting a strong pound drop before securing below the moving average. And even overcoming the moving average line will not allow traders to expect a fall. The problem is that the market only thinks about buying the pair. The pair has been growing almost non-stop for a month. During this time, there were at most three downward pullbacks to the moving average, which was always close enough to the price. It is unlikely that anyone can say there was not a single "bullish" factor for the dollar in a month. And even if there weren't, after a 600-point rise, it would be nice to correct downwards by at least 250-300 points. But now we can only dream about that.

On the 24-hour timeframe, the pair slightly exceeded the sideways channel 1.1840-1.2440. This is what everyone has been waiting for so long - an exit from the flat on the daily chart! But in fact, no. Securing above the channel by 40 points for the daily timeframe is nothing. Formally, the quotes left the sideways channel. Still, from the current positions, a downward movement of 600-700 points may begin if the market recalls the real situation in the British and American economies. Therefore, we continue advising traders to be cautious when opening positions. The pair is moving illogically, ignoring the macroeconomic and fundamental background.

The pound may collapse at any moment! Many experts in the world are now expecting a continuation of the strengthening of the British currency. Moreover, as arguments, they sometimes list factors that make one want to cry. We have already said that any movement can be "explained" after the fact. The most trivial one is the market's growth or decline of risk/anti-risk sentiment. That is, at the moment, traders favor one or another currency, so it is growing. But if every movement is given such an explanation, it would be simply impossible to trade because it is impossible to predict when the market will begin to grow risk or anti-risk sentiment. Therefore, the progress in the Brexit negotiations between the EU and the UK has nothing to do with it. The state of the British economy compared to the American one - even purely theoretically cannot be "relevant." The Bank of England's rate is lower than the Federal Reserve's. How much more the BoE rate will rise is a big question. Even if slightly higher than the Fed rate, is that enough for the pound to grow non-stop without corrections? Recall that the pound has already strengthened by 2100 points from last year's lows!

In May, the Fed is widely expected to raise the rate again by 0.25%. Further on, everything will depend on the pace of inflation decline. If it slows down, another increase of 0.25% later is not excluded. That is, the market can count on one or two times. The Bank of England will raise its rate by the same amount. It is impossible to imagine that it slowed down the tightening pace to 0.25% in March to increase it to 0.5% in May. Thus, the "rate factor" cannot support the British currency. In general, the situation in the currency market remains strange, illogical, and unfounded. Unfortunately, nothing can be done about it. Remember that the pound may start a sharp decline at any moment, but be cautious about sell signals because many have been false recently.

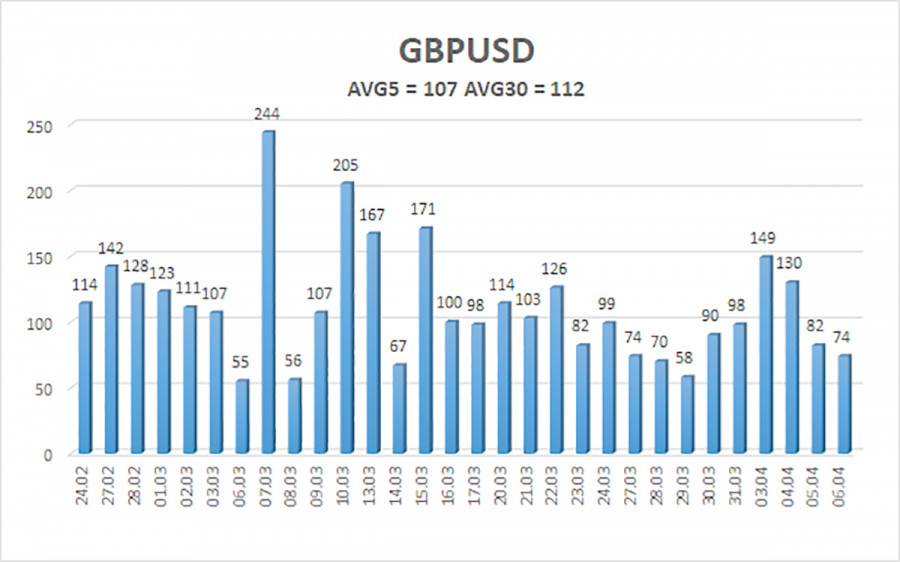

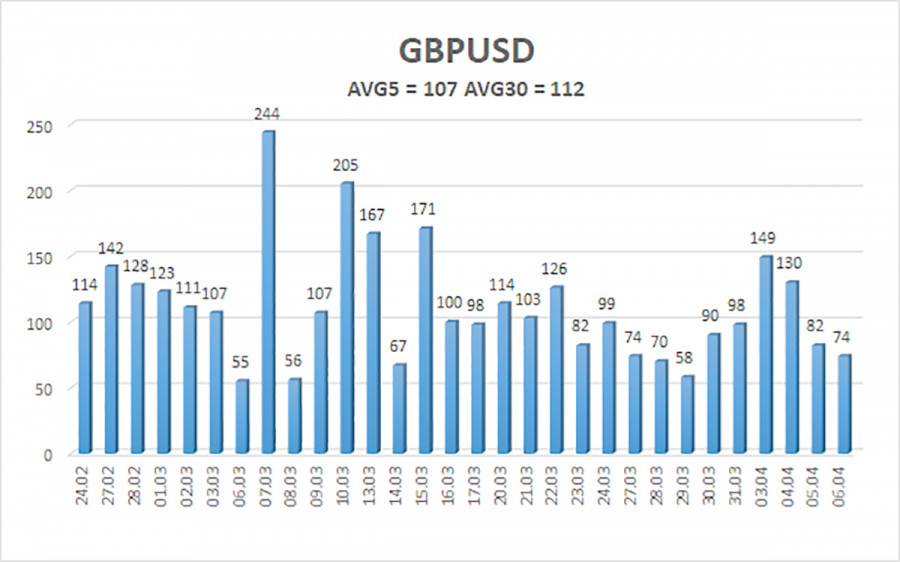

The average volatility of the GBP/USD pair over the last five trading days is 107 points. For the pound/dollar pair, this value is considered "high." On Friday, April 7, we expect movement within the channel limited by levels 1.2326 and 1.2540. The reversal of the Heiken Ashi indicator upwards will signal a resumption of the uptrend.

Nearest support levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trade recommendations:

The GBP/USD pair in the 4-hour timeframe has started a weak correction. At the moment, new long positions can be considered with targets at 1.2512 and 1.2540 if the Heiken Ashi indicator is reversed upwards or a bounce off the moving average. Short positions can be considered if the price consolidates below the moving average with targets of 1.2329 and 1.2268.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, the trend is strong.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and direction in which to trade now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.