On Wednesday, the EUR/USD currency pair showed an upward movement again. The day before, the pair had consolidated below the moving average line, the CCI indicator had already entered the overbought area twice (which happens extremely rarely), and there were no reasons for the euro to grow yesterday. But that's precisely why the European currency grew. For several weeks now, almost every day, we have talked about the illogicality of the current movement. Yesterday can be considered the apotheosis of absurdity. Only one report worth traders' attention was published during the day. US durable goods orders turned out to be much better than forecasted values, but the dollar fell in the morning, and after the report came out, it began to fall even more. And this is all you need to know about how the market reacts to news and reports. We said yesterday that we don't consider the orders report important; the market proved it isn't. Traders continue to interpret any report in favor of the European currency or ignore the entire fundamental background. Naturally, such a situation greatly complicates the trading process.

And, of course, it's worth noting once again that all sell signals can be safely ignored. They simply last worked properly over a month ago. Consolidation below the moving average now means absolutely nothing. Even more, it means that the pair will soon resume its upward movement. Other sell signals are no better. The largest number of times we saw the CCI indicator enter the overbought area before a drop started was three. So, are we waiting for the third time? Or will a new record be set in our case? One thing is clear: the European currency is heavily overbought and will sooner or later crash. The market may be waiting for next week's ECB and Fed meetings. The market may be waiting for large players to start selling.

Inflation in the EU will drop to 2% in a year and a half.

Yesterday, an ECB representative gave the market another important and meaningless speech. The Governor of the Bank of France and one of the members of the ECB Monetary Committee, Francois Villeroy de Galhau, said that inflation is likely to decline to the target level by the end of 2024. He noted that the peak of inflation had recently been passed and that food inflation would begin to decline in the second half of the current year. Recall that the European regulator's main concern is core inflation. The main consumer price index has decreased from month to month, sometimes very quickly (as in March). However, core inflation has not decreased yet. However, this information has no value for the European currency and traders. What can be done with this data? Nothing.

We will already find out how much the ECB will raise the rate next week. The market is still wavering between 0.25% and 0.5%. We lean towards the first option, as do most Bloomberg economists surveyed. However, surprises are possible. We believe that any more "hawkish" scenarios have been accounted for several times in the current exchange rate. Therefore, the main question is: "When will the market start trading following the fundamental background?" rather than "How will the market react to the ECB and Fed decisions?" If the current situation persists next week, the ECB could lower the rate to 0.5%, and the European currency would still show growth. We generally await a new consolidation of the price below the moving average and further growth.

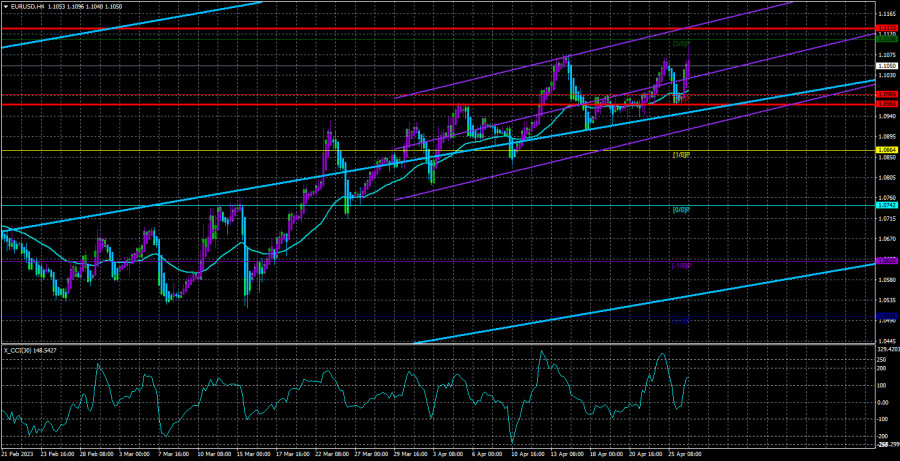

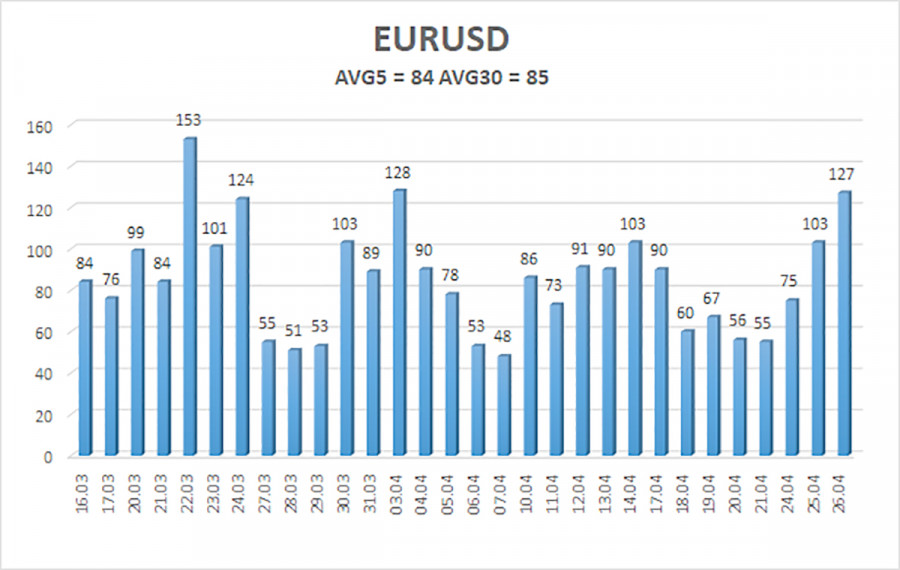

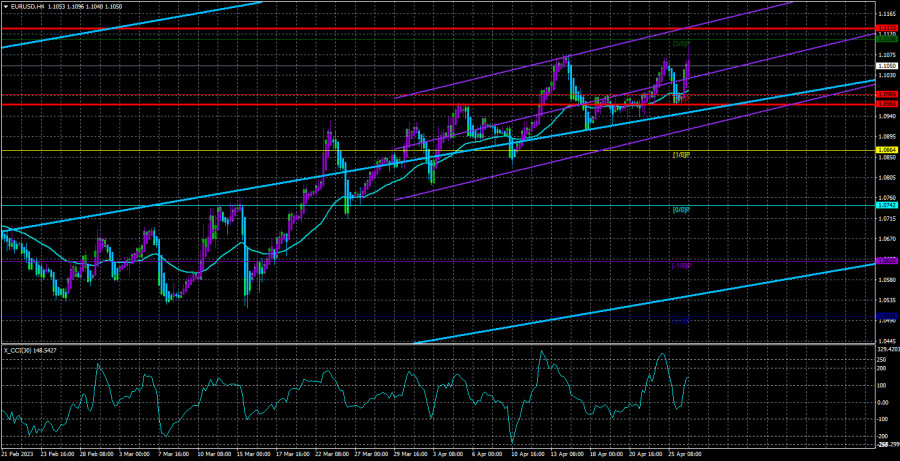

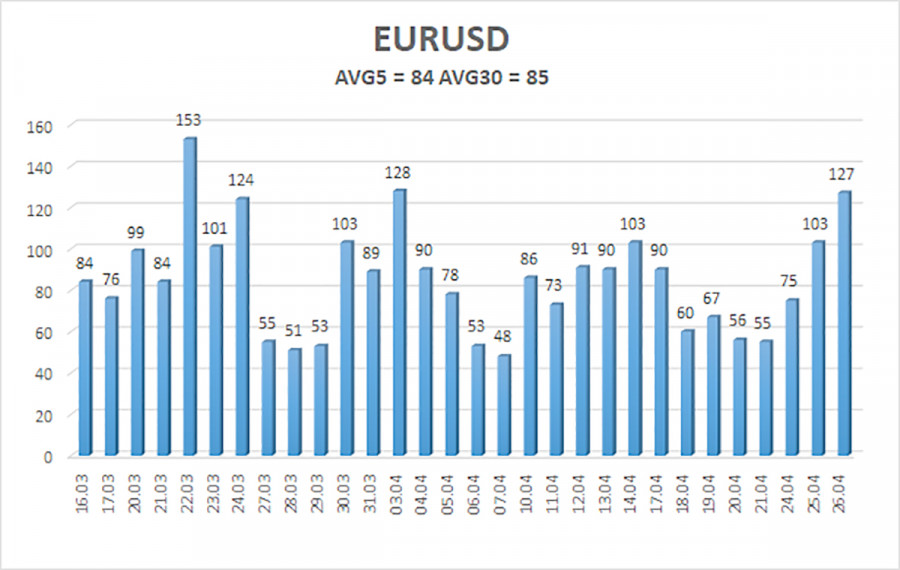

The average volatility of the EUR/USD currency pair over the last five trading days as of April 27 is 84 points and is characterized as "medium." Thus, we expect the pair to move between 1.0965 and 1.1133 on Thursday. The reversal of the Heiken Ashi indicator back down will indicate a new attempt to start a downward correction.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair tried to correct again, unsuccessfully. You can remain in long positions with targets of 1.1108 and 1.1133 until the Heiken Ashi indicator reverses downward. Short positions can be opened after the price consolidates below the moving average with a target of 1.0864.

Explanations for illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.