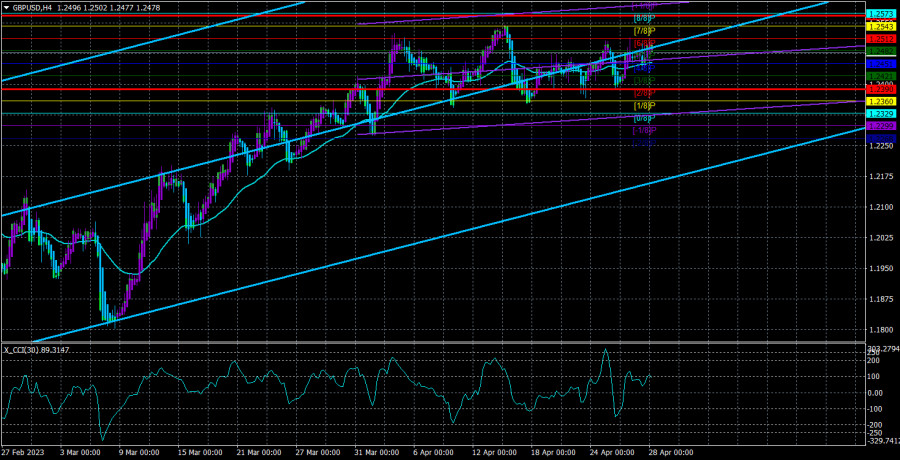

The GBP/USD currency pair has remained flat for over three weeks. Therefore, any movements within this flat are random by default. There is no point in looking for logic in yesterday's movements. In the euro currency article, we already mentioned that there is no point in trying to justify current movements using macroeconomics or fundamentals. Here is another proof of our words: the British pound yesterday, on the same news, showed a volatility of 63 points and an absolute flat, even intraday. Thus, it is impossible to conclude that the market worked off the US GDP report. Logical or illogical, it doesn't even matter. We saw a minimal burst of emotions during the publication (as for the 4-hour TF), and it all ended in the next 15 minutes. Therefore, for the pound, it remains only to wait for the end of the flat. Opening trades on the 4-hour TF now makes no sense. Trading should be done on the youngest TFs, where you can catch some movements.

A lot has already been said about the pound's prospects while it was in the sideways channel. In the illustration above, it is perfectly visible that the pair has not been able to correct itself properly for a month and a half, given that the macroeconomic statistics from the UK are mostly disappointing. Some analysts may say things are not going well in America, and they will be right. However, the US economy has been growing for the last three quarters faster than the UK's. The UK's GDP has long been on the verge of 0%, inflation is skyrocketing and does not respond to all the efforts of the Bank of England, and the regulator itself could take a break from tightening monetary policy in March. How can such a background provoke growth in the British currency? Even without corrections?

The pound still has no growth factors.

This week, we received no reports or events from the UK. The market has already switched to waiting for the Fed and Bank of England meetings. However, there is little to expect from the Fed now. Everyone knows the rate will increase by another 0.25% next week, and then there is a 90% chance of a pause. With the Bank of England, the fork of possible options is slightly wider. The British regulator can raise the rate by 0.25% or take a break after 11 consecutive tightenings. But the Bank of England meeting will take place only in 2 weeks, and it is unlikely that the market is preparing for it now. In any case, in the most "hawkish" scenario, both central banks will raise rates by 0.25%. Therefore, the pound has no advantage.

We still believe that sooner or later, the pound will collapse. We have been waiting for a strong correction for a long time and are trying to understand why it has yet to start. If we take a medium-term perspective, there are no serious growth factors for the pound or the dollar. Both central banks are close to the point where rates will stop rising. But since we did not see a normal correction, a fall is more likely.

On the 24-hour TF, it is quite possible to see the preservation of the three-month flat. The pair has consolidated slightly above the sideways channel of 1.1840–1.2440, but this consolidation is so unconvincing that it is very difficult to expect further growth. We do not see any factors in favor of the British currency. The pair is overbought, the CCI indicator has entered the overbought area, there are no downward corrections, the fundamental background is weak, and the macroeconomic background is weak. The pound has no reason to continue growing. But at the same time, it can continue against everything, as the market can trade as it sees fit. The "Bitcoin factor" is in action – buy because the instrument is growing. Today, there will only be a few secondary reports in the United States, which the market may not pay any attention to.

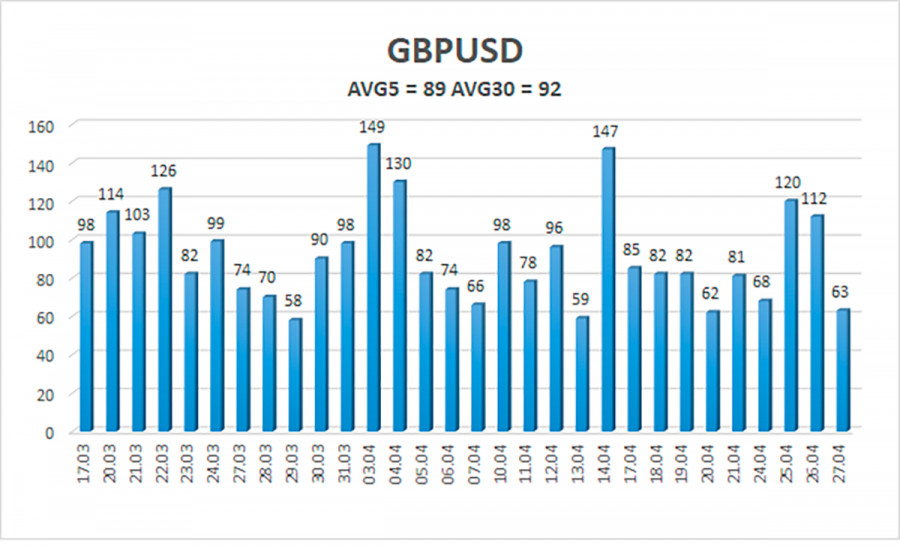

The average GBP/USD pair volatility for the last five trading days is 89 points. For the pound/dollar pair, this value is considered "medium." On Friday, April 28th, we thus expect movement within the channel limited by levels 1.2390 and 1.2568. A reversal of the Heiken Ashi indicator downward will signal a new round of downward movement within the sideways channel.

Nearest support levels:

S1 – 1.2482

S2 – 1.2451

S3 – 1.2421

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2543

R3 – 1.2573

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues to be near the moving average line in the flat. Currently, you can trade only by the reversals of the Heiken Ashi indicator or on younger TFs, as there is no clear trend – the price is too close to the moving average and ignores it.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, it means the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal is approaching in the opposite direction.