The GBP/USD currency pair also unexpectedly shifted to growth on Friday. In the case of the British pound, this movement seems less strange than with the euro, as the pound corrected downward after the Tuesday rise. However, the British currency had reasons for a decline, as the inflation report in the UK on Wednesday showed a much greater slowdown and deviation from the forecast than American inflation. However, the dollar fell by 200 points on US inflation, and the pound fell by 70 points on UK inflation, which is also not entirely logical.

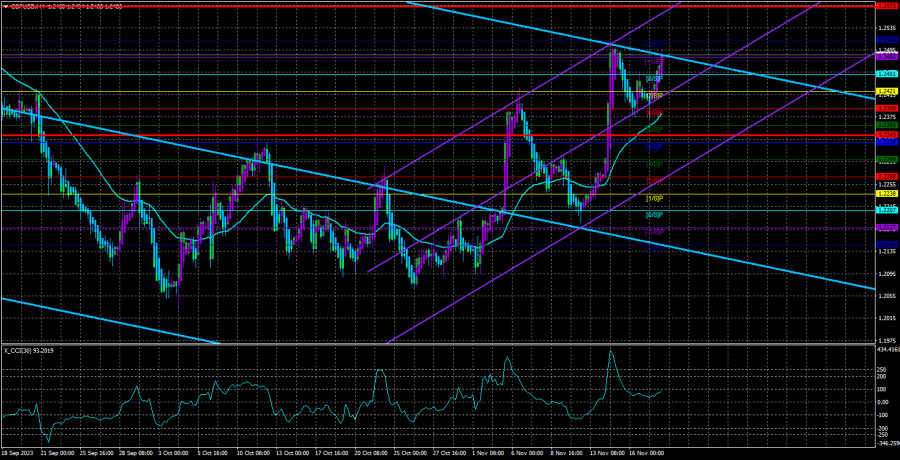

As seen in the illustration above, something resembling an upward trend has emerged in the last few weeks. We still consider this movement a "correction" against a stronger decline in the pair earlier. And this correction should have ended long ago. However, practically all the most important reports in November from across the ocean did not favor the dollar. The two recent strong growth spurts (clearly visible on the chart) happened precisely because of such reports. So, with these reports, there is a continuation of the correction.

Like the euro, the British pound currently has no grounds for growth, except for bad news from the US. Of course, the market "may fear a reduction in the key Fed rate next year," but then it should also fear a rate cut by the Bank of England because the decline in inflation in the UK has already exceeded Bailey's forecast by 5% by the end of the year. Therefore, further inflation slowdown should also soften the position of the British regulator. But the market seems somewhat one-sidedly "afraid." We do not think something terrible happened, and the downward trend has been unjustly broken. But at the same time, each new strengthening of the British currency raises certain questions about its justification.

Does Bailey's speech matter to traders?

During today's speech, Mr. Bailey may not touch on monetary policy and inflation. Or touch on them superficially. The market may not be waiting for this speech and may be unprepared to react. How often have we seen a situation where an important decision by the regulator or statements by the central bank chief are not properly reflected? How often have we seen a situation where what seems like an absolutely ordinary and routine report provokes a painful movement to watch? Everything depends on the market and its participants; we can only guess how the market will react.

And what can be assumed about the speech of the Bank of England Governor? After inflation in the UK fell to 4.6%, one can only assume an increase in "dovish" rhetoric. The British regulator was not particularly eager to continue raising the rate even before. After Bailey's forecast came true (inflation fell below 5% by the end of the year), the Bank of England has no reason to talk about new tightening. Therefore, we believe Mr. Bailey will not be gushing with statements like "additional tightening is needed" and "inflation may require central bank intervention" today. But whether his statements will matter to the market is a big question.

If the market is currently set for selling the dollar and buying the pound, then the pair's rise will continue, whatever Bailey says. Overbought CCI will not matter, and the absence of strong growth factors for the pound will not matter. Nothing will matter at all. In such a situation, we can only recommend following the trend, if the trend continues at all. And believing in its continuation takes a lot of work. A decline to the level of 1.1840 looks the most reasonable and logical.

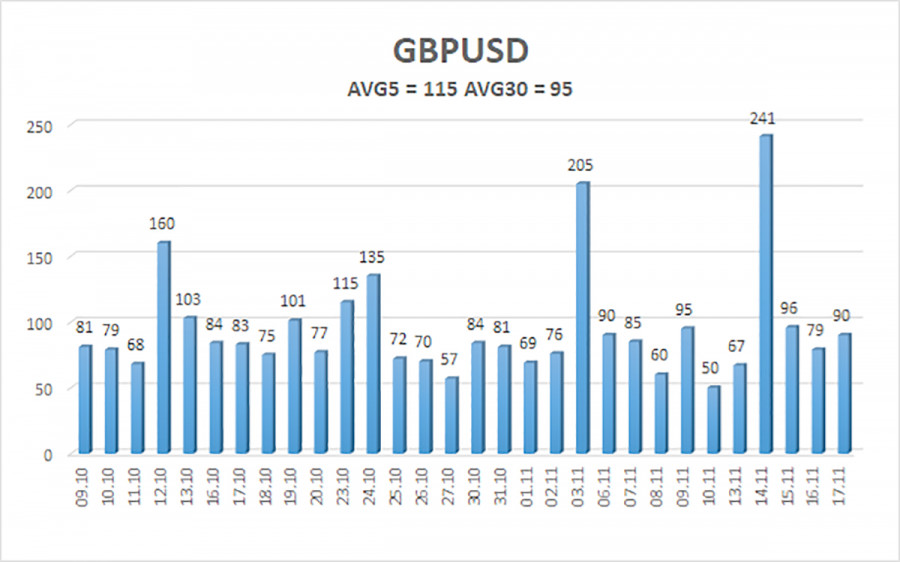

The average GBP/USD pair volatility for the last five trading days is 115 points. For the pound/dollar pair, this value is considered "high." On Monday, November 20th, we expect movements within the range limited by 1.2343 and 1.2573. A downward reversal of the Heiken Ashi indicator will indicate a new stage of a downward correction.

Nearest support levels:

S1 – 1.2451

S2 – 1.2421

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2482

R2 – 1.2512

Trading recommendations:

The GBP/USD currency pair has started a new stage of a downward movement but is still located above the moving average. Short positions can be opened with targets at 1.2329 and 1.2299 if the price is below the moving average. Long positions can formally be considered since the price is above the moving average, with targets at 1.2512 and 1.2573. Still, the triple overbought condition of the CCI indicator indicates the danger of opening such deals.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which to trade.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.