The number of job vacancies in the United States, as per the JOLTS report, slowed more than expected, coming in at 8.733 million in October (forecast: 9.300 million, previous: 9.350 million). In addition, JOLTS showed that the ratio of vacancies to unemployed fell to 1.34 (from 1.47), the lowest level since August 2021, suggesting that labor markets continue to cool.

The ISM in the US services sector grew more than expected, reaching 52.7 points (forecast: 52.3 points), with the employment index close to neutral and prices decreasing. Overall, the ISM supports the forecast of moderate economic growth in the US services sector.

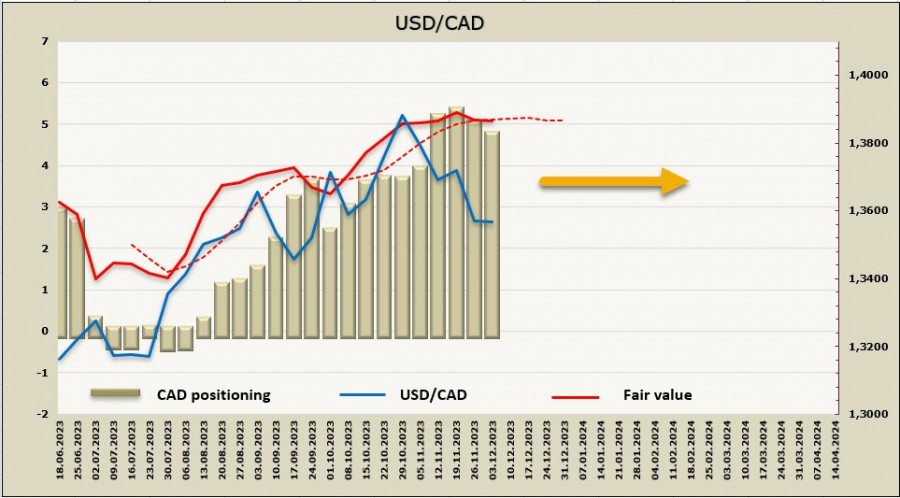

USD/CAD

The Bank of Canada will publish the final statement on monetary policy after a two-day meeting. The forecast is neutral, with the current rate of 5% expected to remain unchanged, but the tone of the accompanying statement may change.

Inflation expectations for the next two years remain very high, the labor market is still overheated, which also contributes to inflationary pressures, and the fundamental indicators of the economy as a whole are better than expected. Accordingly, reasons for further wage growth remain substantial, and there is a chance that the Bank of Canada will decide on another rate hike. This probability is low, but it exists, and if it happens, the loonie could strengthen immediately by two figures, dropping below the 133.80 level.

A more likely scenario is an unchanged interest rate with a moderately hawkish statement, and the focus will shift to Bank of Canada Governor Macklem's speech on Thursday. In this case, volatility will be low, and the pair could move in any direction if Macklem outlines the contours of credit and monetary policy for the near term, as expected.

The net short CAD position decreased by 117 million to -4.66 billion over the reporting week, and the bearish bias remains intact. The price has no direction.

The Canadian dollar has strengthened against the USD in the past month, following general market trends. However, on the futures market, longs on the CAD are weak, speculative positioning is clearly not in its favor, and there are no signs of a change in trend. We assume that the current decline in USD/CAD is corrective and lacks deep fundamental justification.

The decline in USD/CAD ended at the technical level of 1.3493 (50% of the July-October rise), and there's a low probability of falling below the next support at 1.3380/3400. A more reasonable scenario is consolidation with an attempt to rebound, targeting 1.3690/3710, or sideways trading awaiting new data.

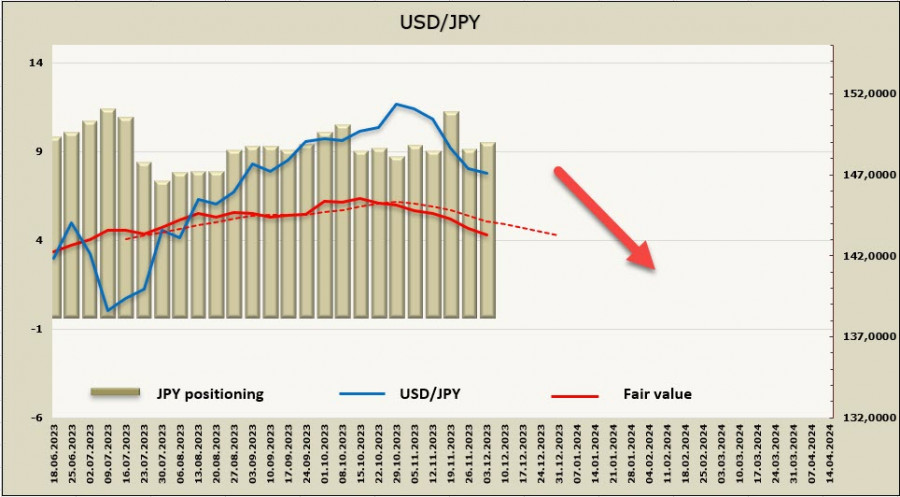

USD/JPY

In financial circles in Japan, the discussion intensifies regarding when and under what conditions the Bank of Japan will start its exit strategy from negative interest rates. Currently, the most suitable date mentioned is the meeting on April 25-26, which will follow immediately after major employers begin implementing the agreement on adjusting average wages.

Calculations by the Ministry of Health, Labour, and Welfare showed that in 2023, the average wage increased by 3.2%, which is 1.3% higher than the previous year. The key question for 2024 is not whether the largest companies can afford another year of significant growth. If this growth continues, Japan may finally emerge from a state of internal deflation that it has been grappling with for at least two decades, and inflation in the last two years has been almost exclusively imported. If wages continue to rise, the BOJ will not delay its exit from negative rates, significantly strengthening the yen.

The market is thus preparing for the yen to begin strengthening as soon as markets can confirm such news. While yen positioning is currently bearish, and there are no signs of a massive capital movement favoring yen purchases in anticipation of future growth, the first signs are already emerging.

The net short position increased by 375 million over the reporting week to -9.25 billion, indicating a bearish bias. This suggests that another attempt at growth in the short- to medium-term is possible before a final reversal to the downside. At the same time, the price is below the long-term average and is clearly heading downwards, making signs of increasing bullish prospects for the yen more evident.

USD/JPY has reached the target of 145.90, updating its low set the week before. We expect that after consolidation, the pair will continue to fall. Resistances at 147.50/60, further at 148.52, indicate that an upward movement is unlikely under current conditions. If signals from Japan suggest that the scenario outlined above has a chance of realization, the pair will continue to fall, with the nearest target at 145.08, followed by 144.30/50. Clear signals from the BOJ are necessary for a deeper decline.