Tech sector under pressure

The U.S. stock market closed lower on Wednesday, with the Nasdaq index losing 1%. The main reason was a decline in tech stocks, exacerbated by weak interest in the 10-year Treasury auction, which caused investor jitters amid volatile trading.

Morning gains turn to losses

Trading started on a positive note with tech giants rising, but both indexes began to lose ground as the day progressed. Investors, still jittery from the recent global sell-off in equities, added to the sell-off after a weak Treasury auction sent the market lower.

Red Zone: All Indexes Die

All three major indexes ended the day in the red, with losses widening just before the close. The tech-heavy S&P 500 (.SPLRCT) fell 1.4%, becoming the biggest drag on the benchmark index.

Recession Worries

Investors are worried about a possible U.S. recession, as well as weaker forecasts from major U.S. companies. These factors are weighing on the market.

Day's Results: Big Losses

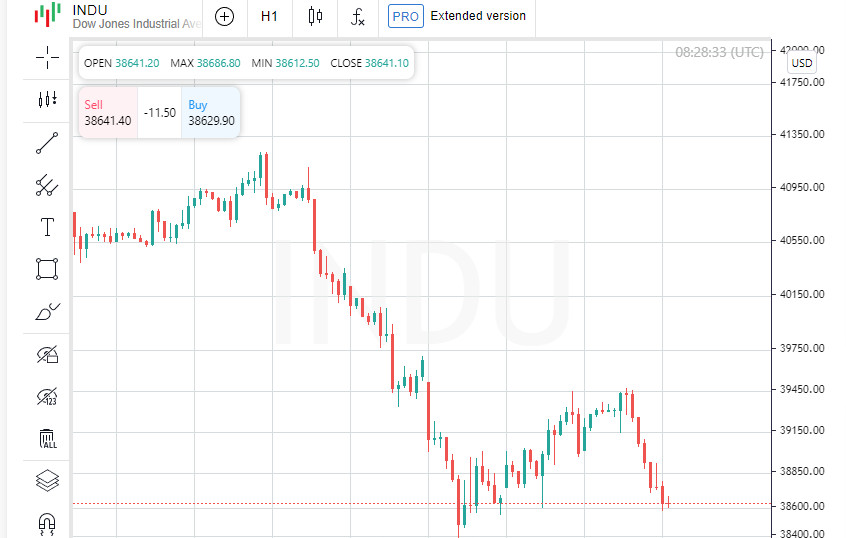

The Dow Jones Industrial Average (.DJI) fell 234.21 points, or 0.6%, to 38,763.45. The S&P 500 (.SPX) lost 40.53 points, or 0.77%, to 5,199.5. The Nasdaq Composite (.IXIC) fell 171.05 points, or 1.05%, to 16,195.81.

Expert Opinions

Lindsey Bell, chief strategist at 248 Ventures in Charlotte, North Carolina, said investors may also have been taking profits after stocks rebounded Tuesday.

Big Losses

The Nasdaq and S&P 500 each lost at least 3% on Monday, underscoring the volatility of the current market environment.

Impact of Comments from Japan

Stocks received some support Wednesday after Bank of Japan (BOJ) Deputy Governor Shinichi Uchida said the central bank has no plans to raise rates amid volatile financial markets.

Nikkei surges after decline

Japanese stocks rose on the news. The Nikkei (.N225) rose 1%, extending a 10% rebound that began on Tuesday after a sharp decline on Monday. The Nikkei's sudden 12.4% decline triggered a global decline in equities as investors turned away from risky assets.

Japan rate hike fallout

The Bank of Japan's surprise rate hike on July 31 to a level not seen in 15 years triggered a sell-off in global markets. Investors began unloading their yen positions in a carry trade, sending the low-yielding Japanese currency, which is typically used to buy high-yielding assets, sharply higher.

Disappointing Corporate Results

Walt Disney Shares Slide

Walt Disney (DIS.N) shares fell 4.5% after the company warned of "moderate demand" for its theme parks in coming quarters.

Super Micro Computer Slide

Super Micro Computer (SMCI.O) shares tumbled 20.1% after the company reported lower-than-expected quarterly adjusted gross profit. Rival Dell Technologies (DELL.N) also fell 4.9%.

Market Expectations

Federal Reserve Eyes

Investors are eagerly awaiting further comments on monetary policy from the Federal Reserve, with particular attention focused on an event in Jackson Hole, Wyoming, where Fed Chairman Jerome Powell is scheduled to speak.

Trading Activity

Trading volume on U.S. exchanges on Wednesday was 12.93 billion shares, slightly above the 20-day average of 12.63 billion shares.

Declining Stocks Prevail

Declining stocks outnumbered advancing stocks on the New York Stock Exchange (NYSE) by 1.48 to 1. On the Nasdaq, the ratio was even more pronounced, with decliners outnumbering advancing stocks by 2.08 to 1.

Highs and Lows: Market Trends

S&P 500 and Nasdaq Performance

The S&P 500 posted 16 new 52-week highs and 9 new lows. The Nasdaq Composite posted 34 new highs and 195 new lows, putting the tech sector under significant pressure.

External Factors

Oil Price Rise

Oil prices rose on a bigger-than-expected draw in U.S. crude inventories and a possible escalation in the Middle East. However, investors continue to voice concerns about weak demand in China.

S&P 500 Volatility

Daily Performance

After a morning rally on Wednesday, the S&P 500 began to lose ground around midday and then fell further after the 10-year U.S. Treasury auction.

Profit Taking

Bell also noted that some investors are using short-term stock gains to take profits, adding to the volatility in the market.

MSCI falls, STOXX 600 rises

The MSCI World Share Index (.MIWD00000PUS) fell 0.35 points, or 0.05%, to 770.64, after hitting a session high of 783.83. Meanwhile, Europe's STOXX 600 (.STOXX) ended the day up 1.5%, reflecting positive momentum in European markets.

FX Markets: BoJ Statements React

Yen Falls

The Japanese yen weakened after the Bank of Japan's rate hike announcements, somewhat reassuring investors worried about the volatility of the Japanese currency. The yen strengthened sharply against the dollar on Monday amid concerns about a possible U.S. recession, sending markets falling broadly.

Strengthening dollar

The US dollar strengthened 1.75% against the yen, reaching 146.83. The dollar index, which tracks the greenback against a basket of currencies including the yen and the euro, rose 0.2% to 103.19. The euro, meanwhile, fell 0.08% to $1.0921.

Bond yields: An analysis of supply and demand

US Treasury yields rise

US Treasury yields rose after weak demand at a $42 billion auction of 10-year notes. Companies rushed to place their debt amid growing risk appetite. Traders are closely monitoring supply and awaiting more economic data to assess the health of the US economy.

Specifics

The 10-year Treasury yield rose 7 basis points to 3.958%, up from 3.888% late Tuesday. The 30-year yield also rose, adding 8.1 basis points to 4.2579%.

These moves highlight the current market sentiment, with investors seeking to balance risk and return amid economic uncertainty.

Two-Year Yields Decline

The two-year Treasury yield, which closely tracks interest rate expectations, fell 0.2 basis points to 3.9827%, down from 3.985% late Tuesday. The move reflects a slight softening in investor expectations for future Federal Reserve action.

Energy Markets: Oil Prices Rising

Oil Prices Strengthening

Energy markets are seeing a significant rise in oil prices. US crude oil rose 2.77% to $75.23 per barrel. Brent crude prices also rose, rising 2.42% to $78.33 per barrel. These changes come amid concerns about depleting reserves and a possible escalation of conflicts in the Middle East.

Precious Metals Market: Gold Prices Fall

Gold Price Decline

Precious metal prices declined. Spot gold lost 0.2% to $2,384.59 per ounce. US gold futures also fell, falling 0.05% to $2,387.80 per ounce. These changes may be related to fluctuations in currency markets and changing investor sentiment.

Results and Prospects

Markets continue to show volatility in response to changes in economic indicators and geopolitical risks. Investors are closely monitoring developments, trying to adapt their strategies to the new conditions. Interest rate expectations and rising oil prices play key roles in shaping market sentiment.