The EUR/USD currency pair continued to trade on Thursday with not the highest volatility, as for those events that were scheduled for that day. Recall that the volatility of the pair has decreased very much recently, and now we are forced to observe 40-50 points per day in most cases. The European currency continues its upward correction against the stronger, previous downward movement, and this week ignored several events that should have caused its fall, not growth. Perhaps this was an isolated incident and we should not panic about it. However, we don't really like it when the fundamental background goes against the movement of the instrument.

Someone can say "the market is always right" and will be right. The market is really always right, because it balances itself. By itself, the foundation or macroeconomics does not oblige traders to make certain transactions. However, if you are a big player and manage billions, you are unlikely to read these lines. Small traders are forced to try to follow the big ones, that is, to work according to the trend. And our task is to predict the further movement of the pair. And this can be done by applying various types of analysis, one of which is fundamental. If the couple does not react to the foundation in any way, then why consider all the events and publications at all?

Therefore, we always draw a clear conclusion. If the market is trading illogically, we say so. And our readers can draw their own conclusions based on this. But there is no need to try to fit every piece of news or report into the current movement. You can always explain or, more precisely, "invent an explanation," but what is the point? Why deceive ourselves?

After such a long preamble, we would like to point out that the results of yesterday's ECB meeting (the second this year) did not surprise traders. All three rates remained unchanged, but no market participants expected them to decrease or increase. Immediately after the meeting, we saw a decline in the euro, but conclusions should be made today, on Friday. Remember that the market can react to such a significant event for up to 24 hours.

Thus, today we will not draw hasty conclusions. We believe that the dollar should continue to strengthen against the euro in any case. And this week, there were events that played into the hands of the U.S. currency. The market confidently ignored them, so if this continues, the euro will rise despite everything.

But at this stage, we still believe that we are witnessing a regular correction, albeit one that has dragged on a bit in time. In the 24-hour timeframe, the price hit the Senkou Span B line, near which the correction may and should end. The ECB did not lower rates in March, but it may move towards easing monetary policy even before the Fed. And it was precisely the factor of a more rapid shift towards easing Fed policy that pushed the euro up for a long time. Now, the opposite picture should be observed.

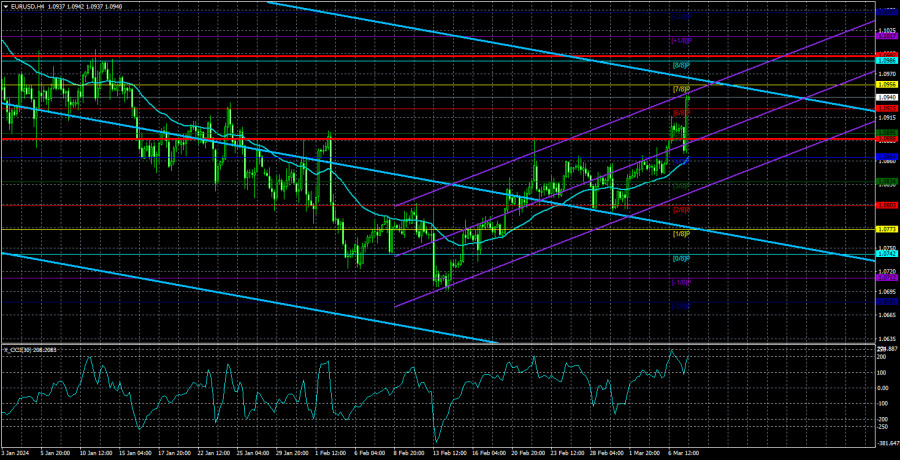

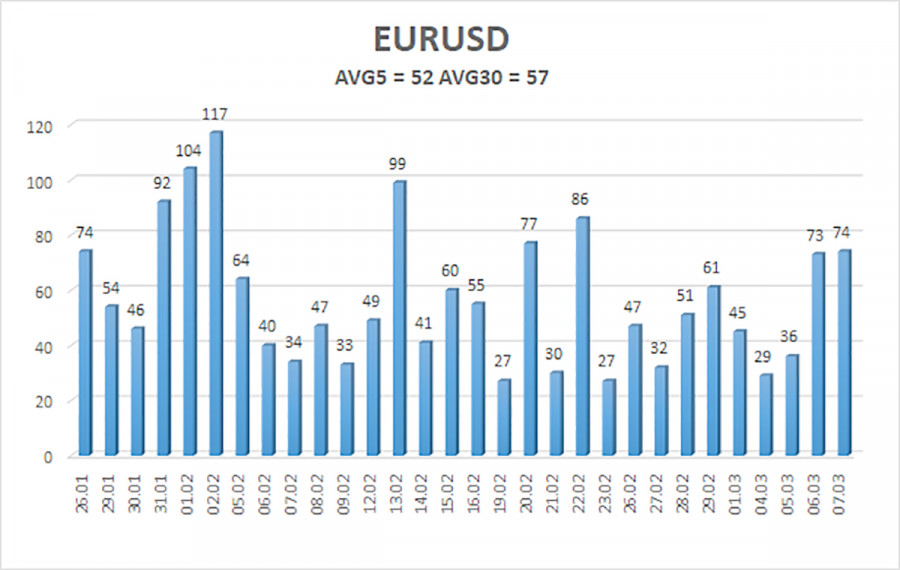

The average volatility of the EUR/USD currency pair over the last 5 trading days as of March 8th is 52 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0888 and 1.0992 on Friday. The senior linear regression channel is still directed downward, maintaining the downward trend. The oversold CCI indicator triggered a small upward correction, but now the indicator may enter the overbought zone.

Nearest support levels:

S1 – 1.0925

S2 – 1.0895

S3 – 1.0864

Nearest resistance levels:

R1 – 1.0956

R2 – 1.0986

R3 – 1.1017

Trading recommendations:

The EUR/USD pair continues to stay above the moving average line and continues its upward movement. Long positions can formally be considered until the price consolidates below the moving average, with targets at 1.0956 and 1.0992. However, we remind you that the current upward movement is not only corrective but also completely illogical. Neither yesterday nor the day before did the euro have reasons to continue its rise. Thus, we continue to expect a decline, but there are no sell signals yet. As long as they are absent, naturally, one should consider buying, not selling.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20.0, smoothed) determines the short-term trend and direction in which trading should currently be conducted.

Murray Levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.