The EUR/USD currency pair attempted to resume its downward movement on Friday but failed to establish itself even below the moving average. All the necessary information was present, but the pair traded strangely and illogically throughout the past week. The rise of the European currency began as early as Tuesday, and over the next three days, the market effectively ignored strong data on business activity, unemployment, the labor market, and vacancies in the US. Yes, on Friday, we saw a slight strengthening of the dollar, which quickly ended. The market responded with purchases of the US currency to the reports on nonfarm payrolls and unemployment. But what was the point of reacting to these reports if the price returned to its initial position within 2 hours?

In fact, the dollar should have been rising and the euro falling all last week. And exactly in this interpretation, apart from important and strong data from across the ocean, the inflation report in the EU was also published, showing a more significant slowdown in inflation in March. Now, the ECB can theoretically decide on a rate cut this week. It is hard to believe this at the moment, but considering how, in recent months, the market and experts have been wrong in their forecasts regarding central bank rates, one cannot dismiss the possibility. It is beyond doubt that the ECB's stance will be dovish. And Lagarde's dovish sentiment and rhetoric should cause a new decline in the European currency multiplied by purchases of the dollar, based on the statistics from the US last week.

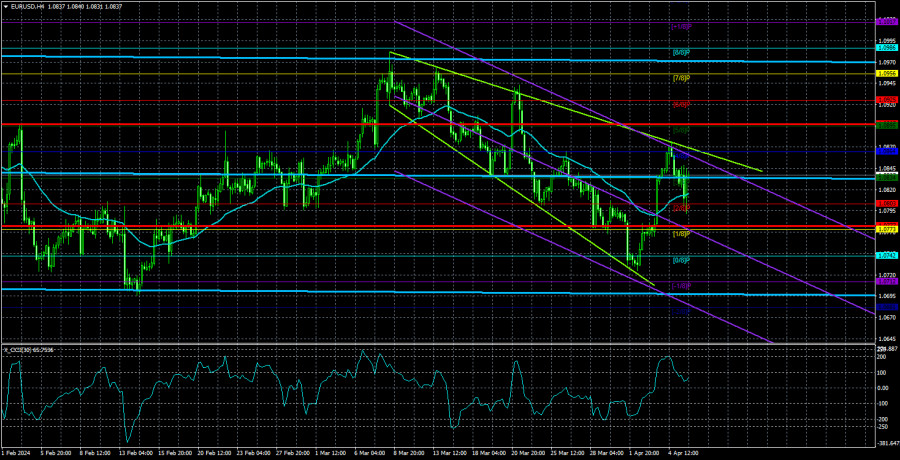

Therefore, as before, we expect only southward movement from the EUR/USD pair. Practically all possible factors at the moment indicate this. Also, an interesting "wedge" pattern has formed in the 4-hour timeframe. Last week, the price just worked out its upper boundary, so now it may head downwards towards the 7th level, as we predicted in our recent articles. We also believe that the market will reconsider its attitude towards US statistics and still resume purchases of the US dollar. Thus, in any case, we are only looking at selling the pair.

In the European Union, apart from the ECB meeting, there will be practically no important events this week. In Germany, reports on industrial production and inflation will be published, which have extremely little significance for the market. Industrial production may, as usual, decrease in volume, and everything necessary about the decline in inflation in March is already known. The second estimate of the indicator will not change anything. Only Christine Lagarde's speech after the central bank meeting will be truly interesting, but even here, the intrigue is minimal. Inflation in the Eurozone has already slowed to 2.4% y/y, so the ECB will almost certainly move to ease monetary policy in June. The only question is whether such a state of affairs is sufficient grounds for selling the euro to the market. After all, next door, we have an example with the pound, which does not fall despite any fundamental or macroeconomic background.

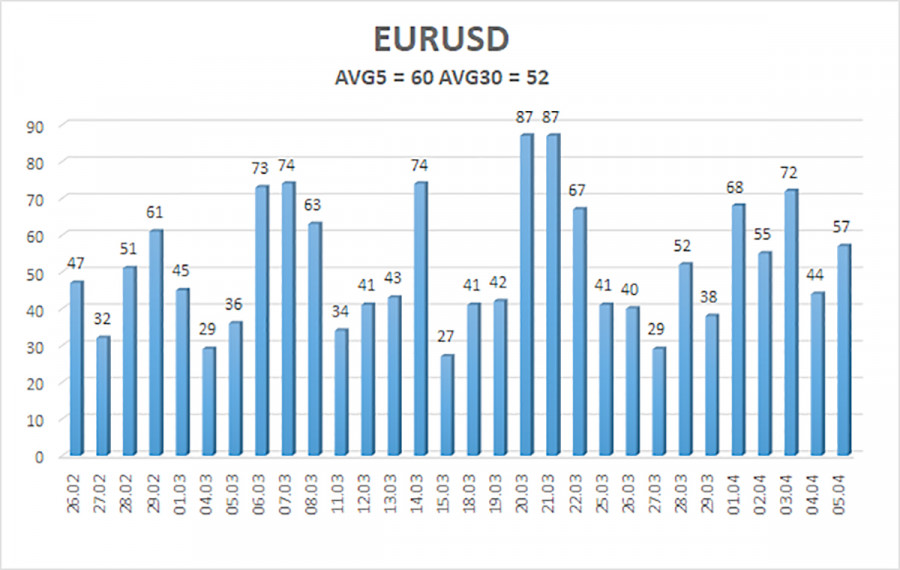

The average volatility of the EUR/USD currency pair over the last 5 trading days as of April 7th is 60 points and is characterized as "average." We expect the pair to move between the levels of 1.0777 and 1.0897 on Monday. The senior linear regression channel is sideways, but the overall downward trend is still intact. The CCI indicator has not entered extreme areas lately. The "wedge" pattern indicates the technical necessity of a new decline.

Nearest support levels:

S1 - 1.0803

S2 - 1.0773

S3 - 1.0742

Nearest resistance levels:

R1 - 1.0834

R2 - 1.0864

R3 - 1.0895

Trading recommendations:

The EUR/USD pair has settled above the moving average line. However, the movement is clearly corrective, so we believe that one should wait for new sell signals with targets at 1.0742 and 1.0712. We expect a decline to the 7th level and, in the longer term, to the level of 1.0200. After a fairly long rise in the pair (which we consider a correction), we see no reason to consider long positions. Even with the price above the moving average. Volatility is not the lowest at the moment, but it leaves something to be desired.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.