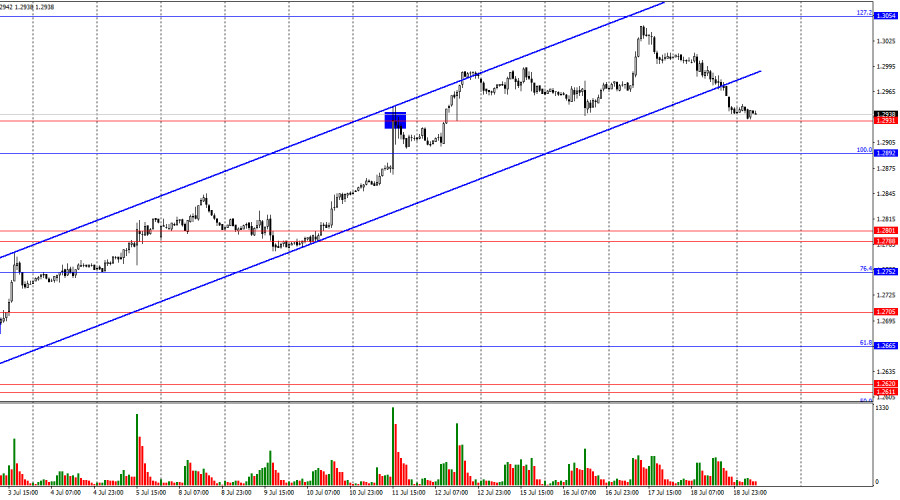

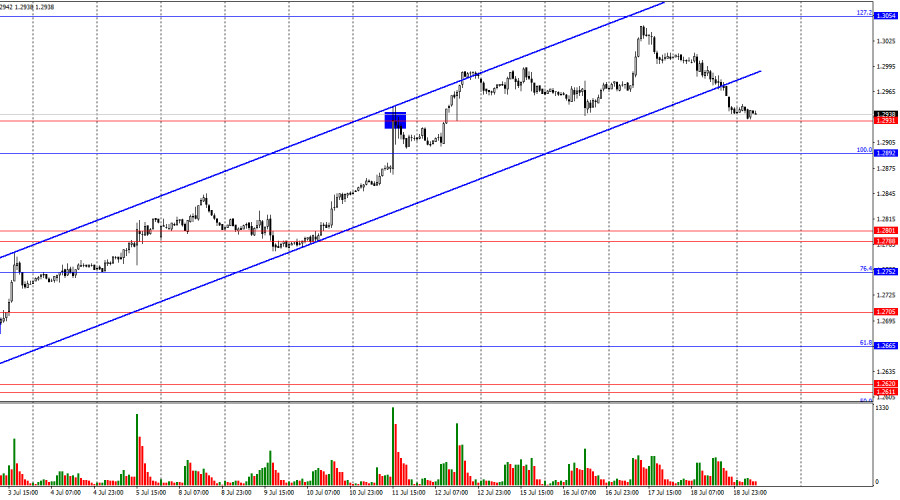

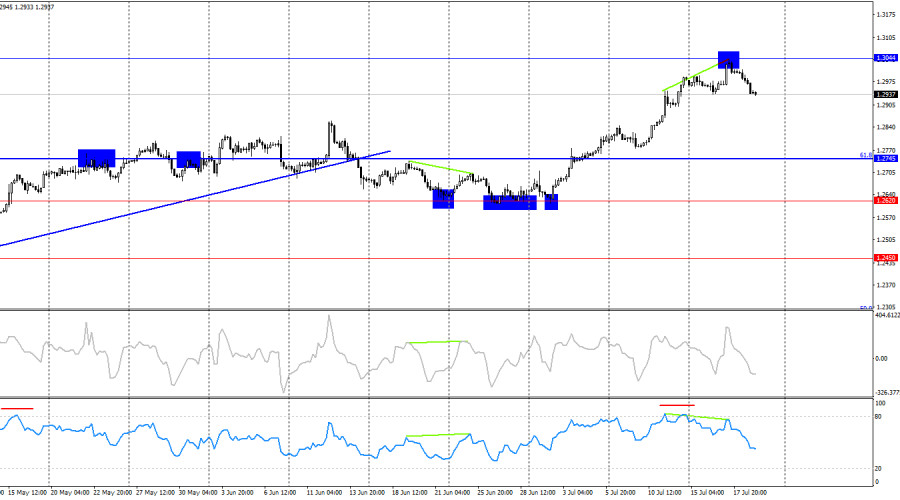

On the hourly chart, the GBP/USD pair declined on Thursday and consolidated below the upward trend channel. Thus, the decline in the pound's value may continue in the near future. A rebound from the level of 1.2931 or the Fibonacci level of 100.0% – 1.2892 will allow for new growth in the pound. However, this growth is unlikely to be strong. Consolidating below the levels of 1.2931 and 1.2892 will increase the likelihood of further decline towards the support zone of 1.2788 – 1.2801.

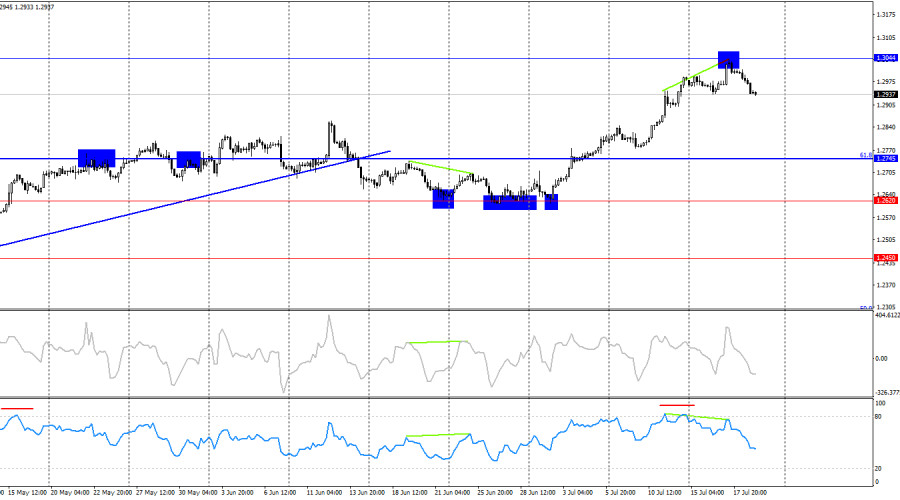

The wave situation changed last week. The last downward wave (which started forming on June 12th) managed to break the low of the previous downward wave, and the new upward wave (which is still forming now) managed to break the peak of the previous upward wave. Thus, we got the first sign of a trend reversal to "bullish" after a "bearish" trend that did not materialize. The pound's growth may continue, but now traders must form at least a corrective downward wave. A trend reversal to "bearish" is not being considered yet.

The information background on Thursday turned out to be completely neutral for the pound. The unemployment rate in May remained unchanged, the number of employed people increased by 19 thousand, which matched market expectations, and average wages rose by 5.7%, including bonuses, as forecasted. American data could have created new problems for the US currency, as the number of initial jobless claims was higher than forecasted. However, the Philadelphia Fed Business Activity Index in July was 13.9 points, much higher than traders' expectations. Thus, the dollar made the most of the information background. Bull traders could not continue their attacks on Thursday; their strength is also not unlimited. Now is a good time to form a corrective wave.

On the 4-hour chart, the pair rebounded from 1.3044, forming a "bearish" divergence on the RSI. Earlier, this indicator entered the overbought zone. Thus, several sell signals were received on the larger timeframe. These signals were the reason for the pair's decline yesterday. The decline may continue towards the corrective level of 61.8% at 1.2745, as the bears closed below the trend channel on the hourly chart.

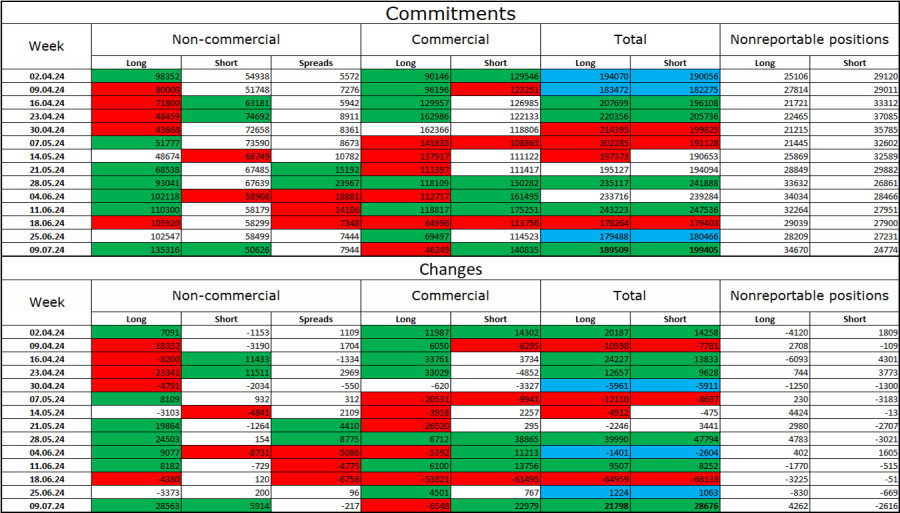

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders became even more "bullish" in the last reporting week. The number of long positions held by speculators increased by 28,563, while the number of short positions increased by 5,914. Bulls still hold a solid advantage. The gap between long and short positions is already 85 thousand: 135 thousand vs. 50 thousand.

The pound still has prospects for a decline, but the COT reports and technical analysis indicate otherwise. Over the past three months, the number of long positions has increased from 98 thousand to 135 thousand, while the number of short positions has decreased from 54 thousand to 50 thousand. Over time, major players will likely start reducing or increasing their positions, as all possible factors for buying the British pound have been exhausted. However, it should be remembered that this is just an assumption. Technical analysis still indicates the weakness of the bears, who could not even break the level of 1.2620.

News calendar for the USA and the UK:

- UK - Retail Sales Change (06:00 UTC).

The economic events calendar contains only one entry on Friday. The information background may have a very weak influence on market sentiment today.

Forecast for GBP/USD and advice to traders:

Selling the pound was possible on a rebound from 1.3044 on the 4-hour chart, targeting the lower boundary of the upward channel. Now, sales can be held until a rebound from a significant level. Considering purchases after several sell signals is not recommended today.

The Fibonacci grid levels are built on 1.2892–1.2298 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.