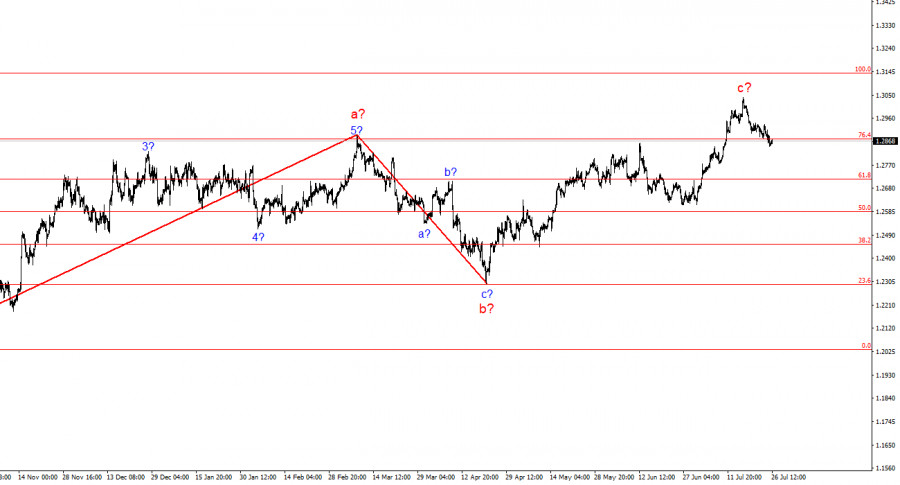

The wave pattern for GBP/USD remains quite complex and ambiguous. For a while, the wave structure looked convincing, suggesting the formation of a downward wave set with targets below the 1.2300 level. However, in practice, demand for the US currency increased too strongly to realize this scenario.

Currently, the wave pattern has become completely unreadable. I strive to use simple structures in my analysis, as complex ones have too many nuances and ambiguities. We are now seeing an upward wave that has overlapped a downward wave, which in turn overlapped the previous upward wave, which overlapped the previous downward wave. The only assumption is an expanding triangle with the upper boundary around the 1.3000 level and the support line around the 1.2600 level. Last week, the upper boundary of the triangle was reached, and the failed attempt to break it indicates the market's readiness to form a downward wave set.

The Pound Is Ready to Continue Falling

The GBP/USD exchange rate rose by 10 basis points on Friday, following a 50 basis point drop the previous day. This suggests that the market noted the strong growth of the American economy in the second quarter. It is puzzling why the EUR/USD pair barely reacted, but it is important to note that the euro and the pound have been trading very differently in recent months. Each of these currencies has its own path and economic backdrop.

In my opinion, the key point for the pound is the action on the upper line of the expanding triangle. If the Federal Reserve decides to lower the interest rate next week (which seems unlikely), and the Nonfarm Payrolls and unemployment reports are again worse than expected, demand for the US currency may fall, and the GBP/USD could return to the peaks reached on July 17. However, the US economy cannot continuously disappoint, and the GDP report this week should not leave even the most ardent skeptics indifferent. Based on this, I believe the GBP/USD will continue to fall, and negative news from the US (which will likely come from time to time) may be used by the market for pullbacks.

Today, the US released the PCE index, which is considered quite important. Its value was 2.6%, almost in line with market expectations. It accelerated by 0.1% year-on-year and by 0.2% month-on-month. Consequently, core and basic inflation may slightly slow their deceleration. Therefore, I do not believe that values will be reached by September that would allow the Fed to start easing monetary policy.

General Conclusions

The wave pattern for GBP/USD still suggests a decline. If a new upward trend segment started on April 22, it has already taken on a five-wave form. Consequently, at least a three-wave correction should now be expected. The failed attempt to break the upper boundary of the triangle indicates the market's readiness to form a downward wave set. In my opinion, in the near future, it is worth considering selling the GBP/USD with targets around 1.2820 and 1.2627, corresponding to 23.6% and 38.2% Fibonacci retracement levels.

At a larger wave scale, the wave pattern has transformed. We can now assume the formation of a complex and extended upward corrective structure. Currently, it's a three-wave pattern, but it could transform into a five-wave structure, potentially taking several more months to complete.

Basic Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are hard to trade and often change.

- If there is no confidence in the market's direction, it is better not to enter.

- There can never be 100% certainty in the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.