Analysis of Trades and Tips for Trading the British Pound

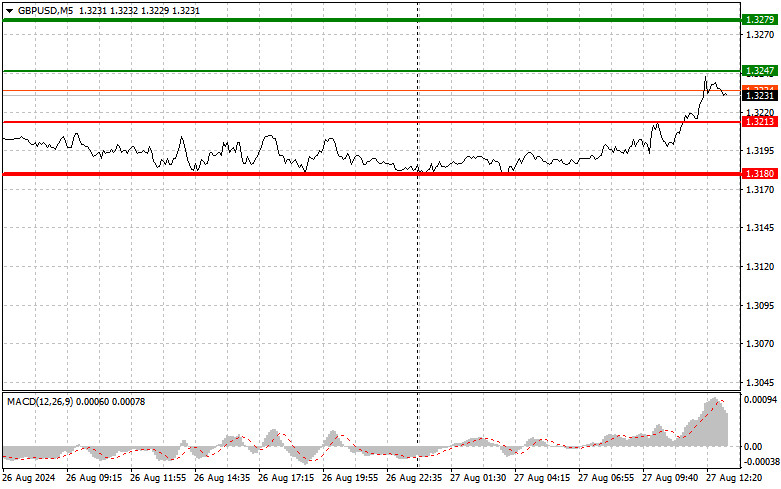

The test of the 1.3200 price level occurred when the MACD indicator had already moved significantly above the zero line. This limited the pair's upward potential. For this reason, I chose not to buy the pound. The second test of this price after a short interval made me consider selling the pound since the MACD had been in the overbought zone for quite some time. As a result, the pair corrected by only 10 points. It was only after the third test of 1.3200, when the MACD started moving upward from the zero line, that I confirmed the decision to buy the pound, which then rose to the target level of 1.3234. In the second half of the day, we expect the U.S. consumer confidence index, and weak figures will likely continue the upward trend, leading to another update of the monthly high. Don't forget about the Richmond Fed Manufacturing Index and the S&P/Case-Shiller home price index for the 20 largest U.S. cities. As for the intraday strategy, I plan to act based on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at the entry point around 1.3247 (the green line on the chart) with a target of rising to 1.3279 (the thicker green line on the chart). At 1.3279, I will close buy positions and open sell positions in the opposite direction, anticipating a movement of 30-35 points from this level. The pound is expected to continue its upward trend today. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3213 price level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. A rise toward the levels of 1.3247 and 1.3279 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after it drops below the 1.3213 level (the red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 1.3180 level, where I will exit sales and immediately buy the pound again, expecting a movement of 20-25 points in the opposite direction from this level. Sellers will emerge if there is a lack of active buying near the new weekly high. Important! Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3247 price level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward market reversal. A decline to the support levels of 1.3213 and 1.3180 can be expected.

What's on the chart:

- Thin green line: The entry price at which you can buy the GBP/USD pair.

- Thick green line: The presumed price at which you can set a Take Profit or manually take profits, as further growth above this level is unlikely.

- Thin red line: The entry price at which you can sell the GBP/USD pair.

- Thick red line: The presumed price at which you can set a Take Profit or manually take profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very cautious when making market entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sudden price fluctuations. If you decide to trade during news releases, it is advisable to use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation typically result in losses for intraday traders.