The GBP/USD pair experienced a slight decline again on Thursday. This drop can be considered formal, as the price remains close to its 2.5-year high. Can a 100-pip retracement be called a "correction" when the pound has risen by 600 pips in just the past few weeks? Thus, we would characterize the current movement of the British currency as "standing still." Even the euro managed to show some correction, but not the pound! We have been pointing out this since the beginning of the year. The pound sterling rarely falls; in fact, it falls much less often than the euro. Simply put, if the market is not inclined to sell the euro, it is even less inclined to sell the pound.

There could be many reasons, but we have discussed the main one numerous times. The market continues to wait for the start of the monetary easing cycle in the US. It is indifferent to the fact that the Bank of England began lowering rates earlier and can do it faster, as inflation in the UK allows for a quick rate cut. No, the market is expecting a 100-point rate cut in the US, even though inflation there is much closer to 3% than to 2%. Various experts continue to explain the relentless and unbridled rise of the British pound as a result of "increased risk appetite," "the Bank of England's reluctance to continue easing," "the new government in the UK," and "the recovery of the British economy." However, it is unclear how all these factors support the pound.

Increased risk or anti-risk sentiment can be used to explain any movement in principle. The BoE's reluctance to lower rates is a subjective opinion that has yet to be confirmed by BoE Governor Andrew Bailey or anyone else. And what difference does it make whether the BoE is ready if the pound continues to rise even after the first rate cut? The new UK government has already announced difficult economic times that require complex decisions and personal involvement from every citizen in the recovery process. Therefore, it is unlikely that the economic situation in Britain will improve under the Labour Party. As for the recovery of the British economy, it is laughable. Of course, if the economy grows by 0.1% per quarter, that is growth. But how can one compare the growth rates of the American and British economies and prefer the British one?

Separately, the pound has been in a downward trend for 16 years. And this trend has not been canceled, as seen in the weekly time frame. Therefore, the pair's upward movement in the last two years is still considered a correction. To expect a global reversal, the price would need to rise to the level of 1.4230 and firmly hold above it. Thus, the British currency would need to rise by another 1200-1500 pips for the global trend to reverse. We do not understand how the pound can show such growth. However, anything is possible if the market continues to buy the pound for any reason or without any reason. Although, there will again be no logic in such a movement.

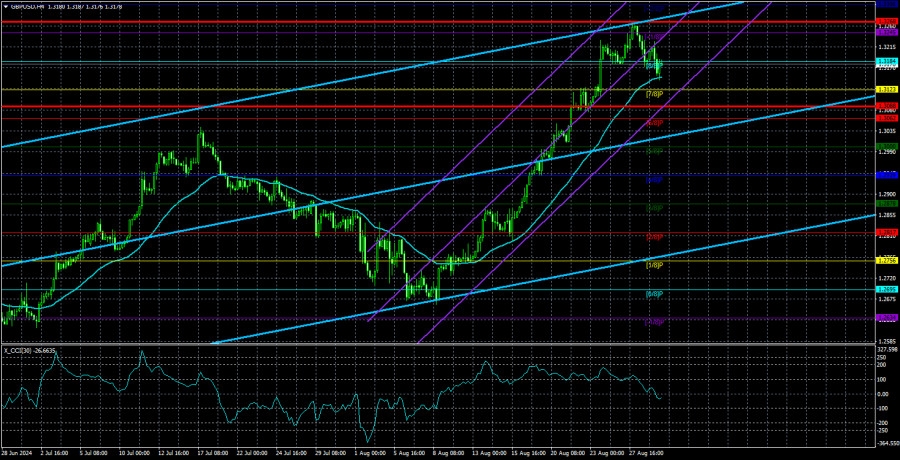

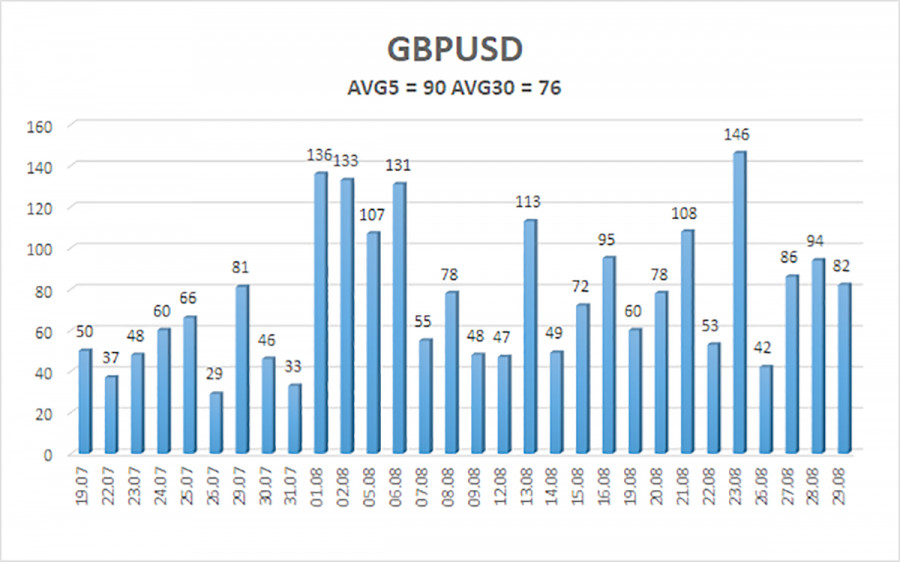

The average volatility of the GBP/USD pair over the past five trading days is 90 pips. For the GBP/USD pair, this value is considered average. On Friday, August 30, we expect movement within the range bounded by levels 1.3088 and 1.3268. The upper linear regression channel is directed upwards, signaling the continuation of the upward trend. The CCI indicator has formed a triple bearish divergence, implying a strong decline.

Nearest Support Levels:

- S1 – 1.3123

- S2 – 1.3062

- S3 – 1.3000

Nearest Resistance Levels:

- R1 – 1.3184

- R2 – 1.3245

- R3 – 1.3306

Trading Recommendations:

The GBP/USD pair continues its illogical rise but retains a good chance of resuming a downward momentum. We are not considering long positions at this time, as we believe that the market has already factored in all the bullish factors for the British currency (which are not much) several times. At present, the market continues to buy without any reason. Short positions could be considered, at the very least, after the price settles below the moving average, with targets at 1.2939 and 1.2878. The current movement of the pair has nothing to do with the concepts of "logic" and "consistency."

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong at the moment.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below -250) or the overbought area (above +250) means a trend reversal in the opposite direction is approaching.