Analysis of Monday's Trades:

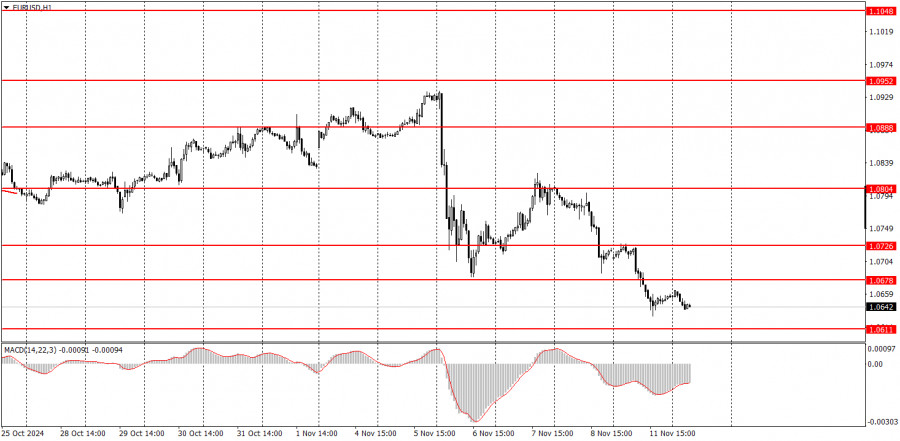

1H Chart of EUR/USD Pair

The EUR/USD currency pair continued to show significant declines on Monday. It's worth noting that the second wave of the euro's fall (or, instead, the U.S. dollar's rise) began last week as the elections unfolded. However, we do not believe the market is still processing Donald Trump's victory. Instead, the Republican's rise to power offers additional support to the U.S. dollar, but there are plenty of reasons for its strength even without the presidential elections.

Recall that the U.S. dollar's rally began after September 18, when the Federal Reserve officially started its monetary policy easing cycle. This scenario appears counterintuitive, but we've warned multiple times that the market had preemptively priced in the anticipated policy easing in the U.S. Once the process began, the dollar had no further reasons to decline. Hence, we believe that the U.S. dollar will continue to strengthen. The first day of the week has shown that the market is ready to buy the dollar even without local news or reports.

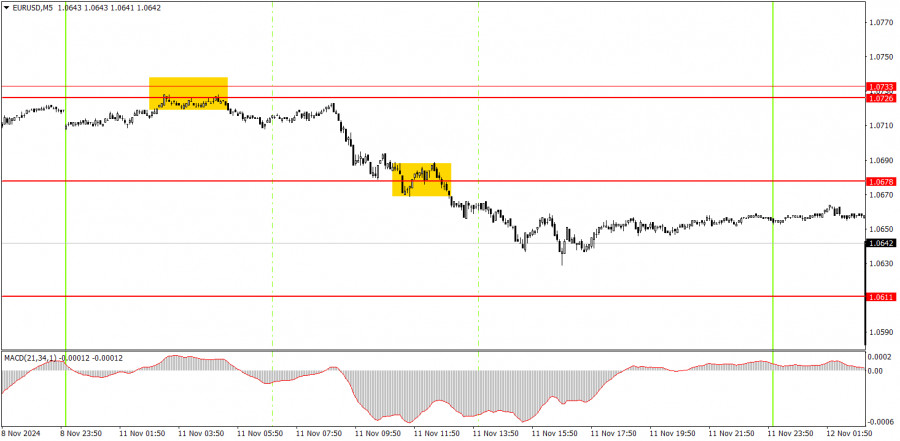

5M Chart of EUR/USD Pair

Two good sell signals formed in the 5-minute time frame on Monday. First, the price bounced off the 1.0726-1.0733 area, and later, it broke below the 1.0678 level. Consequently, novice traders could have opened short positions in the morning and closed them anywhere by the evening. The downward movement may continue into Tuesday. With high current volatility, trading has become easier than before.

How to Trade on Tuesday:

In the hourly time frame, the EUR/USD pair might attempt to correct again, but the market shows no inclination to do so. We believe that even if a correction occurs soon, it is unlikely to be significant, and consistent news supporting the euro would be required. Even then, such news may not always assist the euro, as the market is now focused on buying the dollar.

We expect the decline to persist on Tuesday since the price broke below the 1.0678 level on Monday. In any case, buying in such a strong downtrend is not the best decision.

On the 5-minute TF, we should consider the levels of 1.0568, 1.0611, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0951, 1.1011. On Tuesday, no significant events are planned in either the Eurozone or the U.S. Noteworthy releases include the ZEW Economic Sentiment Indexes for Germany and the EU and Germany's second estimate of its Consumer Price Index. However, these data points will unlikely reverse the trend or lead to a substantial euro recovery. The dollar continues to rise without their influence.

Basic Trading System Rules:

- The strength of a signal is determined by the time it takes to form (whether a bounce or breakthrough of a level). The quicker the formation, the stronger the signal.

- If two or more trades have been made near a level due to false signals, any further signals from that level should be ignored.

- In a flat market, a pair can generate many false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trading occurs between the start of the European and middle of the US sessions, after which all trades should be manually closed.

- On the hourly time frame, it's recommended to trade MACD indicator signals only when there is good volatility and a trendline or trend channel confirms a trend.

- If two levels are too close together (5 to 20 pips apart), they should be treated as support or resistance areas.

- After the price moves 15 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.