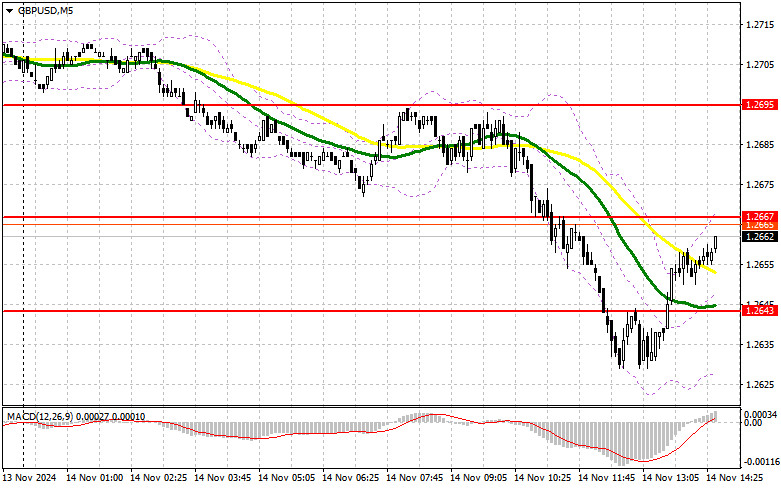

In my morning forecast, I focused on the 1.2667 level and planned trading decisions around it. Let us review the 5-minute chart to assess market activity. Although the pair dropped to 1.2667, a false breakout did not occur, leaving no suitable entry points. The technical outlook has now been updated for the second half of the day.

To Open Long Positions on GBP/USD:

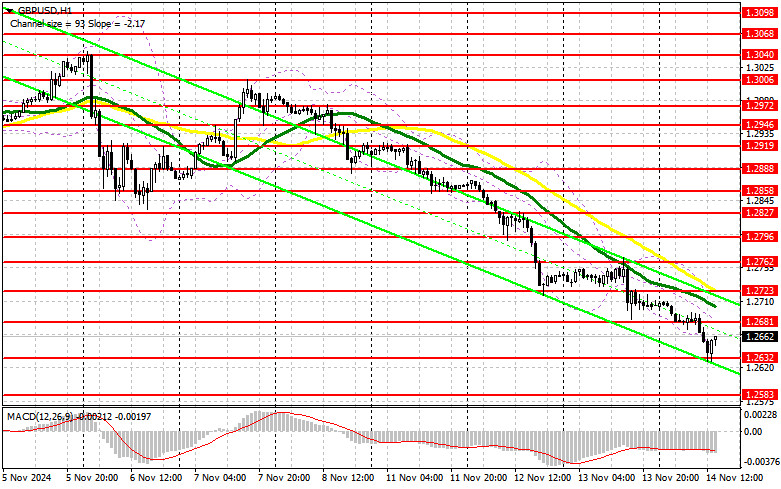

US economic data could trigger renewed selling pressure on the British pound, particularly if the statistics indicate a decline in initial jobless claims and an increase in producer prices for October. However, if the pound holds its ground despite strong data, a larger correction could materialize during the US session. A false breakout near the new support level at 1.2632 would confirm a valid entry point for long positions, targeting a recovery toward 1.2681. A breakout and subsequent retest of this range following the data release would establish a new entry point for long positions, aiming for 1.2723. The final target will be 1.2762, where I plan to take profits.

If GBP/USD continues to decline without any bullish activity around 1.2632, the bearish trend is expected to persist, potentially pushing the pair toward 1.2583. A false breakout at this level would be the only condition for opening long positions. I plan to initiate long positions on a rebound from 1.2550, targeting a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Given the pound's oversold condition, a lack of reaction to strong US data could trigger a significant upward correction. Therefore, I will avoid rushing into selling during the second half of the day. If the pair rises, a false breakout at the 1.2681 resistance level would provide a suitable entry point for short positions, targeting a decline toward the 1.2632 support level, which represents the new monthly low. A breakout and retest of this range from below would further weaken bullish positions, potentially driving the pair to 1.2583. The final target will be 1.2550, where I plan to take profits. This level is likely to come into play only if US inflation data shows substantial growth.

If GBP/USD rises and buyers maintain activity above 1.2681, they may attempt a broader correction. In this scenario, bears could retreat to the 1.2723 resistance level, where the moving averages favor sellers. I plan to sell at this level only after a failed consolidation. If no downward movement occurs from this point, I will look for short positions on a rebound near 1.2762, targeting a 30–35 point intraday correction.

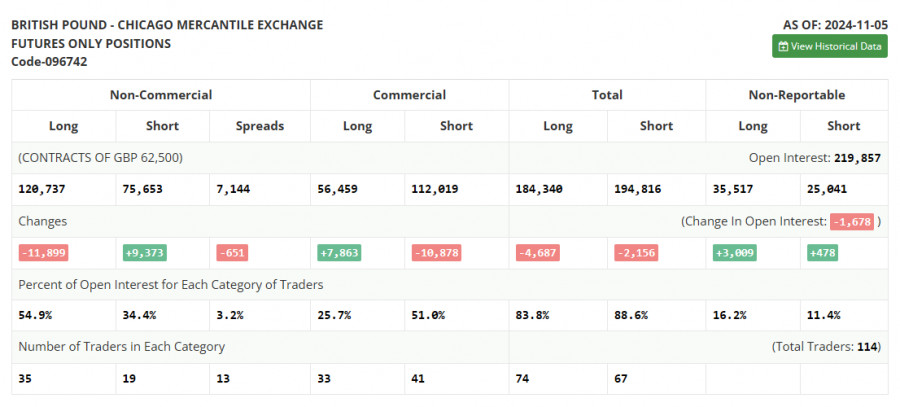

The Commitments of Traders (COT) report for November 5 highlighted a decrease in long positions and an increase in short positions. Despite significant market developments, the figures do not reflect Donald Trump's victory in the US presidential election or the Bank of England's recent rate cut during the November meeting. Therefore, the report's relevance is limited. With strong pressure on risk assets, a short-term recovery for the British pound remains unlikely.

- Long non-commercial positions decreased by 11,899, totaling 120,737.

- Short non-commercial positions increased by 9,373, reaching 75,653.

- This widened the net position gap by 1,079, reflecting growing bearish sentiment.

Indicator Signals:

- Moving Averages: Trading remains below the 30-day and 50-day moving averages, signaling continued downward pressure on the pound.

- Bollinger Bands: The lower boundary near 1.2630 will serve as support during further declines.

Indicator Descriptions:

- Moving Average (MA): A trend-following indicator that smooths price fluctuations and market noise. (Periods: 50, marked in yellow; 30, marked in green.)

- MACD (Moving Average Convergence/Divergence): Measures momentum based on the convergence and divergence of moving averages. (Fast EMA: 12; Slow EMA: 26; Signal Line: 9.)

- Bollinger Bands: A volatility indicator that identifies potential support and resistance levels based on standard deviations from a moving average. (Period: 20.)

- Non-commercial traders: Speculators, including individual traders, hedge funds, and institutions, using futures markets for speculative purposes.

- Long non-commercial positions: The total long positions held by non-commercial traders.

- Short non-commercial positions: The total short positions held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.