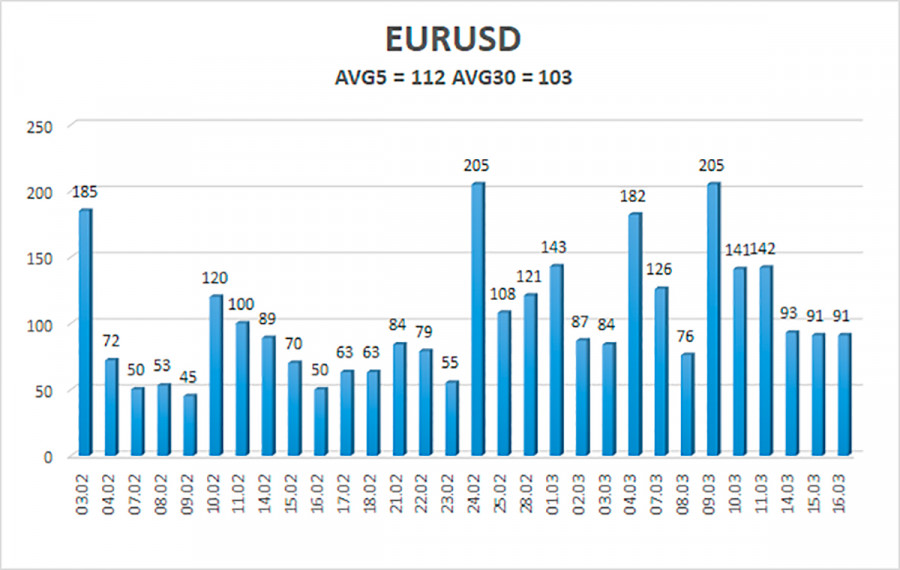

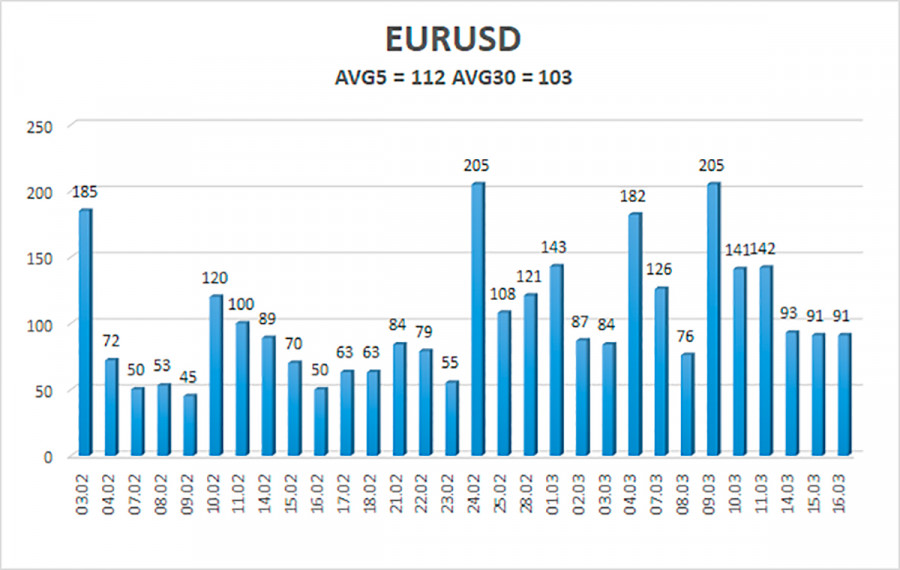

The EUR/USD currency pair has been behaving very calmly for most of the past day. Recall that in the last few weeks, the volatility of the pair has increased significantly, which is seen in the illustration below. Naturally, this is due to Russia's military operation in Ukraine. Therefore, now the average volatility for the euro is 90 points per day. A few weeks ago, this value was considered high. However, in recent days, the activity of traders has decreased slightly. It's hard to say exactly why this happened. The fighting in Ukraine continues without interruptions and a truce. We have already said that the military confrontation has moved into the stage of "Donbas 2.0", which may drag on for many years. Nevertheless, in any case, this is a military action, which means victims on both sides. Moreover, both sides of the conflict are suffering enormous losses. Infrastructure is being destroyed in Ukraine, the economy has collapsed, the country is in a state of war. In Russia, the economy may experience a default in the coming days. Moreover, it will be a default not like in 1998, but much more powerful, on foreign debt. Simply put, Moscow will not be able to pay its obligations to international partners.

What is most interesting, it will not be able to do this because of the sanctions of the partners themselves, since at this time it is simply impossible to make currency transfers abroad. It is very difficult to say now what the consequences of default will be. However, it seems that Moscow was ready for such a scenario. One way or another, we continue to believe that the worst is yet to come. With what for the whole world. According to many experts, sanctions against the Russian Federation will begin to bear fruit no earlier than a month after their introduction. That is, so far, neither those against whom sanctions have been imposed nor those who have imposed sanctions, have yet felt their consequences. Because there are no consequences themselves yet. However, Russia is rushing at full speed to the state system of "DPRK 2.0" and again, it does not seem to be very afraid of it. The foreign exchange market has calmed down a bit, and now the main thing is that the conflict in Ukraine does not escalate again, and the negotiations between Kyiv and Moscow indicate that the two sides are approaching a consensus.

Almost everything now depends on the negotiations and their outcome.

We traditionally do not consider the results of the Fed meeting immediately after their publication. We believe that after they become known, you need to wait at least a day to clearly understand how the market reacted to them. The fact is that the results are published late in the evening when the European markets are already closed and their traders and investors cannot work out information from the Fed. The same applies to Asian markets, which are still closed at the time of the announcement of the results. Therefore, in general, the market can react to the Fed meeting within a day. We prefer to first fully study the reaction of traders, and only after that draw conclusions. The information that the Fed provides is not always logically worked out.

So for now, we advise you to focus your attention on more important topics. Yes, there are now. According to statements by both sides of the military conflict in Ukraine, negotiations have finally begun to move forward. Kyiv stated that it requires security guarantees, with real security, and not as it is now. According to the Ukrainian government, an agreement should be signed that in the event of aggression against Ukraine, the countries participating in the deal will have to provide military, financial and humanitarian assistance without fail. Kyiv also wants one of the nuclear powers to act as a guarantor of security. Moscow, as before, wants guarantees that NATO bases will not be located in Ukraine, and it seems that Kyiv agrees to this option. However, we would still not be overjoyed yet. For there is nothing to rejoice about. Kyiv also very rightly wants the restoration of the territorial integrity of Ukraine and the return of Crimea, which Moscow is unlikely to do. Thus, these negotiations may drag on for many months.

The volatility of the euro/dollar currency pair as of March 17 is 112 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0916 and 1.1141. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair has consolidated above the moving average line. Thus, now it is necessary to stay in long positions with targets of 1.1108 and 1.1141 until the Heiken Ashi indicator turns down. Short positions should be opened no earlier than the price-fixing below the moving average line with targets of 1.0864 and 1.0742.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.