The EUR/USD currency pair also traded lower on Monday, not far from its 15-month lows. The pair has again fallen to the important psychological level of 1.3000 and will again try to overcome it. We believe that a breakthrough at this level is just a matter of time. Consequently, the British pound will continue its decline. Question: until when? If a couple of months ago it was possible to assume that the fall would soon end, and there the upward trend of 2020 could even be restored, then with the beginning of the military conflict in Ukraine it became clear that you can forget about it. Now the British pound is falling, although the Bank of England has already raised the key rate three times, and the UK itself is much further from a military conflict than many EU countries. Moreover, the UK is much less dependent on Russian oil and gas and food from Ukraine, and its "anti-Russian" rhetoric is very strong.

However, all this does not add optimism to the bulls of the pound/dollar pair. Anyway, Britain is in Europe, and who knows how this whole conflict in Ukraine will end? Who can guarantee that it will not be the beginning of the Third World War? Of course, there have been many warriors in the world over the past few decades, as in the entire history of mankind, but let us recall that the Second World War also began with only two countries. Now, half the world is behind Ukraine. America, EU countries, and even Australia are sending humanitarian aid, weapons, and financial assistance to Ukraine. By and large, this resistance of Ukrainians is carried out at the expense of the finances of the West. Ukrainians are fighting for their territory, with their own hands, but with the weapons of the West. The European Union believes that if Ukraine falls, Russia will move further to Western Europe, so it is easier for him to give Ukraine everything she asks for, just to avoid a military clash with Russia. But one way or another, the military conflict has already begun and it is taking place in Europe. If you were an investor, where would you invest: in the European economy or the American one?

The United States will receive huge profits from the military conflict in Europe.

In principle, absolutely every adult understands that the States benefited the most from the Second World War, which first supplied a huge amount of weapons to Europe (naturally, not for free), and then restored Europe according to the Marshall Plan. The UK has already abandoned gas and oil from Russia, and European countries will also arrive in the next year or two. Accordingly, Russian oil and gas will need to be replaced with something. Washington has already announced that it is ready to supply LNG to Europe. And who benefits from the military conflict and sanctions? The United States has supplied aid to Ukraine for several billion dollars and will sell gas to Europe for tens of billions or even hundreds.

Next, oil. There is enough oil in the States to also supply it to the European Union. If you remember, a few years ago, shale oil was actively discussed, which is more expensive to produce than conventional oil from Russia or Saudi Arabia. But now, if Europe refuses oil from Russia, there will be a shortage, and then it will not matter whether it is shale oil or not, and how much it costs. Again, the United States will benefit from oil sales to Europe. And after these banal logical chains, what conclusion can be drawn? The US dollar will continue to grow as long as the military conflict in Europe persists. If it worsens, it will mean that the European and British economies may suffer even more, but the American economy is not in any danger. Naturally, it is in the States that there will be an influx of capital, and a much larger number of traders will invest in the dollar than in the euro or pound. These are the prospects for European currencies in the coming months.

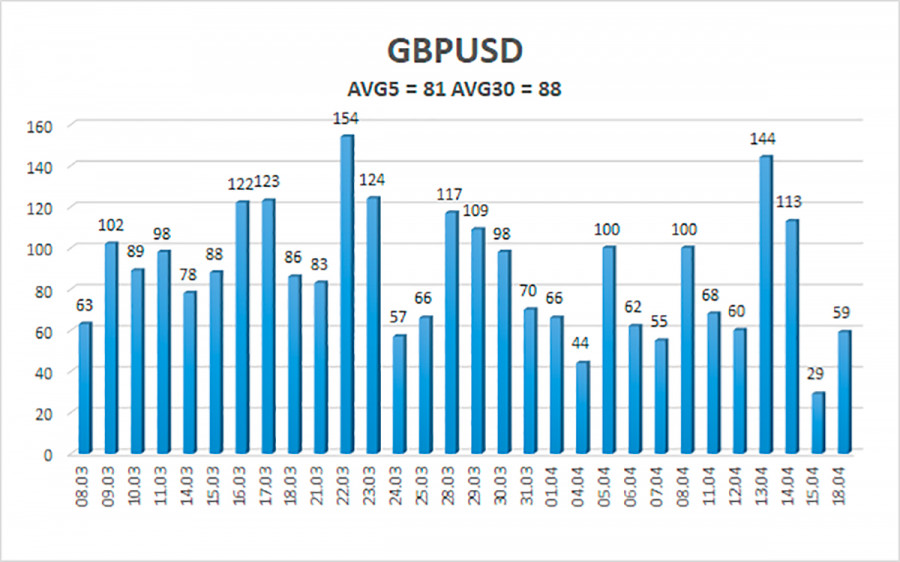

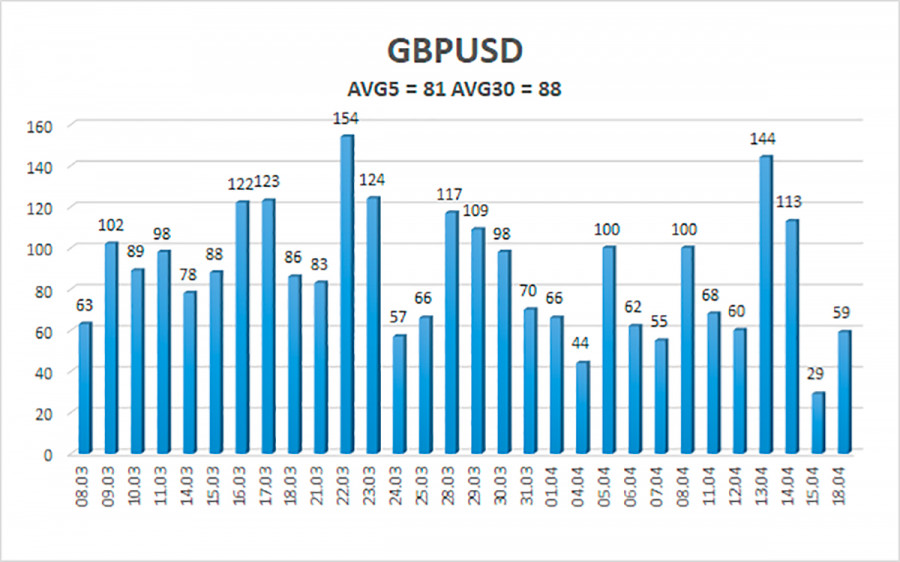

The average volatility of the GBP/USD pair over the last 5 trading days is 81 points. For the pound/dollar pair, this value is "average". On Tuesday, April 19, thus, we expect movement inside the channel, limited by the levels of 1.2943 and 1.3104. A reversal of the Heiken Ashi indicator to the top will signal a new round of downward movement.

Nearest support levels:

S1 – 1.3000

S2 – 1.2970

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3031

R2 – 1.3062

R3 – 1.3092

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe will again test the Murray level of "2/8" - 1.3000. Thus, at this time, you should stay in sell orders with targets of 1.2970 and 1.2939 until the Heiken Ashi turns upwards, but remember that there may be another rebound from the 1.3000 level. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.3092 and 1.3123.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.