The GBP/USD currency pair on Monday could not continue the corrective movement and failed even to work out the moving. Thus, the last correction can end very quickly, and the pound sterling can resume falling. In principle, the fundamental, geopolitical, and macroeconomic backgrounds have not changed at all recently, so there is no special reason to expect strong growth of the British currency. It should also be remembered about the COT reports, which indicate powerful weekly sales of the pound. However, at the same time, it is worth recognizing that the pound cannot fall forever, and all the factors that pushed it down in recent weeks and months could have been worked out several times already. Unfortunately, it is impossible to predict at what price point most market participants will say "That's enough!". Therefore, the only thing left now is to sell (since the downtrend persists) and keep in mind the possible completion of a strong downward trend.

On Monday, as expected, nothing interesting happened and was not planned either in the UK, the US, Ukraine, or Russia. In principle, London has already imposed all possible sanctions against Russia, so there is simply nothing more to threaten. This week, Joe Biden is to sign a lend-lease law for Ukraine in the United States, and the sixth package of sanctions against Russia, which may contain an oil embargo, is to be adopted in the European Union. There will also be several important macroeconomic reports and a BA meeting this week. However, all these events will only happen, so at the moment there is nothing to analyze by and large.

The meeting of the Bank of England may be a boost for the pound.

In principle, there is not much to say about the meeting of the Bank of England now. The market has little doubt that the British regulator will raise the key rate by 0.25%, but at the same time very much doubts that this increase will not be the last this year. There has been more and more talk lately about the state of the British economy, which will not allow BA to raise the rate further. In principle, all three Central banks of interest to us are now in a similar situation. Monetary policy needs to be tightened to at least stop the growth of inflation, but at the same time, any tightening will lead to a reduction in GDP growth, which is not necessary for any country. Therefore, in the coming months or years, all three central banks will balance between the desire to reduce inflation and the unwillingness to "cool" the economy. Therefore, the market is likely to face more "surprises" from regulators.

As for the prospects of the pound, of course, it may feel the support of the market if the Bank of England raises the rate again. However, will this growth be the beginning of a new upward trend? Recall that BA has already raised the rate three times, which, as we can see, did not help the British pound in any way. Therefore, we do not believe that the new tightening will help the pair to start at least a long correction. But at the same time, the BA meeting may be the impetus for this very correction, because the pound has been falling for quite a long time and has lost a lot. That is, sooner or later, traders should start at least simply fixing profits on short positions, which should lead to an upward correction. Therefore, the grounds for growth are exclusively "corrective", so to speak.

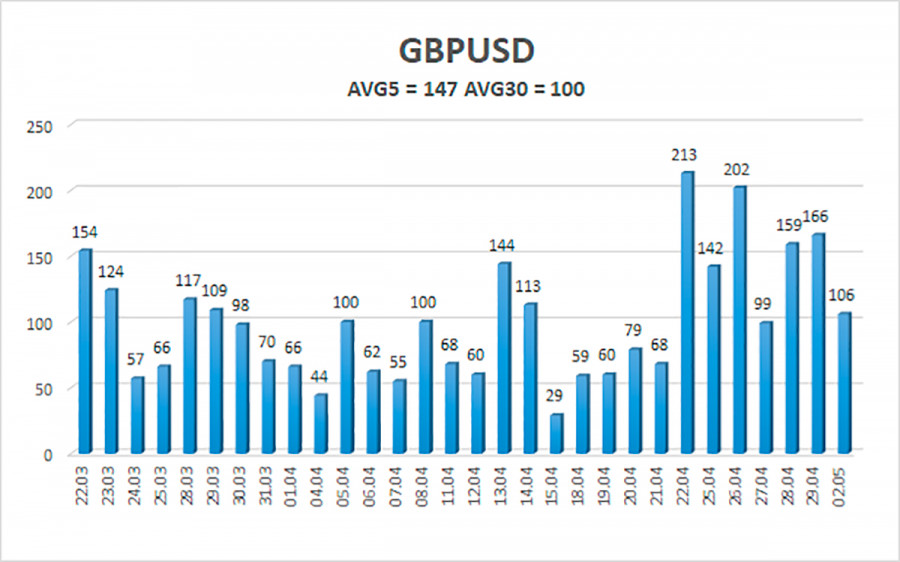

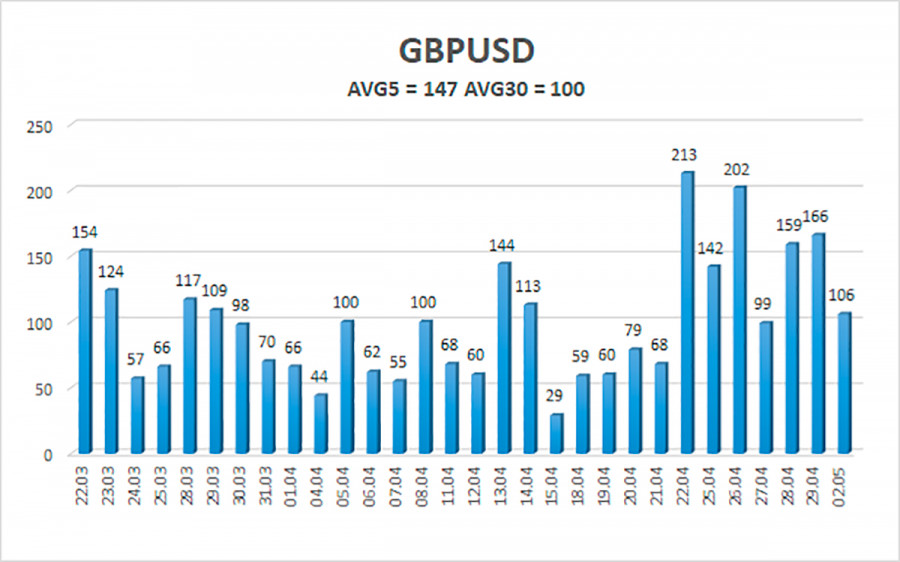

The average volatility of the GBP/USD pair over the last 5 trading days is 147 points. For the pound/dollar pair, this value is "high". On Tuesday, May 3, thus, we expect movement inside the channel, limited by the levels of 1.2349 and 1.2643. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.2451

S2 – 1.2329

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2695

R3 – 1.2817

Trading recommendations:

The GBP/USD pair resumed its downward movement in the 4-hour timeframe. Thus, at this time, you should stay in new sell orders with targets of 1.2451 and 1.2349 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2695.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.