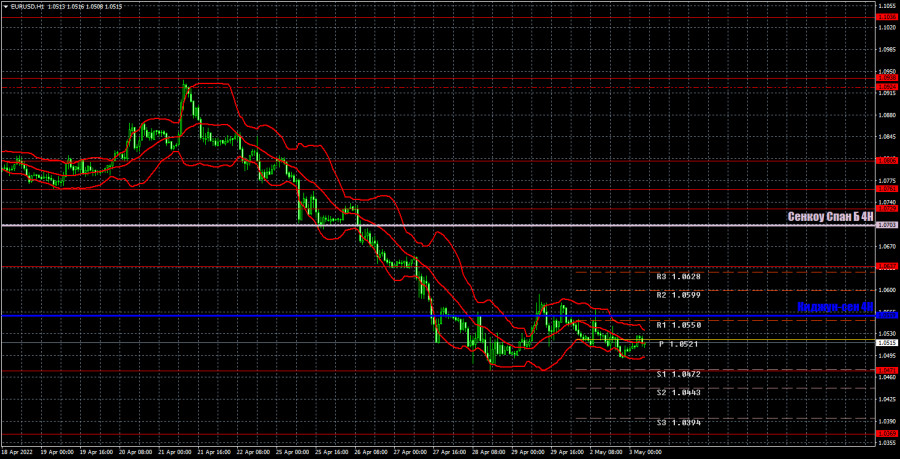

EUR/USD 5M

The EUR/USD pair traded more sideways than a trend on Monday. The US and the EU were set to publish only business activity indices in the manufacturing sector. Not the most important data in the current circumstances. Therefore, traders did not react to them. Nevertheless, traders were quite actively trading the pair, as evidenced by the volatility of almost 80 points. Thus, we believe that the flat is more an accident than a pattern on Monday. Recall that the euro continues to trade very low, and literally any day can renew its local lows. Most of the factors that brought the pair so low remain, so there are no special and concrete grounds for expecting a strong euro growth now. We can only assume that the euro has fallen already enough to stop this process. Nevertheless, even the "techniques" does not yet give grounds to assume an upward correction.

As for trading signals, only one was formed on Monday. However, due to the fact that it was formed at the highest point of the day, it was strong and profitable. The price rebounded from the critical Kijun-sen line at the beginning of the European session, after which it went down in total by about 50 points. Since the nearest target level 1.0471 was not reached, the deal should have been closed manually in the late afternoon. It was absolutely free to earn 30-40 points on it.

COT report:

The latest Commitment of Traders (COT) reports on the euro raised more questions than they answered! Major players, starting from January 2022, maintain a bullish mood, and the euro currency, starting from January 2022, maintains a downward trend. During this time, it has already fallen in price by almost 10 cents, however, all this time the mood remained bullish. During the reporting week, the number of long positions increased by 2,000, while the number of shorts in the non-commercial group increased by 11,000. Thus, the net position decreased by 9,000 contracts. This means that the bullish sentiment has eased, but it is still bullish, as the number of long positions now exceeds the number of short positions held by non-commercial traders by 22,000. Accordingly, the paradox remains and it lies in the fact that professional players generally buy more euros than they sell, while the euro continues to fall almost non-stop, which is clearly seen in the chart above. We explained earlier that this effect is achieved by higher demand for the US dollar (there are simply no other options). The demand for the dollar is higher than the demand for the euro, so the dollar is growing in tandem with the euro. Therefore, the data of COT reports on the euro now does not make it possible to predict the further movement of the pair. The longer the phase of active hostilities in Ukraine lasts, the higher the likelihood of serious consequences of the food and energy crises for the European Union, and the dollar may continue to grow due to its status as a "reserve" currency and the stability of the American economy.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 3. The European Union is almost ripe for the introduction of an oil embargo.

Overview of the GBP/USD pair. May 3. Boring Monday, another fall of the pound, waiting for the Bank of England meeting.

Forecast and trading signals for GBP/USD on May 3. Detailed analysis of the movement of the pair and trading transactions.

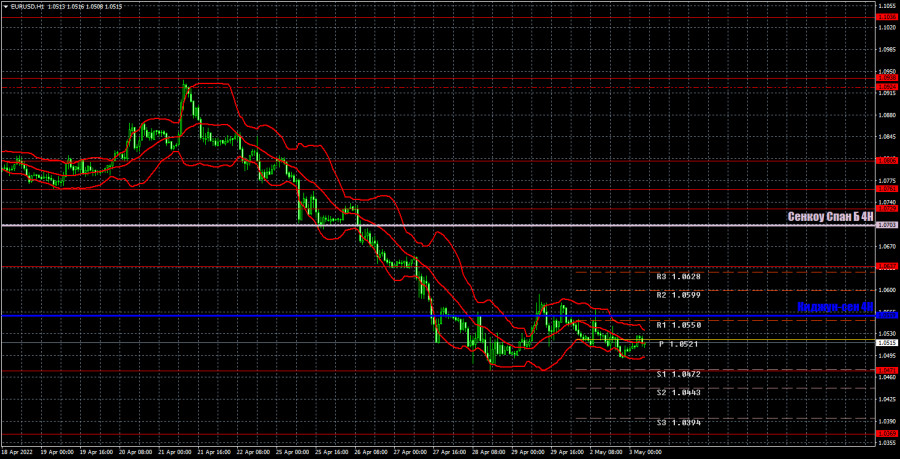

EUR/USD 1H

It is clearly seen that the pair maintains a downward trend and is in close proximity to its local lows on the hourly timeframe, which are also five-year lows. Even if there is no new negative for the euro, traders still continue to sell this currency. The fact that the price could not even continue Friday's pullback speaks volumes. On Tuesday, we allocate the following levels for trading - 1.0340-1.0369, 1.0471, 1.0637, 1.0729, as well as Senkou Span B (1.0703) and Kijun-sen (1.0559). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. European Central Bank President Christine Lagarde is scheduled to speak in the European Union on May 3, as well as a report on unemployment. The report is unlikely to be of interest to anyone, but Lagarde's speech after the events of a week ago, when the opinions of Lagarde and de Guindos on the rate diverged, may be interesting. The market can wait for hawkish rhetoric from the European Central Bank to finally get a reason to buy the European currency.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.