The EUR/USD currency pair on Monday once again failed to overcome the Murray level of "2/8"-1.0498. Another rebound and another attempt at growth. However, over the past six trading days, the pair has not managed to overcome even the nearest Murray level of "3/8"-1.0620. Thus, so far we are talking about maximum growth to this level, where the bulls will again try to seize the initiative in the market. To be honest, it's pretty hard to say how real this is right now. We have already said that even if we take into account all the negative factors for the euro, they have already been worked out by the market twice. The euro currency, whatever it was, has already fallen quite low. And given the fact that the pair can't even really adjust in any way (which is especially clearly seen on the 24-hour TF), there are big doubts that the pair will continue to fall at the pace of recent months. Even if all factors were playing against the euro now, the currency cannot constantly move in only one direction.

The US dollar is growing by leaps and bounds, not paying any attention to talk about a possible recession of the American economy or about a giant external debt and that it ceases to be the world's reserve currency. The Fed has been printing dollars faster than the stationery industry has been printing printer paper for the past two years, so what? The US currency has already risen to almost 20-year highs against the European currency. Yes, things are not going well in the EU right now. The Alliance is on the verge of an energy and food crisis, as we have repeatedly written about. But we should not put an end to the European economy ahead of time. No matter how weak the GDP figures are, no matter how high the risks for the European economy are, no matter how dangerous the situation with the military conflict in Ukraine is, so far there are no crises, and military actions are taking place exclusively in the East of Ukraine. Moreover, in recent weeks, there has been a sharp decrease in the talk about atomic war, Russian strikes against other European states, and, in general, the escalation of the conflict beyond the current combat zone.

Hungary is trying to sit on two chairs at once.

As we have already said in previous articles, Hungary can block the sixth package of EU sanctions against Russia, which implies the introduction of an oil embargo. And the Hungarian ambassador at a meeting with other EU ambassadors on Sunday refused to support this initiative. However, not everything is as clear as it could be. If someone thought that there would be no embargo now, then this is not the case. First, no one has canceled the political pressure on Hungary. As we have already said, Hungary is not an advanced country in the EU, without which the bloc itself cannot exist. And given its openly "pro-Russian" rhetoric against the background of pan-European "pro-Ukrainian" sentiments, various sanctions against Hungary itself are not excluded if it continues to persist. Second, Prime Minister Viktor Orban said that his country would need a delay the embargo for 4-5 years, instead of the 20 months proposed by the European Union. That is, theoretically, if such a postponement is granted, the issue will be resolved very quickly.

It should also be noted that the European Union is not going to abandon Russian oil and gas momentarily and simultaneously. It is assumed that purchases of crude oil should stop within six months, and petroleum products - by the end of 2023. There is no question of abandoning gas now. Thus, the European Commission is trying to mitigate as much as possible the possible consequences for the European economy from the rejection of energy carriers from the Russian Federation. This is about the imminent energy crisis in the EU. It is quite possible that it will not be, prices will just rise and that's it. Who is surprised by rising prices now, if they are growing for everything and almost everywhere in the world? Therefore, from our point of view, the euro currency, if it has not yet reached the "bottom" point, will do so in the near future. Without a tangible correction, it will be very difficult for the euro to fall further.

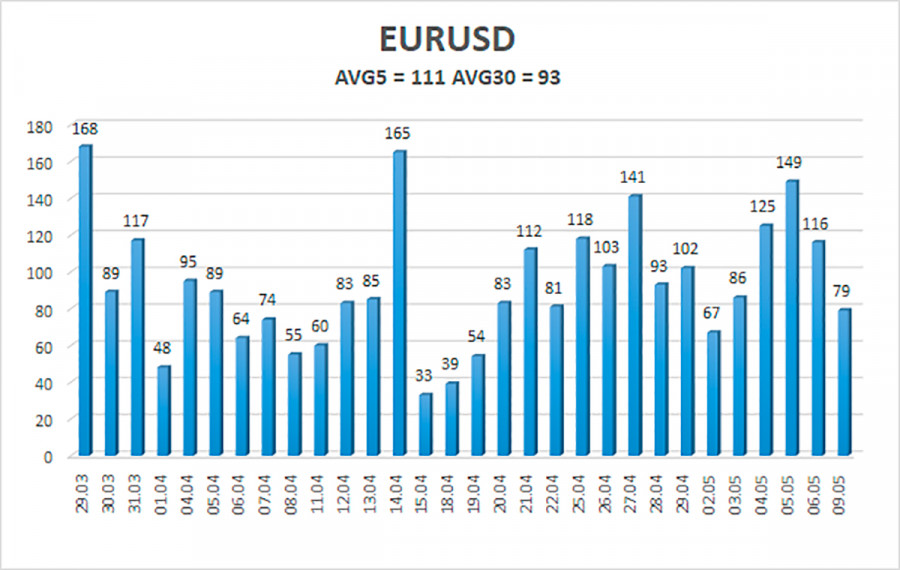

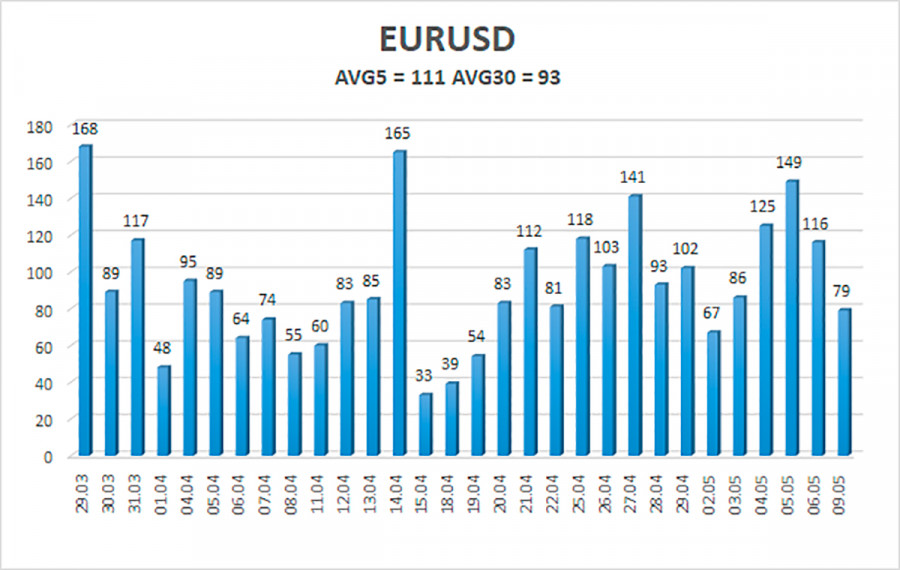

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 10 is 111 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0452 and 1.0674. The reversal of the Heiken Ashi indicator downwards signals a new attempt to continue the downward trend.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair is trying to maintain a downward trend. Thus, new short positions with targets of 1.0442 and 1.0376 should now be considered if the level of 1.0498 is overcome. Long positions should be opened with a target of 1.0742 if the price is fixed above the level of 1.0620.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.