The EUR/USD currency pair failed to overcome the Murray level of "4/8"-1.0742 on Wednesday and began to adjust. Recall that in the last two weeks the pair have been desperately trying to grow and it succeeded. For the first time in a very long time. Nevertheless, despite the growth of about 400 points, we cannot yet conclude that the global downward trend is over. The senior linear regression channel is still directed downwards and it will take much longer than two weeks for it to be able to turn up already. We have also repeatedly said that the fundamental and geopolitical backgrounds have not changed much recently. That is, if the euro has been falling for months because of the ECB's "ultra-deep" attitude and the Fed's "hawkish plans", then what has changed now? The Fed is also going to raise the rate at least in the next two meetings.

Recall also that Christine Lagarde at the beginning of the year spoke several times about the weakness of the European economy, comparing it even with a disabled person standing on two crutches. And what has changed now? Did the European economy grow strongly in the first and second quarters? No. Most likely, the ECB began to be seriously criticized due to high inflation. If the Fed and the Bank of England raise rates, then the refusal to tighten the monetary policy of the ECB is perceived as weakness and unwillingness to solve important problems. It is clear to everyone that inflation needs to be fought, perhaps even by reducing economic growth. And the initial approach of Lagarde, who expected, along with Jerome Powell, that inflation would begin to slow down by itself, led to the fact that it was already approaching 10%. If Powell at least changed his mind, Lagarde stood her ground to the last.

How Viktor Orban is antagonizing the European Union.

The head of the ECB has already spoken twice this week. For the first time, she said that by the end of the third quarter, rates could be raised to positive values, although in reality they could be raised to 0%. But 0% is formally positive, so everything is fine. During the second speech, she touched upon the topic of the geopolitical conflict between Ukraine and the Russian Federation. At the International Economic Forum in Davos, Lagarde said that the European Union does not realize and underestimates its strength and power. After all, the EU is an alliance of 27 states with a powerful economy and serious opportunities. Also, in her opinion, many resources that are necessary for production and the economy come from unfriendly and aggressive-minded countries and this is a great vulnerability for the European Union. According to Lagarde, a list of such resources should be compiled, and they should be replaced with similar ones from friendly countries or their analogs. Naturally, we are talking about Russian oil and gas, because all the EU rhetoric has recently been directed exclusively against the Russian Federation. The Alliance continues to discuss the sixth package of sanctions, which Hungary is still blocking, trying to bargain for as many economic preferences as possible in exchange for the approval of the oil embargo. However, yesterday, it became known that Germany could single-handedly impose an embargo on "black gold" from Russia by the end of the year, without even waiting for the rest of the EU countries. And the Hungarian veto on oil will have no meaning for the Germans. Other EU countries may follow this example. After all, nothing prevents 26 countries from abandoning the "black gold" from Russia and letting Hungary continue to buy it if it is unprofitable for her to refuse. In any case, an embargo from 26 EU countries is almost the same as an embargo from the entire European Union. Thus, Viktor Orban may not receive any preferences for his country and also get on the "black list" for European politicians.

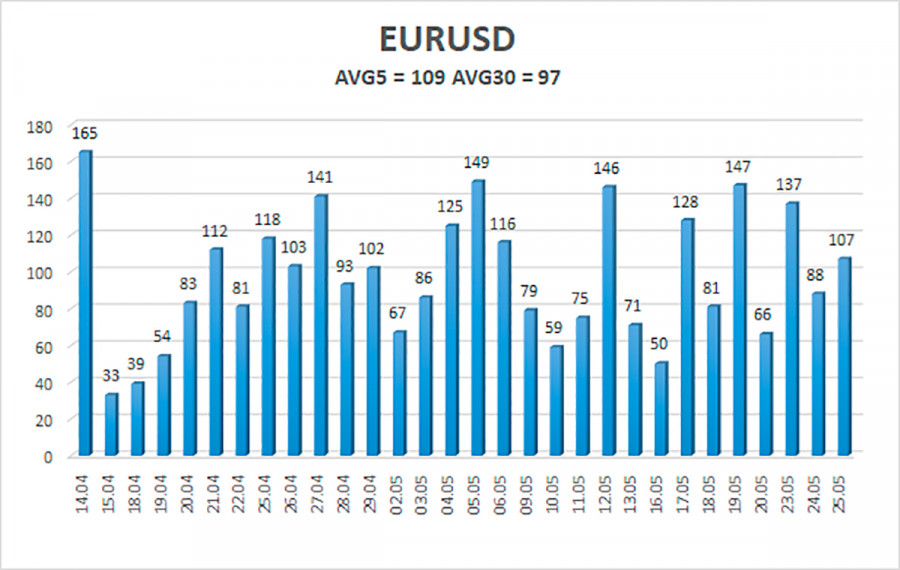

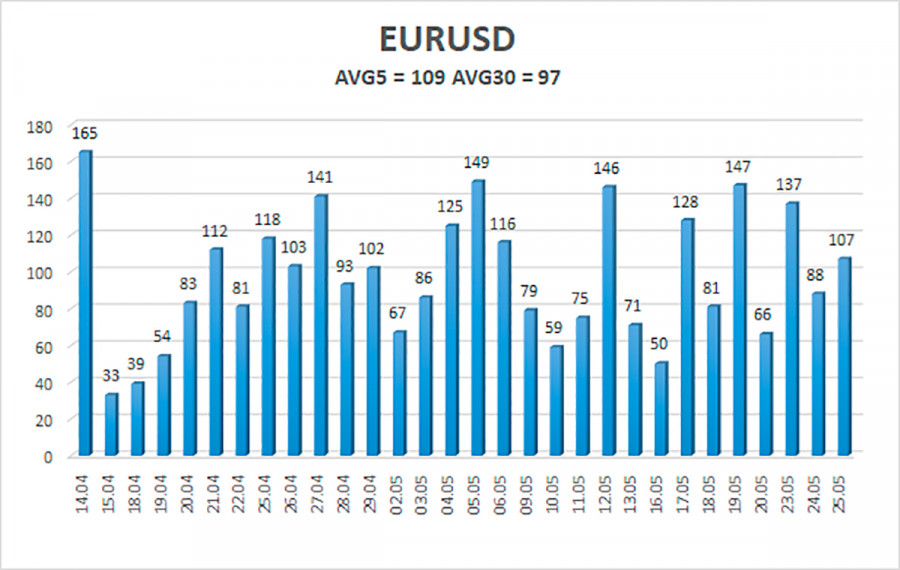

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 26 is 109 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0554 and 1.0771. The upward reversal of the Heiken Ashi indicator will signal the resumption of the upward movement.

Nearest support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and continues to form an upward trend. Thus, now we should consider new long positions with targets of 1.0742 and 1.0771 in the case of a reversal of the Heiken Ashi indicator upwards. Short positions should be opened with targets of 1.0554 and 1.0498 if the price is fixed below the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.