The EUR/USD currency pair showed a "super volatility" of 30 points on Friday. This has not happened for a very long time, since in recent weeks and even months, the average volatility has increased several times. If earlier, before February 24, the euro/dollar quite often passed 40-50 points per day, traders are already used to the fact that a 60-70 points per day minimum is normal. Therefore, Friday became a disappointment and a "semi-final" day. As for the trend, it has been going up for more than two weeks, which was also not the case for the euro currency for a long time. Although the euro is tearing up, in the last few days the growth of this currency is frankly slowing down. Formally, the upward trend persists, as the price continues to be located above the moving average, and the junior linear regression channel has turned upward. Nevertheless, we continue to believe that the only factor that supports the euro currency at this time is technical. If you look at the whole movement of the last year and a half on the senior TF, it becomes clear that the pair has been falling very much all this time. Accordingly, 400-500 points, which on the younger TF look like an independent trend, on the older TF look like a banal correction. Accordingly, the fall of the euro currency may resume.It should be immediately recalled that the geopolitical and fundamental factors (those that have exerted the greatest pressure on the euro and the pound in recent months) have hardly changed over the past few weeks. The military operation in Ukraine continues and may drag on for a very long time. Unfortunately, things are not the same now as in 2014. Now the whole world is solving the problem of preventing hunger since it is Russia and Ukraine that are among the largest food exporters. Russia is under sanctions, fighting is underway in Ukraine and export is impossible. The international community is trying to negotiate to unblock the Black Sea so that grain and other crops can be exported from Ukraine, but there are no results yet.

The same goes for the fundamental background. Last week and the week before last, the ECB finally turned its anger to mercy and finally informed the markets that it was ready to raise the rate once or twice in 2022. But what do these "once or twice" mean? They mean that the rate in the European Union will rise to 0.25% maximum. And 0.25% is still an optimistic scenario because now the deposit rate is -0.5%. First, it needs to be brought at least to zero, and then we can talk about an increase. The Fed may raise the rate by another 0.5% in June and the same in July. Thus, the euro currency has very little reason to grow.

Meanwhile, inflation in the EU will continue to accelerate.

There won't be a lot of macroeconomic statistics this week, but not a little either. In the European Union, and inflation report for May will be published on Tuesday and, according to experts' forecasts, this indicator will grow to 7.6-7.7% y/y. Thus, most likely, what will happen is what, in principle, we are waiting for - the continuation of the growth of the consumer price index. And what else can we expect in the EU if inflation is rising even in Britain, which has already raised the key rate four times? On Wednesday, ECB President Christine Lagarde will give a speech, to which there has been increased attention lately because the rhetoric of the regulator has begun to tighten. Now the markets are waiting for explanations and explanations: how many times will the rate be raised, to what values? Also on Wednesday, the unemployment rate in the EU and the index of business activity in the manufacturing sector for May will be released. On Friday, a report on business activity in the service sector will be published, as well as a report on retail sales. In the current circumstances, this is far from the most significant data, so Lagarde's speech and inflation will be the most important. In the USA, there will also be something to pay attention to, but we'll talk about this in the article on the pound/dollar.

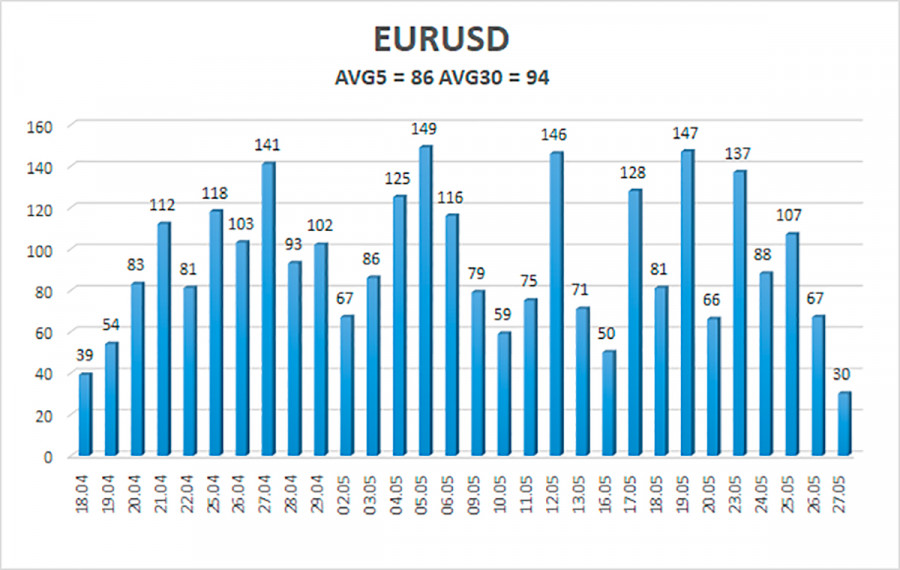

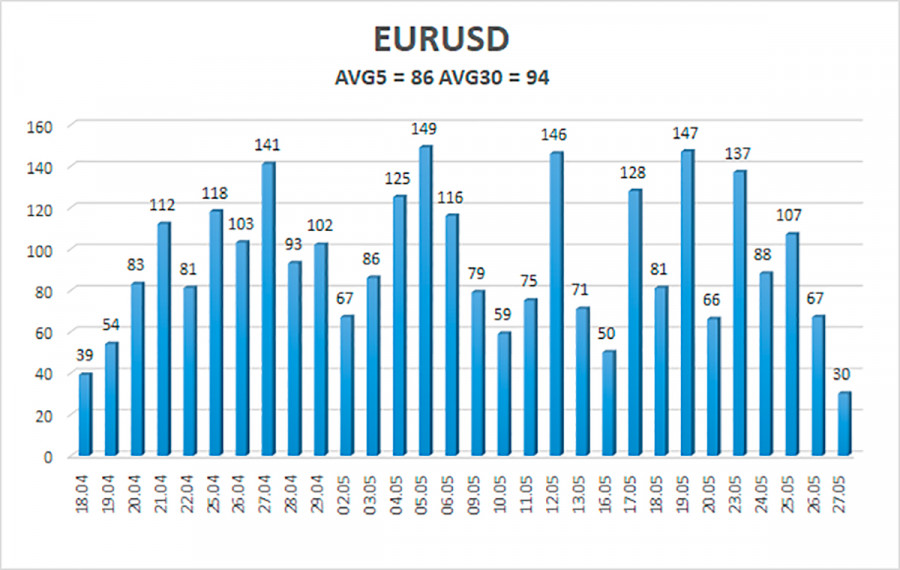

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 30 is 86 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0667 and 1.0839. The reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement.

Nearest support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and continues to form an upward trend. Thus, now you should stay in long positions with targets of 1.0839 and 1.0864 until the Heiken Ashi indicator turns down. Short positions should be opened with a target of 1.0498 if the price is fixed below the moving average line.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.